START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

The Definitive Guide to the Registered Investment Advisor (RIA) Ecosystem

The registered investment advisor (RIA) ecosystem is a complex and ever-evolving landscape that plays an increasingly important role in the wealth management industry. Whether you're a financial professional looking to start your own investment advisory firm or an investor seeking the services of an RIA, it's important to have a deep understanding of this ecosystem and the various players involved. In this comprehensive RIA guide, we'll provide a detailed overview of the registered investment advisor ecosystem, including the history and evolution of the industry, regulatory environment, different types, advantages of working with RIAs, key trends and challenges facing the industry and numerous other topics. Whether you're a seasoned professional or just starting out in the industry, this guide will provide valuable insight into the world of registered investment advisors.

What is an RIA?

An RIA, or Registered Investment Advisor, is a professional or firm that provides investment advice and financial planning services to clients for a fee. RIAs are regulated by the U.S. Securities and Exchange Commission (SEC) or state securities regulators, depending on the size of the firm's assets under management (AUM). They are required to register with the appropriate authority and adhere to the fiduciary standard, which means they must act in the best interest of their clients by providing impartial and objective advice.

As fiduciaries, RIAs must disclose any potential conflicts of interest, provide transparent information about fees and investment strategies and are legally obligated to put their client's interests ahead of their own. They typically offer a range of services, including investment management, financial planning, retirement planning, tax planning and estate planning, among numerous other financial services.

RIAs are different from broker dealers, who facilitate transactions in securities between buyers and sellers and earn commissions on those transactions. RIAs typically charge fees based on a percentage of their client's assets under management, a flat fee or an hourly rate.

RIAs & the SEC

The relationship between RIAs and the U.S. Securities and Exchange Commission (SEC) is one of regulation and oversight. The SEC is the federal agency responsible for regulating and enforcing securities laws in the United States, and its primary mission is to protect investors and maintain fair, orderly, and efficient markets. RIAs are required to register with the SEC (or state securities regulators for smaller firms) and adhere to certain rules and regulations, including the Investment Advisers Act of 1940. This act established the RIA designation and set forth specific standards and requirements for investment advisors, including the fiduciary duty to act in the best interest of their clients.

The SEC's role in the relationship with RIAs includes:

-

Registration: RIAs managing more than $100 million in assets under management (AUM) are required to register with the SEC. Smaller RIAs with less than $100 million AUM typically register with state securities regulators.

-

Compliance: RIAs must comply with the rules and regulations set forth by the SEC, including maintaining accurate records, disclosing potential conflicts of interest, and providing transparent information about fees and investment strategies.

-

Examinations & Audits: The SEC conducts periodic examinations and audits of RIAs to ensure compliance with federal securities laws and regulations. These examinations may include reviews of an RIA's books and records, trading practices, marketing materials, and other aspects of their business.

-

Enforcement: If an RIA is found to be in violation of securities laws or regulations, the SEC has the authority to take enforcement actions, such as issuing fines, sanctions, or cease-and-desist orders. In severe cases, the SEC may also seek to revoke an RIA's registration, effectively barring them from operating as an investment advisor.

The relationship between RIAs and the SEC is essential in maintaining a fair and transparent investment industry, as it helps protect investors by ensuring that investment advisors adhere to high standards of conduct and operate in the best interest of their clients.

How are RIAs Regulated?

RIAs are regulated by either the SEC or state securities regulators, depending on the number of assets they manage. RIAs who manage $100 million or more in assets are required to register with the SEC, while those who manage less than $100 million must register with their state securities regulator.

RIAs are required to adhere to the Investment Advisers Act of 1940, which sets out specific standards and regulations regarding fiduciary duty, disclosure and record-keeping. This means that RIAs must act in the best interests of their clients and provide full and fair disclosure of all conflicts of interest. They must also keep detailed records of all investment transactions and client interactions.

Registered investment advisors are subject to periodic examinations and audits by the SEC or state securities regulators to ensure that they are complying with all applicable laws and regulations. Failure to comply with regulations could result in disciplinary action, fines, or even revocation of registration.

In addition to federal and state regulations, RIAs may also be subject to other industry standards and codes of ethics, such as those established by the Certified Financial Planner Board of Standards or the National Association of Personal Financial Advisors. These standards may help to ensure that RIAs meet certain competency and ethical requirements and provide high-quality services to their clients.

What Legal Requirements Apply to RIAs?

Registered Investment Advisors (RIAs) are subject to various legal requirements and regulations to ensure they act in the best interests of their clients. Here are some of the key legal requirements that apply to RIAs:

Registration: As mentioned above, RIAs are required to register with the Securities and Exchange Commission (SEC) or state securities regulators, depending on the size of the firm and the states in which it does business.

Fiduciary Duty: RIAs have a fiduciary duty to act in the best interest of their clients at all times. They must put their client's interests ahead of their own and avoid conflicts of interest.

Disclosure: RIAs must disclose all material facts related to their advisory services, including fees, investment strategies, and any conflicts of interest.

Recordkeeping: RIAs must maintain comprehensive records of their advisory business, including client agreements, investment recommendations, and other communications with clients.

Compliance: RIAs must comply with various rules and regulations related to registration, disclosure, and recordkeeping. They are subject to regulatory oversight by the SEC or state securities regulators, who conduct periodic examinations of RIA firms.

Anti-Fraud Provisions: RIAs are subject to anti-fraud provisions under the Investment Advisers Act of 1940. They are prohibited from engaging in any fraudulent or deceptive practices in connection with their advisory services.

