START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

The Definitive Guide to Aggregator & Broker Dealer Wealth Teams

In a constantly evolving financial landscape that can be complex and overwhelming, private wealth groups are crucial in helping clients investment strategies and take advantage of financial opportunities. These teams, housed within larger financial institutions, specialize in catering to the needs of their clientele, offering not just financial advice, but an entire spectrum of services designed to safeguard and enhance wealth. In this blog, we define private wealth management, explore the different types of groups & network structures and analyze data derived from the FINTRX Private Wealth Intelligence Platform. Whether you are a seasoned industry professional or new to the world of private wealth, this guide will provide valuable insight into the inner workings of these unique investment advisory groups.

What Are Wealth Teams?

The term 'wealth team' refers to wealth management teams that serve clients such as high-net-worth individuals and families, corporations, foundations and endowments, offering a range of comprehensive financial services tailored to their clients' unique needs. These groups, housed under or within large ‘parent’ financial institutions such as Hightower Advisors or Wells Fargo, provide a wide array of services, such as external manager selection, insurance services, tax strategy, retirement & estate planning, investment & portfolio management and so on, and while each group is unique in the types of services and clients they specialize in, their main purpose is simple: to preserve and grow their clients’ wealth.

With their unique expertise and specialized knowledge, wealth teams have a significant impact on the financial services industry, often providing access to exclusive investment opportunities, such as hedge funds or other alternatives, which allow clients to diversify their portfolios and potentially achieve higher returns. These groups contribute significantly to the overall stability of the financial markets and foster strong client relationships built on trust, confidentiality, and personalized service. They take a holistic approach to wealth management, considering not only financial factors but also the unique values, aspirations, and legacy goals of their clients. This client-centric approach sets them apart and establishes long-term partnerships based on mutual understanding and shared objectives.

Due to the obscure nature of these wealth teams, accurate and actionable data on them and their contacts is widely un-centralized and difficult to gather. Since these groups fall under the umbrella of larger firms, they are often not registered with the SEC or State Securities Commissions, and so information on them is scattered and often unhelpful.

FINTRX RIA & Broker Dealer Intelligence Platform Now Covers Wealth Teams & Advisors

What Services Do Wealth Teams Provide?

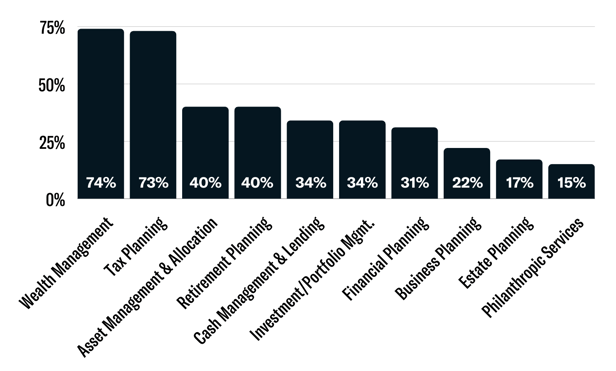

As previously noted, wealth teams provide a myriad of services pertaining to both wealth & estate planning, all for the purpose of making asset preservation and growth more simple, efficient and effective for their clients. While the bulk of these groups’ responsibility usually falls within the realm of wealth and asset management, many groups specialize in anything from legal services to philanthropic giving.

Wealth teams generally offer some combination of the following services to their clients:

Breakdown of Most Common Services Offered by Wealth Teams

Wealth Teams vs. Family Offices

When it comes to the task of managing private wealth, family offices and wealth teams both emerge as key players, operating as small, boutique firms, cultivating an environment of exclusivity and individualized attention to their clients’ needs. Additionally, many wealth teams offer family office services and may even consider themselves family offices, as both types of entities offer a comprehensive suite of services in order to cater to the distinct demands of each client. This broad spectrum of offerings underscores their commitment to covering the multifaceted needs of their clients under one roof.

