START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

The Rise of ESG Investing Among Family Offices

Environmental, social, and corporate governance factors have always been a consideration for family office investors and businesses, but it wasn't until the last decade or so that awareness of ESG topics has skyrocketed. Investing for social good has a rich history dating back thousands of years, as people have long invested their capital based on their values. With that said, data shows a significant increase in ESG consideration among family offices over recent years amid a rapidly-evolving investment landscape.

Download the PDF

Introduction

Until recently, investors that paid much attention to ESG data—information about companies’ carbon footprints, labor policies, board makeup, and so forth—were in the minority. Now, in the wake of a global pandemic and among discussion over possible climate change, family offices have begun to embrace this investment trend at an unprecedented rate. Given the heightened public and investor focus on social and environmental outcomes, these private wealth vehicles are increasingly looking to incorporate ESG investments. With so much pooled capital involved, family offices now rank with pension funds and institutional investors in the ESG realm. Though given the funds, flexibility and expertise to make savvy investment decisions typically associated with family offices, they may be even more important than their counterparts.

ESG Investing: An Overview

ESG considerations widen the scope of investment goals to include benefits for society.

ESG investing pertains to a framework of criteria governing a company's conduct, which socially conscious investors utilize to evaluate potential investment opportunities, taking into account sustainable, ethical and corporate governance issues such as managing a company’s carbon footprint and ensuring there are systems in place to ensure accountability. Often discussed in a similar context as impact investing, the term ESG is not specific to investments made for the purpose of producing a social benefit, but rather as an umbrella term for social responsibility in the operations of a company. Simply put, ESG is a way for investors to apply non-financial measures when looking at the risks and growth opportunities of any given company.

The “E” in ESG, environmental criteria, includes the energy a company takes in, the waste it discharges, the resources it needs and the consequences of its operations. This is the facet that encompasses carbon emissions and climate change. The consideration of people and relationships falls under the “S” or social component, including gender and diversity issues, human rights and labor standards, among numerous others. And finally, the “G” for governance refers to the standards for how a company is run - board composition, bribery and corruption standards, executive compensation or lobbying, for instance.

Quick Hitters:

- - ESG refers to environmental, social and governance issues that an investor may take into consideration for investment decisions.

- - About 27% of family offices currently demonstrate interest in ESG investments.*

- - ESG practices are integral to the long-term strategies that family offices tend to favor.

- - Sustainable investing solutions can be found across all asset classes.

(*Based on FINTRX data as of October 2023)

Where do ESG topics matter to investors?

- 1. Managing investment and portfolio risk

- 2. Taking part in the upside potential of disruptive innovation

- 3. Engaging with the prevailing social and political agenda

Reasons for Spiked ESG Interest Among Family Offices

1. Increase in public awareness

In a world that increasingly judges investors and businesses on their political and social positioning, market players must look to more fundamental drivers, particularly strategy, to achieve real results. Regardless of where the pressure originates, companies today are finding that ignoring their social and environmental responsibility is ultimately bad for business.

2. More pressure from next-generation family members

The push to make more investment decisions with a social impact is mostly driven by younger generations. For next-generation participants, aligning investing with the values of the family and the community as a whole is key.

3. Ability to capitalize on a social responsibility to achieve top-level growth

Socially responsible companies and leadership teams cultivate positive brand recognition, increase customer loyalty, and attract top-tier employees. These elements are among the keys to achieving increased profitability and long-term financial success.

4. Use of AI & alternative data provides the ability to uncover ESG trends

Recent advancements in artificial intelligence and machine learning have allowed investors to leverage new modalities and optimize their decision-making. The dramatic uptick in AI has made sifting through vast datasets to highlight ESG & impactful investment opportunities easier than ever.

How Recent Events Have Impacted ESG Investing

ESG investing hit the mainstream following the coronavirus pandemic.

The outbreak of Covid-19 proved to be a notable turning point for ESG investing. Alongside a steady organic increase in interest in political and social responsibility and scrutiny via social media and public forums, ESG has become a core theme of post-Covid societal reevaluation. As people reflect on the past several years and begin to look to the future, debates surrounding the importance of the common good and positive community impact have jumped into the spotlight.

The events of 2020 and the following years proved that this topic has entered the mainstream – not just as a talking point, but as a driver of valuation and a catalyst for action. It’s unknown whether ESG issues will remain as salient to investors in the coming years, but our bet is that they will.

From a social perspective, we expect companies will be remembered and rewarded for their actions during the pandemic and the economic turbulence of the following years. The societal role of corporations has been illuminated like never before, and we expect business will go to those companies deemed to have done the ‘right thing’ by their employees, customers and communities in such trying times. We also anticipate a continued increase in attention to the impacts of global challenges like climate change, as businesses and individuals begin to take environmental issues more seriously. The events of the past few years spur important considerations for family office investors moving forward.

ESG Trends Among Family Office Investors

In addition to including alternatives such as real estate and private equity in their strategies, family offices are increasingly seeking out ESG-focused investment opportunities, engaging in impact investing, and implementing responsible investment frameworks. Furthermore, family offices are progressively collaborating with other like-minded investors to pool resources and influence positive change at a larger scale, understanding the potential to create high returns while positioning themselves for a more sustainable future.

This trend certainly isn’t groundbreaking and has already been addressed by the majority of significant players in the financial world. Firms such as Fidelity and Vanguard, understanding the widespread demand for ESG investments, offer ETFs comprised of securities they deem responsible. Additionally, leading financial institutions are allocating more time and resources into educating their asset managers on different ways to implement ESG investing and the advantages of doing so. In essence, what began as a small group of individuals looking to invest in socially and environmentally responsible companies has now become a quantitatively effective form of capital allocation.