Registered investment advisors are subject to various legal requirements and regulations related to registration, fiduciary duty, disclosure, recordkeeping, compliance and anti-fraud provisions to ensure they act in the best interests of their clients and maintain a high level of professionalism and integrity.

What Kind of Compliance Requirements do RIAs Have?

Registered investment advisors have various compliance requirements under the Investment Advisers Act of 1940 and other regulatory bodies related to registration, compliance programs, disclosures, recordkeeping, code of ethics, annual filings and regular examinations. These specifications were put in place to guarantee that RIAs maintain a high standard of professionalism and integrity. Below are some of the key compliance requirements that registered investment advisors must meet:

Registration: RIAs must register with the SEC or state securities regulators, depending on the size of the firm and the states in which they do business. RIAs are required to renew their registration annually and must update their registration information promptly if there are any material changes.

Compliance Programs: RIAs must establish and maintain a comprehensive compliance program to ensure they are meeting regulatory requirements. This includes written policies and procedures, annual reviews, and a chief compliance officer responsible for overseeing the program.

Disclosures: RIAs must provide clients with written disclosures that outline their advisory services, fees, investment strategies, conflicts of interest, and other material facts. Certain disclosures must be filed with the SEC or state securities regulators, such as Form ADV.

Recordkeeping: RIAs must maintain comprehensive records of their advisory business, including client agreements, investment recommendations, and other communications with clients. These records must be retained for a certain period of time and made available for inspection by regulators.

Code of Ethics: RIAs must adopt a code of ethics that outlines their ethical obligations and standards of conduct. The code of ethics must include provisions related to conflicts of interest, insider trading, and personal trading by firm employees.

Annual Filings: RIAs are required to file annual updates to their registration information with the SEC or state securities regulators, such as Form ADV Part 1 and 2.

Regular Examinations: RIAs are subject to periodic examinations by the SEC or state securities regulators to ensure compliance with regulatory requirements. These examinations can be announced or unannounced and typically cover areas such as compliance, recordkeeping, and conflicts of interest.

RIA State Cutoff

The state registration cutoff for RIAs is based on their assets under management (AUM). RIAs with AUM of less than $100 million typically need to register with their state's securities regulator, while those with AUM of $100 million or more are required to register with the U.S. SEC. This threshold is often referred to as the state registration cutoff.

However, there are some exceptions to this general rule. For example, RIAs with AUM between $90 million and $100 million may choose to register with the SEC to avoid frequent switches between state and federal registration due to fluctuations in AUM. Additionally, some states may have different requirements, so it's essential for RIAs to be familiar with the specific regulations in their jurisdiction.

RIAs vs. Broker Dealers

Registered investment advisors and broker dealers are both financial professionals involved in the investment industry. They serve different functions, operate under different regulations and have distinct compensation structures. Here's a brief overview of their similarities and differences:

Similarities

Financial Services: Both RIAs and broker dealers offer various financial services and can provide investment advice to their clients.

Regulation: They are both regulated by the ecurities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA), though RIAs are primarily governed by the Investment Advisers Act of 1940, while broker dealers are subject to the Securities Exchange Act of 1934.

Differences

Primary Role: RIAs primarily provide investment advice and financial planning services to clients for a fee, whereas broker dealers facilitate the buying and selling of securities, such as stocks and bonds, and earn commissions on those transactions.

Fiduciary Duty: RIAs have a fiduciary duty to act in the best interest of their clients, which means they must disclose potential conflicts of interest and prioritize their client's needs. Broker dealers are not held to the same fiduciary standard, although recent regulations, such as the SEC's Regulation Best Interest, have imposed a higher standard of conduct on broker dealers when providing personalized investment advice to retail clients.

Compensation Structure: RIAs typically charge fees based on a percentage of their client's assets under management, a flat fee, or an hourly rate. Broker dealers, on the other hand, earn commissions on the transactions they facilitate, which can create potential conflicts of interest.

Registration: RIAs are required to register with the SEC or state securities regulators, depending on their assets under management, while broker dealers must register with the SEC and become members of FINRA.

History of RIAs

The history of RIAs dates back to the 1930s, with the establishment of regulations governing the investment industry in the United States. Below is an overview of the key milestones in the development of RIAs:

-

Stock Market Crash of 1929: The Great Depression was triggered by the stock market crash of 1929. This event exposed widespread fraud, manipulation and a lack of regulation in the securities industry, leading to calls for reform and oversight.

-

Securities Act of 1933: The first federal legislation regulating the securities industry was the Securities Act of 1933, which required the registration and disclosure of financial information for publicly traded securities. The aim was to promote transparency and prevent fraud.

-

Securities Exchange Act of 1934: This act created the Securities and Exchange Commission to enforce federal securities laws and regulate the securities industry. It also introduced rules for the registration of securities exchanges and broker-dealers.

-

Investment Advisers Act of 1940: This act specifically targeted investment advisors and established the RIA designation. It required investment advisors to register with the SEC (or state regulators for smaller firms) and adhere to a fiduciary standard, which mandates putting clients' interests ahead of their own. The act also defined the scope of services provided by investment advisors and the fees they could charge.

-

The Rise of RIAs: The investment industry has evolved significantly since the 1940s. As the U.S. economy expanded and the population accumulated more wealth, the demand for professional investment advice grew. Over the years, RIAs have become increasingly popular as a distinct segment within the financial services industry. They have gained a reputation for providing unbiased, client-focused advice, as opposed to broker dealers who may have conflicts of interest due to their commission-based compensation structure.

