START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Q3 2022 Family Office Data Report

Over the last few months, the family office market has experienced continued growth and expansion, as did the FINTRX Family Office & RIA Data Platform. Throughout Q3, our data set grew to include 3,450+ family offices, 19,300+ decision-makers and 24,000+ tracked investments, among several other updates and additions. Continue reading for a full breakdown of all new and updated family office data throughout Q3 2022...

Family offices are typically private unregulated companies, constructed to manage the wealth and investments of individuals and families with over $50M of investable assets. Because family offices make investment decisions based on a unique combination of considerations, FINTRX makes it easy to identify and create relationships with the right investors.

By providing credible family office intel, capital raising tools and savvy search capabilities, FINTRX continues to bring transparency to the private capital markets. Through our continued expansion of strategic partnerships, private sourcing methods and public aggregation, FINTRX ensures credible family office intel to our global client base.

Note from our VP of Research

Dear Reader,

First, I would like to thank you for taking the time to read through our Q3 Data Report on the family office market.

This report provides a high-level synopsis of the global family office landscape throughout Q3 of 2022 with data compiled using the FINTRX Family Office & RIA Data Platform.

As the family office market continues to shift, our research team remains dedicated to providing the most actionable and up-to-date investor data possible.

Thank you again for reading our Q3 Report and we look forward to a potential engagement with you and your team.

- Dennis Caulfield, Vice President of Research, FINTRX

Q3 Family Office Data Highlights

- New Family Offices: 154

- New Family Office Contacts: 1,120+

- Family Office Contacts Updated: 3,470+

- Family Office Updates: 4,100+

- Newly Tracked Family Office Investments: 920+

- Total Family Office Additions: 2,190+

- Total Family Office Assets Added: $145.5B+

- Total Material Changes/Updates Made: 6,300+

Monthly Family Office Data Breakdown

Since the start of 2022, our dedicated and growing research team has added 429 new family offices and 3,971 new family office contacts to our dataset. Additionally, there were 13,400+ family office updates made.

.png?width=518&height=318&name=Updates%20%26%20Additions%20(full%20breakdown).png)

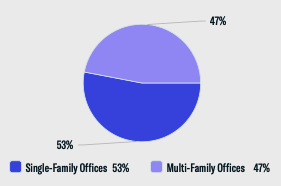

Single-Family Offices vs Multi-Family Offices

Throughout the course of Q3, FINTRX added a total of 154 new family office entities to our private wealth data and research platform. 53% of newly added firms are single-family offices while 47% are multi-family offices.

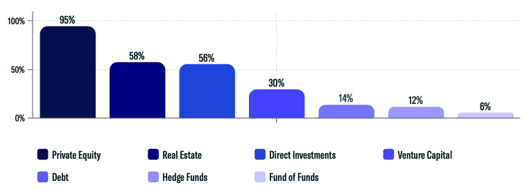

Asset Class Interest Breakdown

The chart below demonstrates the different asset classes utilized by family offices throughout the quarter. Alternative asset classes allow for both wealth preservation and asset growth making them attractive options to those in the private wealth space.

A majority of new family offices displayed tendencies to invest in private equity, real estate and via direct investments. A combined 32% of firms showed interest in debt, hedge funds and fund of funds.

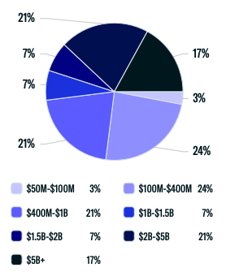

Assets Under Management Breakdown

Here we outline the assets under management (AUM) ranges of new family offices added to our dataset throughout the quarter. The most prevalent among this sample size are groups with assets between $100M-$400M, at 24%. Family offices with AUM between $400M-$1B and $2B-$5B followed at 21%, respectively.

- Total Family Office Assets Added to FINTRX in Q3: $145.5 Billion

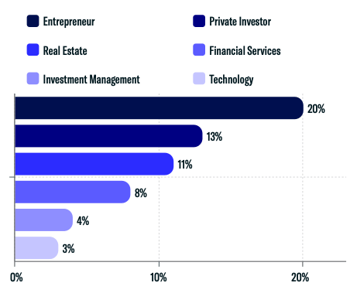

Single Family Office Origin of Wealth Analysis

One of the more prevalent patterns drawn from our research is the relation between the industry in which of wealth origin and the industry of investment interest. With that being said, there is a clear tendency for groups to invest in opportunities throughout familiar industries.

A majority of single-family offices added to our data set in Q3 created their wealth as entrepreneurs, private investors or through real estate ventures. It's important to note that family offices can have more than one origin of wealth.

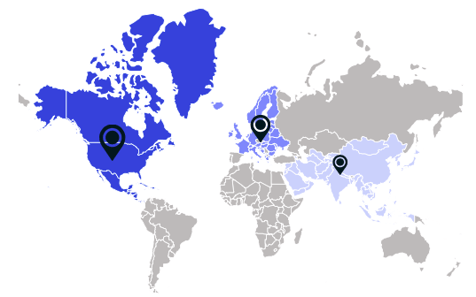

Geographic Breakdown

Our dataset's continued growth in Q3 coincided with the increase of family offices worldwide. A combined 72% of newly added family offices are domiciled in North America and Europe. Asia and the Middle East accounted for 15% of firms while the rest of the world made up the remaining 13%.

Top Regions with New Family Office Activity

- North America: 40%

- Europe: 32%

- Asia & the Middle East: 15%

- Rest of World: 13%

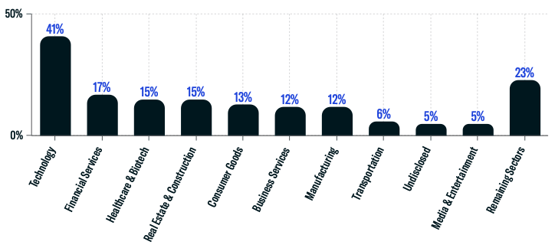

Direct Transactions by Sector

Throughout our research, we continue to see family offices harnessing direct investment opportunities. The shift toward direct investments is often based on the desire to have greater control over decisions relating to asset allocation. Direct transactions allow family offices to invest in or buy companies of a preferred size or industry which often leads to greater fruition down the road.

Technology remained the leading industry for family office investments at 41%, with 380+ transactions made into private tech companies throughout the quarter. Additional sectors of interest include healthcare & biotechnology, real estate & construction, consumer goods, business services, manufacturing and transportation, among others.

Download Your Copy

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office and investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, and advisor growth signals amongst other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Visit the FINTRX Resource Library for useful private wealth narratives, PDFs and guides to success.

Written by: Renae Hatcher |

November 21, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)