Using data derived from the FINTRX Family Office platform, we are able to gain insight into the current ESG trends of family offices.

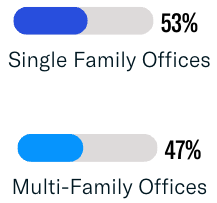

Family Offices Active in ESG Investments by Type

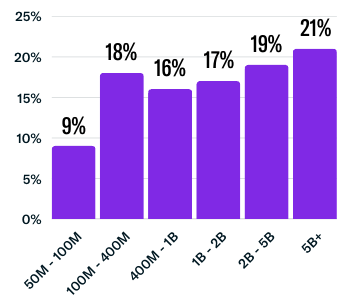

According to the data, ESG interest is fairly equal across single vs. multi-family offices, and firms that manage a larger number of assets have a slightly higher tendency to participate in ESG investments.

Family Offices Active in ESG Investments by AUM

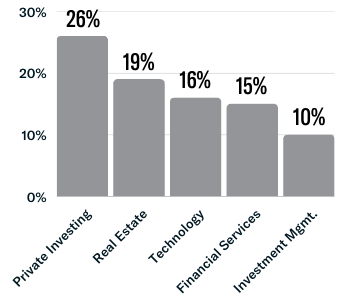

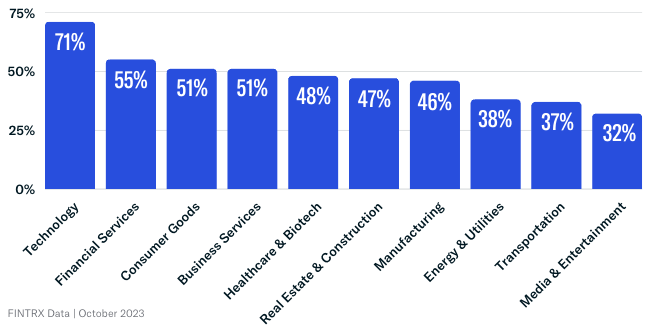

Of the single family offices actively considering ESG factors, the majority earned their wealth in private investing and real estate. Firms showing interest in ESG also tend to favor technology and financial services companies in their direct investments.

Single Family Offices Active in ESG by Industry of Wealth Origin

Direct Investments by Sector (of Family Offices Active in ESG)

All data derived from the FINTRX Family Office Platform as of October 2023

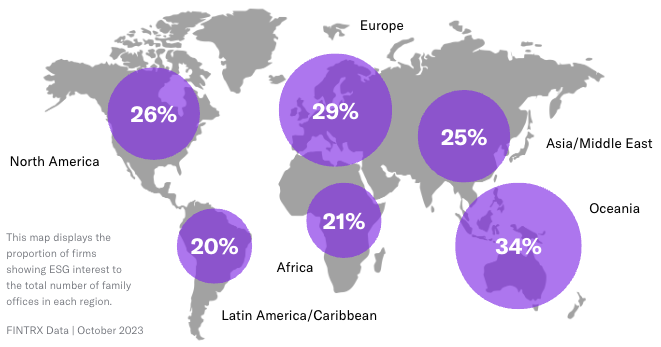

Geographic Breakdown

What was once a niche industry focused mainly in the United States has now gone global. An increase in private wealth across the world has continued to expand the creation of new family offices in areas that were essentially void of family offices in the past. Asia, for example, has seen a significantly rising number of family offices over the past few years, with several major cities now battling to be the top hotspot in the region. The number of family offices is expected to continue to rise in the coming years as generational wealth changes hands. With an increase in family offices, comes an increase in global ESG interests.

Quick Hitters:

- - ESG is most popular in Oceania, with roughly 34%* of firms showing ESG interest.

- - North America has seen the greatest increase in ESG interest, up almost 10%* since 2021.

- - ESG activity is growing at a faster rate than the number of global family offices.

(*Based on FINTRX data as of October 2023)

Conclusion

In essence, what began as a group of individuals looking to invest in socially and environmentally responsible companies has now become a quantitatively effective form of capital allocation.

Despite years of near recession and market volatility, global family office numbers have grown, largely due to the proliferation of younger entrepreneurs and private investors forming their own offices as their wealth multiplies. This new generation of young professionals possesses an ever-increasing awareness of environmental and ethical issues. As the global family office realm trends younger, the drive for social and environmental consideration will continue to cause investors to stray from the “old-school” ways of their predecessors, and focus more on driving responsible success.

The prevalence of social media and increased public scrutiny has created a hostile and unforgiving environment for companies and investors alike, as those who wish to be successful must tread carefully with their social footprint. In such an environment, ESG participation becomes a useful tool for investors attempting to avoid falling victim to ‘cancel culture’ and harness the immense power that the next generation wields to garner success.

Critics have said that ESG investing is merely a bull-market phenomenon, while others argue it represents a fundamental shift in investing. Either way, the ESG trend appears to have solidified itself as a key player in the economy for the foreseeable future, and we feel confident that family offices will continue to fan the flame.

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor with up-to-date information verified by our 75+ person research team. Access data on AUM & accounts, investment preferences and history, rep movements, and advisor growth signals and stay ahead of the competition with best-in-class industry insights.

Written by: Emery Blackwelder |

October 24, 2023

Sr. Product Marketing Associate at FINTRX

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)