-

The Dodd-Frank Wall Street Reform & Consumer Protection Act of 2010: This act introduced several significant changes to the regulation of RIAs. Among other things, it increased the threshold for federal registration from $25 million to $100 million in assets under management, transferring the oversight of smaller advisors to state regulators. The act also mandated a fiduciary standard for broker dealers when providing personalized investment advice to retail clients, bringing them more in line with RIAs.

Today, the RIA industry continues to grow and evolve, with thousands of firms providing a wide range of investment advice and financial planning services to clients across the United States. As investor preferences and technology change, RIAs are continually adapting their offerings and strategies to better serve their clients' needs.

How RIAs Operate

Registered investment advisors operate by providing personalized investment advice and managing client portfolios to help clients achieve their financial goals. Here are some of the key aspects of how RIAs operate:

Fiduciary Duty: RIAs have a fiduciary duty to act in the best interest of their clients at all times. They are legally required to put their client's interests ahead of their own.

Customized Investment Advice: RIAs provide personalized investment advice based on a client's financial goals, risk tolerance, and investment horizon. They develop investment strategies tailored to each client's unique circumstances.

Portfolio Management: RIAs manage client portfolios on a discretionary basis. This means that clients give their RIAs authority to make investment decisions on their behalf without requiring client approval for every transaction.

Fee Structure: RIAs typically charge a fee for their services based on a percentage of assets under management. This fee structure aligns the interests of the RIA with those of the client.

Compliance & Regulation: RIAs are subject to regulatory oversight by the Securities and Exchange Commission (SEC) or state securities regulators. They must comply with various rules and regulations related to registration, disclosure, and recordkeeping.

Custodian Services: RIAs typically use a third-party custodian to hold client assets and execute trades. Custodians provide secure record-keeping, reporting, and compliance oversight services.

Who Registers?

An investment advisory firm registers to become an RIA with either the Securities and Exchange Commission (SEC) or state securities agencies depending on the amount of assets they manage. Generally, firms with more than $100 million in assets under management (AUM) are required to register with the SEC, and firms with less than $100 million in AUM are required to register with the state securities agency in the state where they have their main office.

RIAs must meet certain registration requirements and comply with SEC or state securities laws, which include annual filings, periodic examinations, and audit requirements. Once registered, RIAs are held to a fiduciary standard, meaning they are required to act in the best interest of their clients, and are subject to regulatory oversight to protect investors.

Classifications of RIAs

Hedge Fund: A private investment fund that invests in a variety of assets and uses different strategies to generate returns for investors. Hedge funds often use leverage and may engage in short selling and other speculative investment techniques.

Independent Wealth Advisor: A financial advisor who provides personalized investment and wealth management advice to clients, independent of a large financial institution. Independent wealth advisors work with high-net-worth individuals and families and may provide a wide range of services, from estate planning to portfolio management.

Investment Bank: A financial institution that provides a wide range of services to corporations, governments, and other large organizations. Investment banks often specialize in underwriting, issuing, and trading securities, as well as providing advisory services for mergers and acquisitions.

Liquidity Fund: A type of mutual fund that invests in short-term, low-risk securities, such as Treasury bills and commercial paper. Liquidity funds are designed to provide investors with easy access to cash and are often used as a short-term investment option.

Multifaceted Fund Manager: A fund manager who has expertise in managing a variety of different types of investment funds, such as hedge funds, mutual funds, and private equity funds.

Private Equity Fund: A type of investment fund that invests in private companies, often with the goal of providing capital for expansion or restructuring. Private equity funds typically buy a controlling stake in the target company and work closely with management to improve operations and increase profitability.

Qualified Custodian: A financial institution that is authorized to hold and safeguard client assets, such as securities and cash. Qualified custodians include banks, broker-dealers, and other financial institutions that are regulated by the Securities and Exchange Commission (SEC) or state securities regulators.

Real Estate Fund: A type of investment fund that invests in real estate properties, such as office buildings, shopping centers, and apartment buildings. Real estate funds may generate returns through rental income, property appreciation, or a combination of both.

Securitized Asset Fund: A type of investment fund that invests in securities that are backed by a pool of underlying assets, such as mortgage-backed securities or asset-backed securities.

Wealth Manager: A financial advisor who provides comprehensive wealth management services to high-net-worth individuals and families. Wealth managers may provide advice on a wide range of financial topics, from estate planning to investment management.

Wirehouse: A large full-service brokerage firm that employs financial advisors to provide investment advice and other financial services to clients. Wirehouses may also provide investment banking and other financial services to corporate clients.

Venture Capital Fund: A type of investment fund that invests in early-stage companies with high growth potential. Venture capital funds often provide funding for companies that are not yet profitable and may take an equity stake in the company in exchange for the investment.

Other Fund Provider: A catch-all term for any type of investment fund provider that does not fit into one of the other categories listed.

What Does the Breakdown of RIAs Look Like by Type?

Registered Investment Advisor (RIA): An RIA is a financial firm that provides advice on investments and manages portfolios for clients. RIAs are registered with the Securities and Exchange Commission (SEC) or state securities authorities.

Exempt Reporting Advisor (ERA): An ERA is an advisor who is exempted from SEC registration as an investment advisor under the Dodd-Frank Act. ERAs are required to file a truncated version of Form ADV and are subject to certain compliance obligations.