While family offices and wealth teams share many similarities, wealth teams are governed by larger financial institutions, acting as subsidiaries or specialized units within the parent company. This connection can potentially limit their flexibility and autonomy in decision-making, however, the backing of larger institutions grants these groups increased financial stability and access to abundant resources. This, in turn, can enhance the range and quality of services they provide. Additionally, these groups’ relationships to large SEC-registered firms guarantees their adherence to strict regulatory standards. So, while family offices are a great option for those needing more flexibility in their wealth management ventures, wealth teams have the potential to be a more secure, cost-effective, or robust option, backed by the immense resources and billions of assets of a well-established firm.

Classifying Wealth Teams

The organization of wealth teams and their structures and relationships to their parents firms can take many different forms. Two classifications–broker dealer groups and aggregator groups–are a couple of the more common structures observed with these groups, and while both types refer to wealth management teams operating under larger financial institutions, there are some key differences in their relationships to their parent firms and the products and services they tend to offer.

Broker Dealer Groups

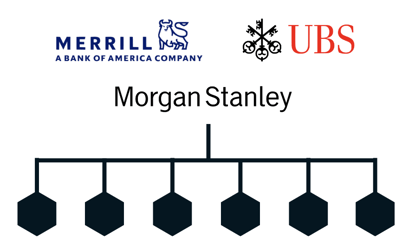

Groups that fall under the ‘Broker Dealer’ category are those that sit directly within a broker dealer firm, most notably those operating within wirehouses. These wealth teams have a very linear relationship to their parent firm and are often limited to the financial products and services offered by them. However, an association with a broker dealer or a wirehouse has its advantages, as these groups have the direct financial backing and resources of some of the world’s largest institutions, such as Merrill Lynch or UBS. They also have direct ties to the products and additional services of the broker dealer, accessing things like top tier fixed income or mutual funds seamlessly and with minimal fees or at a discounted rate. In short, broker dealer and wirehouse advisors provide significant value to their clients by utilizing the resources and extensive range of products offered by their firm.

Examples of large broker dealers managing numerous wealth teams:

Merrill Lynch, UBS, Morgan Stanley, Wells Fargo, Raymond James, Ameriprise

Linear structure of broker dealers to their wealth management teams

Aggregator Groups

Aggregator groups, or groups that are part of an aggregator network, tend to have less of a linear relationship with their parent firm, often acquired as previously-established independent wealth advisory firms. The entities that oversee these firms may or may not manage assets themselves, handling the business operations and compliance, and allowing their acquired wealth teams to operate the wealth management and asset allocation themselves. While this type of structure allows for more flexibility in the products or services these groups can offer their clients, it can make the process of providing certain services more difficult or expensive, accumulating fees as they pull from a variety of providers. This reliance on outside providers can be a weakness, but advisors that fall within this type of network can also benefit from the parent firm's ability to provide access to TAMPs, service providers, custodians and more, typically at a better price than the group would be able to negotiate on its own. Many ultra-high-net-worth clients may opt for these more independent groups, as they often are able to offer a more bespoke wealth management approach for their clients. This is also a useful structure for new wealth advisors or groups that wish to leave a wirehouse or larger broker dealer, as it allows both for more autonomy and flexibility in addition to the backing of a larger firm.

Examples of aggregators with significant wealth team networks:

Hightower, Mariner Wealth Advisors, Commonwealth, Focus Financial Partners

Independent, non-linear structure of wealth team aggregator networks

Conclusion

In summary, wealth teams are vital players in the financial services industry, providing tailored financial solutions and guidance to their clientele. Their impact extends beyond individual clients, influencing market dynamics and contributing to economic growth. Through their comprehensive and customized services, wealth teams help clients navigate complex financial landscapes and work towards achieving their long-term financial objectives.

About FINTRX

FINTRX is a unified wealth management data platform that provides comprehensive data intelligence on 850,000+ family office and investment advisor records, ultimately designed to help asset-raising professionals identify, access and map the global private wealth ecosystem. Find relevant decision-makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it and filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and much more. FINTRX sources data from both public and private sources and has a team of 75+ researchers who map, validate and compile data daily to ensure its accuracy.

Written by: Emery Blackwelder |

October 18, 2023

Emery Blackwelder is a member of the product marketing team at FINTRX--the preeminent resource for family office & registered investment advisor (RIA) data intelligence.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)