START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Private Wealth Group Data Launched

In an effort to provide the most expansive and comprehensive data coverage of the investment advisor landscape, we are proud to unveil our latest edition to the FINTRX Registered Investment Advisor (RIA) Platform: Private Wealth Groups. This new dataset offers users unprecedented access to accurate information and valuable insights on 13,000+ private wealth teams operating within wirehouses & aggregator networks, all in one unified, powerful interface.

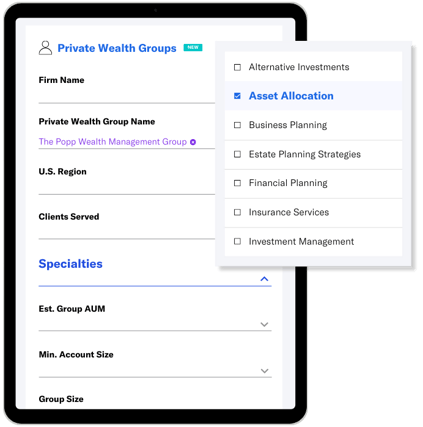

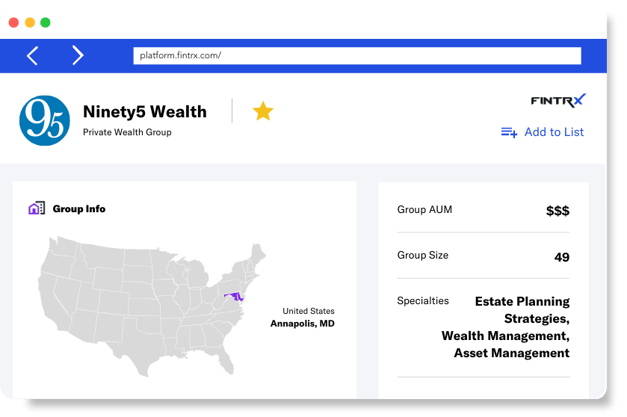

FINTRX Private Wealth Groups Data Offerings & Capabilities

With FINTRX, you can now access a comprehensive directory of previously inaccessible wirehouse and independent aggregator teams and the advisors behind them. Easily build lists, export data and leverage FINTRX tools to seamlessly navigate and parse thousands of hard-to-find data points on private wealth groups.

13,000+ Private Wealth Groups | 50,000+ Reps & Key Contacts

A first of its kind dataset featuring unique insights and direct access to previously unmapped wirehouse and aggregator groups

Advisor teams run by leading wirehouses such as Morgan Stanley, UBS and Merrill Lynch

Groups operating within networks run by aggregators such as Hightower, Mariner and Commonwealth

FINTRX Data Offerings & Capabilities

+ Direct contact information for each team, including phone numbers, email addresses and links to official websites for instant group access

+ Detailed profiles of key contacts & reps enhanced with relationship scoring, custom conversation starters, and direct links to SEC filings & LinkedIn profiles

+ Complete geographic details including office locations for each team, mapped down to street level

+ Extensive client analysis and demographics for each group

+ In-depth breakdowns of investment preferences, advisory services, account & AUM data and more

FINTRX digs further to provide unparalleled access and insights into wealth teams within wirehouses & independent aggregators.

With FINTRX, you can now easily explore the previously unmapped and obscure network of the private wealth teams operating under wirehouses and aggregator networks. Easily access in-depth data and insights on individual groups and the key contacts and advisors behind them that play a substantial role in the realm of wealth management and the financial industry as a whole.

Use Cases:

+ Uncover wealth management professionals and their associated teams with comprehensive profiles and investment strategy data

+ Source potential wealth advisor M&A opportunities and track advisor movements industry-wide

+ Disseminate your fund & investment products directly to advisor groups with direct contact information for key decision-makers

+ Seamlessly leverage vast networks of wealth advisors with advanced filtering functionality and user-friendly interfacing & workflow tools

Instant access to expansive pools of private wealth capital, right at your fingertips.

Overview of Private Wealth Groups

Private wealth groups are the wealth management teams, housed within larger ‘parent’ registered firms, that cater to clients such as high-net-worth individuals, endowments or charities. These groups provide a wide array of services, such as insurance services, tax strategy, retirement & estate planning, external manager selection, investment and portfolio management and so on, tailored to the unique needs of their clientele. While each group is unique in the types of services and clients they specialize in, their main goal is simple: to preserve and grow their clients’ wealth.

Unlike family offices or independent wealth advisors, private wealth groups operate under larger parent firms--wirehouses and aggregators--which often handle the majority of business operations, compliance, or management decisions and allow these teams to focus solely on handling their clients’ finances. All three of these types of entities offer a variety of financial and related services and cater to similar client segments, but what makes private wealth groups unique is that they are backed by the resources and research of a larger firm. While this may restrict these groups in their product or investment strategy offerings, it often offers a more secure, cost-effective, or robust option for clients considering wealth management services.

Due to the obscure nature of private wealth groups, accurate and actionable data on them and their contacts is widely un-centralized and difficult to gather. Since these groups fall under the umbrella of larger firms, they are typically not registered with the SEC or State Securities Commissions, and so information on them is scattered and often unhelpful, until now.

Leverage FINTRX data for unprecedented access to the groups, advisors and key players leading the success of the private wealth management ecosystem.

About FINTRX

FINTRX is a unified family office and RIA database that provides comprehensive data intelligence on 850,000+ family office and investment advisor records, ultimately designed to help asset-raising professionals identify, access and map the global private wealth ecosystem. Find relevant decision-makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it and filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and much more. FINTRX sources data from both public and private sources and has a team of 75+ researchers who map, validate and compile data daily to ensure its accuracy.

Written by: Emery Blackwelder |

October 31, 2023

Emery Blackwelder is a member of the product marketing team at FINTRX--the preeminent resource for family office & registered investment advisor (RIA) data intelligence.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)

.png?width=699&height=490&name=PWG%20Graphics%20(2).png)