External Investment Advisor (EIA): An external investment advisor is an investment professional who provides advice and guidance to clients and manages investment portfolios on their behalf. EIAs are typically registered with the SEC or state securities authorities.

Broker Dealer (BD): A broker-dealer is a firm that engages in buying and selling securities, operating as both a broker and a dealer depending on the transaction. Broker-dealers operate under the Securities Exchange Act of 1934 and are regulated by the Financial Industry Regulatory Authority (FINRA).

RIA Registration Types

The breakdown of registered investment advisors can vary, but they are typically classified into four different types: traditional RIAs, bank and trust companies, dually registered firms and hybrid RIAs.

Traditional RIAs: These are independent investment advisory firms that provide advice and management services to their clients. They typically operate as standalone firms and are not affiliated with any banks, broker-dealers, or other financial institutions.

Bank & Trust Companies: These are RIAs that are subsidiaries of banks or trust companies. They offer investment advisory services to their clients, in addition to traditional banking services such as loans, deposits and fiduciary services.

Dually Registered Firms: These are firms that are registered as both an RIA and a broker-dealer. This allows them to offer investment advisory services as well as buy and sell securities for their clients. Dually registered firms are regulated by both the SEC and FINRA.

Hybrid RIAs: These are firms that offer both fee-based investment advisory services and commission-based brokerage services. These firms are typically associated with a broker-dealer and tend to have a larger commission business than traditional RIAs.

Who are the Largest RIAs by Classification/Type?

Here are the largest Registered Investment Advisers (RIAs) by classification/type as of 2021:

-

Institutional Investment Consulting Firms: Cambridge Associates, Aon Hewitt Investment Consulting, NEPC, Callan, and RVK.

-

Hybrid Firms: Commonwealth Financial Network, Raymond James Financial Services, LPL Financial, Ameriprise Financial, and Wells Fargo Advisors Financial Network.

-

Independent RIAs: Creative Planning, Fisher Investments, CAPTRUST Financial Advisors, Mariner Wealth Advisors, and Mercer Global Advisors.

-

Bank-Owned RIAs: JPMorgan Chase & Co. (J.P. Morgan Securities), UBS Financial Services, Bank of America (Merrill Lynch Wealth Management), Wells Fargo Advisors, and Morgan Stanley (Morgan Stanley Smith Barney).

-

Insurance-Owned RIAs: Northwestern Mutual Wealth Management, MassMutual Financial Group (Commonwealth Financial Network), AXA Advisors, Ameriprise Financial (RiverSource), and Securian Financial Services.

Note that these rankings are based on assets under management and may change over time. Additionally, some firms may fall into multiple categories depending on their business model and ownership structure.

Types of Investments Used by RIAs?

RIAs can recommend a wide range of investment products to their clients, including mutual funds, exchange-traded funds (ETFs) and individual stocks and bonds. In addition to traditional investments, many RIAs also use alternative investments on behalf of their clients. Alternative investments are non-traditional investment vehicles that offer different risk and return characteristics than traditional investments like stocks and bonds.

Alternative Investments

Some of the most common types of alternative investments used by RIAs include the following:

Private Equity: PE investments involve investing in private companies that are not listed on public exchanges. Private equity can include leveraged buyouts, growth capital investments and venture capital investments.

Hedge Funds: Hedge funds are investment vehicles that pool capital from multiple investors and use a variety of investment strategies to generate returns. Hedge funds may use leverage, short selling, and other techniques to generate returns.

Real Estate: RE investments involve investing in physical property, including residential, commercial, and industrial properties. Real estate investments can include direct investments in property, as well as investments in real estate investment trusts (REITs) and other vehicles.

Infrastructure: Infrastructure investments involve investing in physical assets like toll roads, airports, and other infrastructure projects.

Commodities: Commodity investments involve investing in physical assets like gold, silver, and oil. Commodities can offer diversification benefits and may be used as a hedge against inflation.

Traditional Long-Only Asset Management

Traditional long-only asset management is a type of investment approach that focuses on investing in public equities and assets listed on public exchanges. Long-only asset managers typically do not use leverage or engage in short selling, and they focus on generating returns through stock selection and other traditional investment techniques. This approach is known for its conservative approach to investing, as it aims to provide a steady and reliable source of returns over the long term.

In addition to investing in equities, long-only asset managers may also consider other types of assets such as fixed-income securities and real estate to diversify their portfolios and generate more returns. Fixed-income securities are low-risk investments that provide a steady income stream through periodic interest payments, while Real estate investments provide an opportunity for long-term capital appreciation and income through rental income.

Long-only asset managers may use a variety of investment strategies to generate returns, including value investing, growth investing, and index investing. They may also use fundamental analysis and other research techniques to identify undervalued or underappreciated stocks. Additionally, some long-only asset managers may focus on investing in specific industries or sectors, such as technology or healthcare, to capitalize on trends and potential growth opportunities.

Overall, long-only asset managers provide an excellent choice for investors who are looking for traditional investment options with a lower risk profile. They use stock selection and other traditional investment techniques to generate returns and may also consider other types of assets to diversify their portfolios and maximize returns.

RIA Services Offered

RIAs offer a wide range of investment advisory services to help clients achieve their financial goals. Below are some of the key investment advisory services offered:

Investment Management: RIAs provide investment management services, which involve managing client portfolios and making investment decisions on behalf of clients. Investment management services may include asset allocation, security selection, and risk management.

