START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

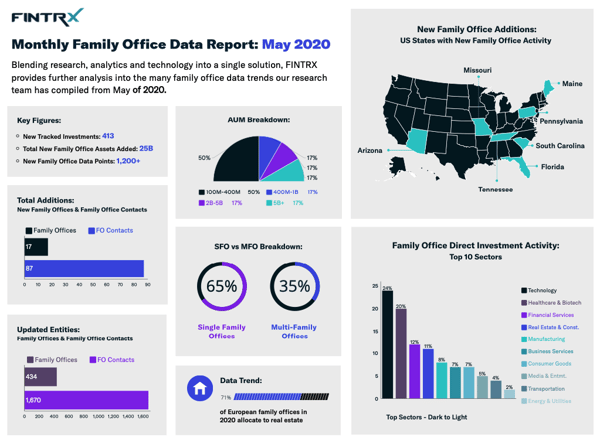

Monthly Family Office Data Report May 2020

As the global family office landscape continues to evolve and diversify, the FINTRX data and research platform consistently grows alongside. With universal coverage on 2,848+ family offices, 11,061+ family office contacts and 11,742+ tracked investments, we have provided further insight into notable family office data trends compiled from May of 2020. Continue reading for a full breakdown on how last month unfolded within our rapidly developing database.

FINTRX Data Reports are produced exclusively utilizing our expansive family office data and research platform. Thanks to our dedicated research team - who continuously works to update and expand our vast data set - we are able to share helpful and credible information regarding the private capital markets.

May Findings

→ New Family Office Data Points = 1,200+

→ Total New Family Office Assets Added = $25 Billion+

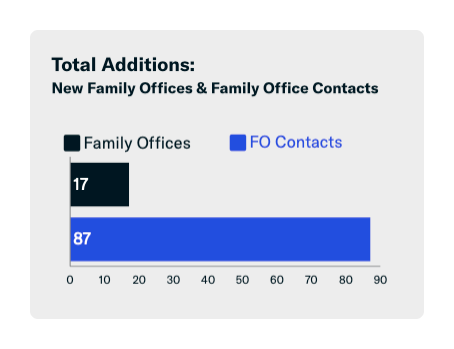

→ Total Additions = 104+

- ⇒ Family offices added: 17

- ⇒ Family office contacts added: 87

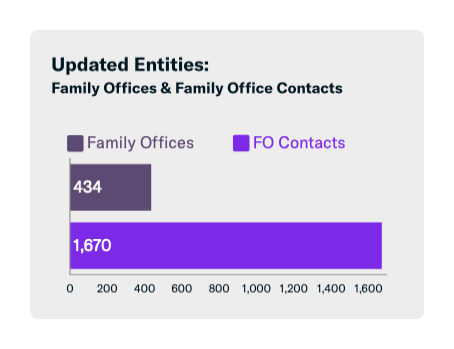

→ Updated Entities = 2,104+

- ⇒ Updated family offices: 434

- ⇒ Updated family office contacts: 1,670

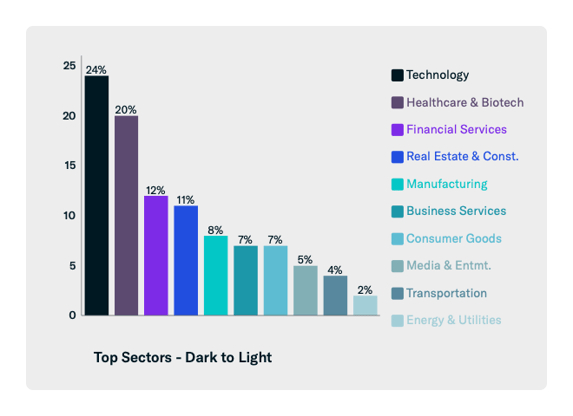

→ Family Office Direct Investment Activity: Top 10 Sectors

- 1. Technology = 24%

- 2. Healthcare & Biotechnology = 20%

- 3. Financial Services = 12%

- 4. Real Estate & Construction = 11%

- 5. Manufacturing = 8%

- 6. Business Services = 7%

- 7. Consumer Goods = 7%

- 8. Media & Entertainment = 5%

- 9. Transportation = 4%

- 10. Energy & Utilities = 2%

→ Notable Family Office Data Trend:

Due to the rise in global real estate opportunities, family offices consistently recognize the importance of having a real estate allocation strategy for the steady returns and tax benefits, for instance. For more information on why family offices gravitate towards real estate, click here.

In the midst of an ever-changing market characterized by volatile human behaviors and rapid technological advancements, it is imperative to craft the right messages with family office investors, ultimately making warm introductions feel smooth and effortless. In our latest 12-page guide available below, we explore outreach best practices and insights derived through the analysis of our proprietary data combined with years of extensive research into the family office ecosystem.

The FINTRX family office data and research platform features comprehensive and accurate investor intelligence relating to the alternative investment industry. Updated daily, our cutting-edge solution offers capital raising tools, intelligent data and smart search capabilities to best facilitate your outreach efforts.

In utilizing the power of the FINTRX platform, we continue to monitor any and all developments when it comes to the private wealth landscape. To stay ahead of the curve, visit our newly refurbished Resource Library, here.

For an in-depth exploration of the FINTRX family office platform, request a demo:

Written by: Renae Hatcher |

June 10, 2020

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)

.png?width=1000&name=EMAIL%20IMAGE%20TEMPLATES%20(15).png)