Financial Planning: RIAs offer financial planning services, which involve creating comprehensive financial plans tailored to each client's unique circumstances. Financial plans may include retirement planning, estate planning, tax planning, and risk management.

Wealth Management: RIAs offer wealth management services, which involve managing all aspects of a client's financial life, including investment management, financial planning, and other services such as tax and estate planning.

Retirement Planning: RIAs offer retirement planning services, which involve helping clients prepare for retirement by creating customized retirement plans and providing ongoing advice and guidance.

Tax Planning: RIAs provide tax planning services, which involve creating tax-efficient investment strategies and recommending tax-saving strategies such as tax-loss harvesting.

Estate Planning: RIAs offer estate planning services, which involve helping clients create and implement estate plans that reflect their wishes and minimize taxes and other costs.

Risk Management: RIAs provide risk management services, which involve identifying and mitigating risks related to a client's financial situation. Risk management services may include insurance planning, liability management, and other strategies to protect client assets.

RIAs offer a range of investment advisory services, including investment management, financial planning, wealth management, retirement planning, tax planning, estate planning, and risk management. These services are designed to help clients achieve their financial goals and manage their financial lives in a holistic and comprehensive manner.

What is the Total Size of the RIA Landscape?

The total size of the Registered Investment Adviser (RIA) landscape is difficult to determine with precision, as the industry is constantly evolving and new firms are being established while others are merging or closing. However, here are some recent statistics and estimates that provide an overview of the industry:

→ At the end of 2020, there were approximately 13,000 SEC-registered investment advisory firms in the United States, with total assets under management (AUM) of $98.5 trillion.

→ The RIA industry has been growing steadily over the past decade, with a compound annual growth rate of 7.6% from 2010 to 2020.

→ Independent RIAs (firms that are not affiliated with a broker-dealer or other financial institution) account for the majority of the industry, with approximately 67% of total AUM.

→ Bank-affiliated RIAs and insurance-affiliated RIAs account for approximately 12% and 5% of total AUM, respectively.

→ The top 1% of RIAs by AUM manage more than 50% of total industry assets.

→ The RIA industry is expected to continue to grow in the coming years, as investors increasingly seek out fiduciary advisors and demand for financial planning services increases.

It's important to note that these figures are estimates and subject to change, but they provide a general idea of the size and scope of the RIA industry. FINTRX offers data on 39,000+ RIA firms and 750,000+ RIA reps/contacts. It is important to note that the RIA landscape is constantly evolving and changing.

RIA Client Makeup

The client makeup of an RIA can vary depending on their business focus and the types of services they provide. Some RIAs may primarily work with high-net-worth individuals while others may focus on managing assets for institutional investors such as pension funds or endowments. RIA clients typically include high-net-worth individuals, families, businesses, institutions, pension plans and endowments seeking investment management and financial planning services.

Entities

RIA entity client makeup can include mutual funds, hedge funds, private equity firms, and other investment management entities seeking advisory services related to portfolio management, risk management, compliance, and regulatory issues. Some RIAs may also serve as sub-advisors or consultants to other financial entities such as insurance companies and broker-dealers. The types of entities served by an RIA can vary depending on its specialty, size and regulatory requirements.

Reps

RIA rep client makeup refers to the types of clients that an RIA representative serves. This can include individuals, families, trusts, foundations, endowments and other institutional clients. The makeup of a particular RIA rep's client base varies depending on factors such as their investment strategy, niche focus and marketing efforts. Having a diverse client base can be beneficial as it can help to mitigate risks and provide a stable source of revenue. Some RIA reps may also specialize in serving specific types of clients such as retirees, physicians, or non-profit organizations. The mix of clients depends on the RIA firm the rep is affiliated with and the geographic location where they operate.

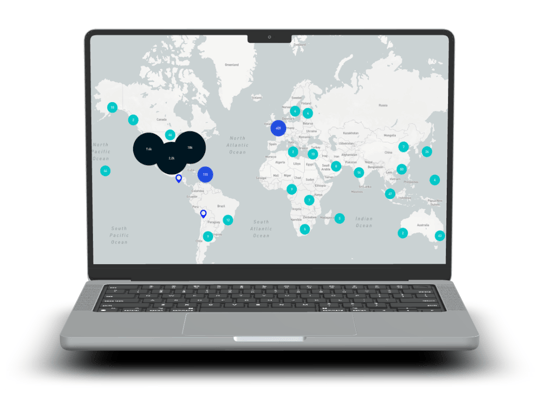

RIA Geographic Breakdown

The geographic breakdown of registered investment advisors refers to the distribution of RIAs across different regions or areas. RIAs can be found throughout the United States, with some regions having more than others.

RIAs are often located in areas with high concentrations of wealth and financial activity, such as major metropolitan areas and financial centers. In the United States, the majority of RIAs are based in California, New York and Texas. However, the number and distribution of RIAs can also be influenced by state regulations and licensing requirements, as well as market demand for investment management and financial planning services. Additionally, some RIAs may operate in multiple geographic regions or serve clients in other countries, depending on their specialty and regulatory permissions.

According to recent data from the Investment Adviser Association, the top states with the highest number of SEC-registered investment advisors as of January 2021 are California, New York, Texas, Florida and Illinois. These states together account for more than half of all SEC-registered investment advisors in the U.S. Other states with significant numbers of RIAs include Massachusetts, Pennsylvania and Ohio.

It is worth noting that while the distribution of RIAs can vary by state, many RIAs now serve clients across multiple regions and even internationally. With advancements in technology, such as digital communication and virtual meetings, RIAs are able to serve clients regardless of their geographic location.

Entities

In the United States, the majority of RIA entities are based in California, New York, and Texas. However, the number and distribution of RIA entities can also be influenced by state regulations and licensing requirements, as well as market demand for investment management and financial planning services. Additionally, some RIA entities may have multiple office locations in different geographic regions or serve clients in other countries, depending on their specialty and regulatory permissions.

Reps

The geographic breakdown of RIA representatives typically varies based on the rep's affiliation and client base. Generally, RIA reps are located in areas with high concentrations of wealth and financial activity, such as major metropolitan areas and financial centers. In the United States, the majority of RIA reps are based in California, New York and Texas. However, the number and distribution of RIA reps can also be influenced by the location of the RIA firm they are affiliated with, as well as the location of their clients.

Money Managers vs. Asset Allocators

Money managers and asset allocators are both financial professionals involved in the management of investment portfolios, but there are key differences between the two roles.

Money managers are professionals who actively manage an investment portfolio on behalf of clients, implementing investment strategies with the goal of maximizing returns while minimizing risks. They might invest in a variety of assets, such as stocks, bonds, commodities or currencies, and they typically use technical analysis and other research methods to make investment decisions. Money managers are typically compensated based on the performance of the investments they manage.

Asset allocators, on the other hand, are financial professionals who work to allocate assets to different asset classes and investment strategies with the goal of achieving an optimal risk-return profile for their clients. They might invest in a range of assets, such as stocks, bonds, real estate or alternative investments, and they typically use a combination of quantitative and qualitative analysis to make investment decisions. Asset allocators are typically compensated based on fees or commissions for the assets they allocate.

The main difference between money managers and asset allocators lies in their areas of focus: money managers are primarily focused on the active management of individual investments, while asset allocators are focused on the overall allocation of assets to various investment strategies. Both roles are important in the management of investment portfolios, and many financial professionals perform both functions to some extent.

Banks vs. RIAs

RIAs and banks are both financial institutions that deal with wealth management, but they differ in their structures, services provided, and regulatory oversight. Banks are typically large institutions that offer a wide range of financial services such as commercial banking, investment banking, asset management, and wealth management. Banks also provide retail banking services, such as checking and savings accounts, loans, and credit cards. Banks are subject to strict regulation and oversight by various government bodies such as the Federal Reserve and the FDIC.

On the other hand, RIAs are financial advisors who offer personalized investment advice to their clients. They manage client portfolios and offer financial planning services. RIAs are typically smaller firms or individuals, subject to less regulatory oversight than banks. RIAs are regulated by the Securities and Exchange Commission (SEC) or state securities regulators.

Custodians and prime brokers are financial institutions that provide services to RIAs. Custodians safeguard clients' assets and execute trades on behalf of the RIA. They provide various services such as record-keeping, reporting, and compliance oversight. Prime brokers, on the other hand, provide margin and securities lending services and execute trades on behalf of the RIA.

While banks and RIAs both provide financial services, they differ in their structures, services provided and regulatory oversight. RIAs are typically smaller and offer personalized investment advice, while banks are larger and provide a wide range of financial services. Custodians and prime brokers are financial institutions that provide services to RIAs.

What’s the Relationship Between RIAs, Custodians & Prime Brokers?

RIAs, custodians, and prime brokers are all integral parts of the investment process. Registered investment advisors provide investment advice and/or manage portfolios on behalf of their clients. RIAs are regulated by the SEC or state securities regulators and they must act in the best interests of their clients.

Custodians are financial institutions that hold securities and other assets on behalf of RIAs and their clients. They are responsible for safeguarding these assets and ensuring that they are properly accounted for. Custodians may also provide a range of other services to RIAs and their clients, such as transaction processing, trade execution, and reporting.

Prime brokers are financial institutions that provide a range of services to RIAs and other institutional investors, such as hedge funds and mutual funds. These services may include securities lending, trade execution, and financing. Prime brokers may also act as custodians for the assets held by these investors.

RIAs rely on custodians and prime brokers to help them manage and safeguard their clients' assets, and to provide a range of other services that are essential to the investment process. Custodians and prime brokers, in turn, rely on RIAs as important sources of business and as partners in the investment process.

How To Find a Reliable & Trustworthy RIA

Finding a reliable and trustworthy registered investment advisor can be a daunting task, but here are some steps you can take to help you find the right one:

Leverage the FINTRX RIA Database Solution: Our RIA data offering includes a comprehensive database of over 37,000 registered investment advisor firms and 850,000 contacts. We offer a range of features to help efficiently connect businesses to the RIA ecosystem, including uncovering key decision-makers and executives, monitoring advisor intent signals, tracking custodial assets and much more.

Check Regulatory Databases: You can search for RIAs in the Investment Adviser Public Disclosure (IAPD) database or the SEC's Investment Adviser Search website. These databases will allow you to find information about the RIA's registration status, disciplinary history, and more.

Check the RIA's Registration: RIAs are required to register with the Securities and Exchange Commission (SEC) or the state where they do business. You can use the SEC's Investment Advisor Public Disclosure (IAPD) website or your state's securities regulator to verify their registration and check for any disciplinary history.

Review the RIA's Form ADV: RIAs are required to file Form ADV with the SEC or state regulators, which provides information about their business practices, fees, services, and potential conflicts of interest. You can request a copy of the firm's Form ADV to review before hiring them.

Research the RIA's Experience & Expertise: Many RIAs hold professional designations, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), which require rigorous education, experience and ethical standards. These designations can be an indication of an RIA's commitment to their profession. Look for RIAs who have experience working with clients in situations similar to yours.

Consider the Fee Structure: RIAs can charge different types of fees such as hourly or flat fees or a percentage of assets under management. Be sure you understand the fees and any additional costs that may be involved such as transaction fees or custody fees.

Overall, finding a reliable and trustworthy RIA takes time and research, but the effort can pay off in the long run. By doing your due diligence and working with an RIA who aligns with your goals and values, you can feel more confident in your financial future.

Advantages & Disadvantages of Working with an RIA?

Working with a Registered Investment Advisor (RIA) has several advantages and disadvantages, depending on the individual's financial goals, preferences, and circumstances.

Advantages

Fiduciary Duty: RIAs have a legal obligation to act in their client's best interests, ultimately putting the client's interests before their own.

Personalized Service: Because RIAs work with fewer clients than many financial advisors, they are often able to offer more personalized attention and customized investment strategies.

Transparency: RIAs are required to disclose their fees and any potential conflicts of interest, which can help clients make informed decisions about their investments.

Access to a Wider Range of Investment Options: RIAs may have access to a wider range of investment options, including alternative investments and private funds, which may not be available through traditional brokerage firms.

Disadvantages

Potentially Higher Fees: RIAs may charge higher fees than traditional brokerage firms, particularly for more personalized services or specialized investment strategies.

Less Regulation: While RIAs are regulated by the Securities and Exchange Commission (SEC) or state securities regulators, they may be subject to less regulation than larger financial institutions.

Potential Conflicts of Interest: While RIAs are required to disclose any potential conflicts of interest, it's still important for clients to thoroughly vet their advisors and ensure they are acting in their best interests.

Compliance Requirements: RIAs are subject to various compliance requirements and regulatory oversight, which can increase their administrative costs and potentially impact their ability to serve clients.

Limited Access to Proprietary Products: RIAs typically do not have access to proprietary investment products, which may limit their investment options compared to larger financial institutions.

Ultimately, whether working with an RIA is right for you will depend on your individual needs and goals. It's important to do your research and evaluate your options before making a decision.

How do Registered Reps Become Investment Advisors?

Registered representatives can become investment advisors by meeting certain requirements and obtaining the necessary licenses. To become an investment advisor, a registered representative must first pass the Series 65 exam, which is administered by the Financial Industry Regulatory Authority (FINRA). They may also qualify for registration by holding certain other securities licenses, such as the Series 7 or Series 6.

Once they have passed the exam, they can then register with either the Securities and Exchange Commission (SEC) or the state in which they plan to operate as an Investment Advisor. This process involves filing Form ADV, which provides information about the advisor's business practices, fees, and investment strategies.

Registered representatives must also adhere to specific standards and regulations when transitioning to becoming Investment Advisors. For example, they must act in the best interests of their clients and provide full and fair disclosure of all conflicts of interest. They must also keep detailed records of all investment transactions and client interactions.

Registered Investment Advisor (RIA) FAQs

What is an RIA and what services do they provide?

A Registered Investment Advisor (RIA) is a financial professional or firm that provides investment advice and portfolio management services to clients in exchange for a fee. RIA services often include investment management, financial planning, retirement planning, tax and estate planning, among others.

What is the relationship between RIAs and the SEC?

RIAs are regulated by the SEC or state securities agencies, depending on the amount of assets they manage. They must register with either agency and comply with their rules and regulations.

What is the difference between an RIA and a BD?

An RIA provides investment advice and manages client portfolios, while a Broker-Dealer (BD) buys and sells securities for clients and executes trades.

What is the history of RIAs and how have they evolved?

RIAs were first created by the Investment Advisers Act of 1940 and have evolved to become a significant force in the investment industry, with more than $100 trillion in assets under management.

How do RIAs operate and manage their clients' portfolios?

RIAs create customized investment plans based on their client's goals and risk tolerance and manage their portfolios accordingly.

Who is required to register as an RIA?

Anyone who provides investment advice for a fee and manages assets must register as an RIA with either the SEC or state securities agencies.

What are the different classifications of RIAs and how are they defined?

RIAs are often classified as hedge funds, independent wealth advisors, investment banks, liquidity funds, multifaceted fund managers, private equity funds, qualified custodians, real estate funds, securitized asset funds, venture capital funds, wealth managers, wirehouses and other fund providers.

What are the most common types of investments used by RIAs for their clients?

The most common types of investments used by RIAs are stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments.

What are alternative investments, and what are the five most heavily used alternative investments by RIAs?

Alternative investments are non-traditional assets, including private equity, real estate, hedge funds, commodities, and infrastructure. The five most heavily used alternative investments by RIAs are private equity, real estate, hedge funds, commodities and infrastructure.

What is traditional long-only asset management, and how does it differ from alternative investments?

Traditional long-only asset management involves investing in publicly traded securities such as stocks and bonds, while alternative investments are non-traditional assets that are less liquid and less regulated.

What is the state cut-off for RIAs to register with the SEC?

RIAs with $100 million or more in assets under management are required to register with the SEC, while those with less than $100 million in assets under management are required to register with their state securities agency.

How are RIAs regulated, and what are the compliance requirements?

RIAs are regulated by the SEC or state securities agencies, and they must comply with a range of rules and regulations related to client disclosure, reporting, and record keeping.

How can one find a reliable and trustworthy RIA?

One can find a reliable and trustworthy RIA by conducting thorough research, checking their credentials, and reading reviews and testimonials from current and former clients.

What are the advantages and disadvantages of working with an RIA?

The advantages of working with an RIA include customized investment plans, professional management, and fiduciary duty. The disadvantages include fees and potential conflicts of interest.

What are the legal requirements for RIAs, and how do they differ from other financial professionals?

RIAs must register with the SEC or state securities agencies and comply with a range of rules and regulations related to client disclosure, reporting, and record-keeping.

What are the compliance requirements for RIAs, and how do they differ from other financial professionals?

RIAs are subject to higher compliance requirements than other financial professionals, including regular reporting and record-keeping, and they must adhere to a fiduciary standard, which requires them to act in their client's best interests.

What is the total size of the RIA landscape, and how has it grown over time?

The RIA industry manages over $100 trillion in assets under management and has grown significantly over the past decade due to increased demand for customized investment solutions and fee-based

What does the client makeup of the overall RIA landscape look like in terms of entities, reps, and money managers vs. asset allocators?

The client makeup of the overall RIA landscape is diverse and includes a range of entities, such as individuals, families, trusts, foundations, and corporations. Reps may work directly with clients or manage client relationships through other professionals, such as attorneys or accountants. Money managers focus on investing and managing client portfolios, while asset allocators focus on creating diversified investment strategies.

Who are the largest RIAs by classification/type, and how do they compare in terms of assets under management?

The largest RIAs by classification/type include firms such as BlackRock, Vanguard, J.P. Morgan Asset Management, and Goldman Sachs Asset Management. These firms manage trillions of dollars in assets under management and provide a range of investment products and services to clients.

Understanding the Differences Between Family Offices & RIAs

What is a family office, and how does it differ from an RIA?

A family office is a wealth management firm that serves a single high-net-worth family or a small group of families. An RIA, on the other hand, provides investment advice and portfolio management services to a broader range of clients.

How do family offices and RIAs overlap in terms of services offered?

Family offices and RIAs both offer investment management, financial planning, tax planning, and estate planning services to their clients.

What are some common reasons why a family office might work with an RIA?

A family office might work with an RIA to gain access to specialized investment expertise, outsource investment management or leverage technology and infrastructure provided by the RIA.

How do family offices and RIAs differ in terms of regulatory requirements?

Family offices are typically exempt from registration with the SEC or state securities agencies, while RIAs are required to register and comply with a range of rules and regulations.

What are some of the challenges that family offices face when working with RIAs?

Family offices may face challenges when working with RIAs related to coordination and communication, as well as potential conflicts of interest if the RIA is also working with other clients in the same industry or geographic region.

What are some benefits of working with an RIA for a family office?

Working with an RIA can provide a family office with access to specialized investment expertise, increased operational efficiencies, and greater scalability and flexibility.

How do family offices and RIAs differ in terms of investment strategies and approaches?

Family offices may be more focused on preserving and growing wealth over multiple generations, while RIAs may be more focused on meeting specific investment goals and objectives for their clients.

What are some common investment vehicles used by family offices and RIAs?

Family offices and RIAs both commonly use traditional investment vehicles such as stocks, bonds and mutual funds, as well as alternative investments such as private equity, real estate, and hedge funds.

How do family offices and RIAs differ in terms of client makeup and services offered?

Family offices typically serve a single high-net-worth family or a small group of families, while RIAs serve a broader range of clients. Family offices may also offer more comprehensive wealth management services, such as tax planning and estate planning.

What are some best practices for family offices working with RIAs?

Best practices for family offices working with RIAs include setting clear expectations, establishing open lines of communication, and conducting thorough due diligence before selecting an RIA partner.

%20A%20Comparative%20Analysis.png?width=1920&height=384&name=Family%20Offices%20%26%20Registered%20Investment%20Advisors%20(RIAs)%20A%20Comparative%20Analysis.png)

In conclusion, the Registered Investment Advisor (RIA) ecosystem is a diverse and dynamic industry that provides investment management and financial planning services to a wide range of clients. Whether you are an individual investor, a high-net-worth individual or an institutional client, there is an RIA that can meet your needs and help you achieve your financial goals. By understanding the classifications of RIAs, their client makeup, geographic breakdown, and advantages and disadvantages, you can make an informed decision about working with an RIA and find a trusted advisor who can guide you on your financial journey. With the proper due diligence and research, you can find an RIA that aligns with your values and objectives and help you navigate the complex world of finance with confidence.

FINTRX is a leading family office and RIA data intelligence platform that provides valuable insights and information to help users grow their businesses and connect with high-net-worth individuals and institutional investors. Our platform offers a comprehensive database of 3,600+ family offices, 20,000 family office contacts, 37,000 RIAs and 850,000 registered RIA reps/contacts. We provide detailed profiles of each family office and RIA, including investment preferences, asset allocation and detailed contact information.

In addition to our private wealth database, FINTRX offers custom data feeds, API integrations and research reports to help users make informed investment decisions and identify new business opportunities. Equipped with 375+ advanced search and filtering capabilities FINTRX help users find the exact information they need.

For an in-depth exploration of the FINTRX family office & RIA data platform, request a demo below.

Written by: Renae Hatcher |

March 31, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)

.png?width=1920&height=384&name=RIA%20CTA%20(2).png)