START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX RIA Geographical Breakdown

With an estimated 35,000+ entities and 405,000+ contacts in operation today, registered investment advisors (RIAs) continue to experience growth in nearly every metric - from a record number of firms and employees to client demand and increased assets under management. To shine a light on the space, FINTRX explores the RIA industry at large, offering insight and analytics into the current geographical breakdown of the RIA market.

RIA Review

Regulated directly by the Securities and Exchange Commission (SEC), a registered investment adviser (RIA) is any firm that advises or manages the wealth of high net-worth individuals or institutions. All RIAs are fiduciary organizations and therefore have a legal obligation to act in the best interest of their clients. Registered investment advisors make up a broad range of groups throughout the financial landscape, including wealth advisers, hedge funds, retail investment advisories, private equity firms, and several other groups that manage institutional capital. Some RIAs register as family offices as well.

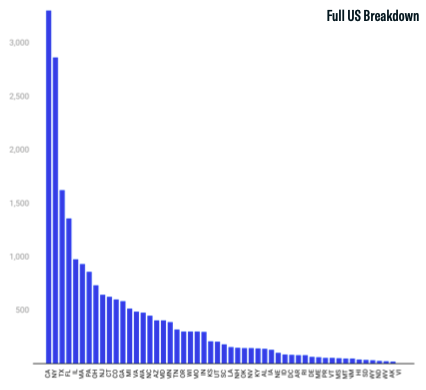

RIA Count Per State

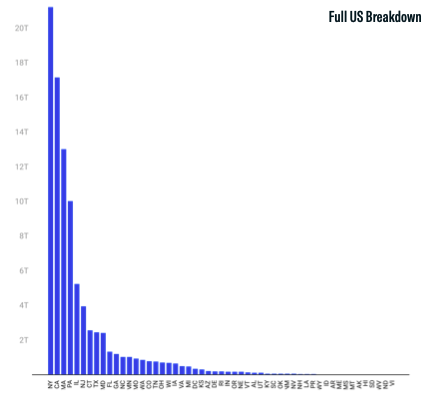

Total AUM Per State

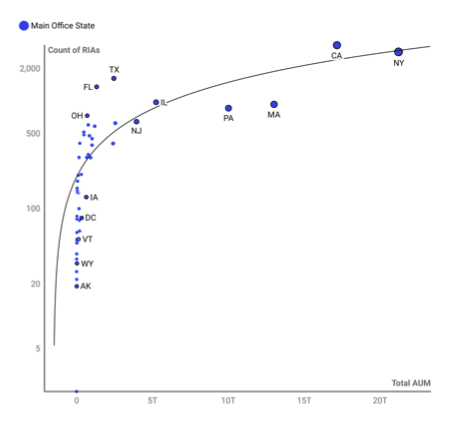

Comparing RIA Count vs AUM

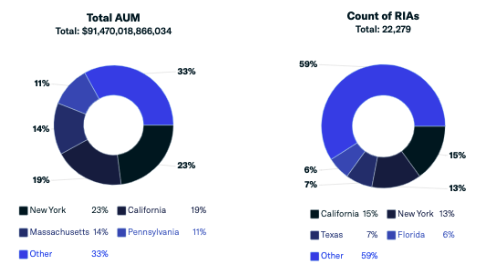

RIA Count: Visual Breakdown

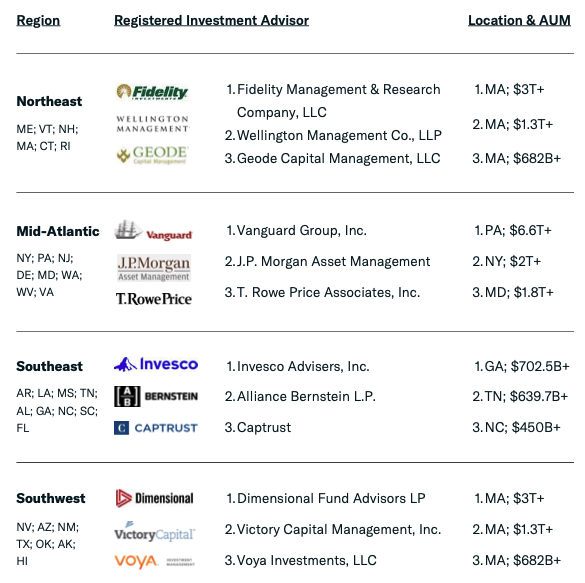

Top 3 Largest RIAs by Region

Below, we provide a breakdown of the top three largest registered investment advisors per region. Regions include the Northeast, Mid-Atlantic, Southeast, Southwest, Midwest, and West Coast.

.png?width=585&name=Top%203%20Largest%20RIAs%20per%20Region%20(2).png)

Download the Full 9-Page Report

FINTRX provides comprehensive intelligence on thousands of private family offices, each designed to facilitate your prospecting and capital-raising efforts. Explore in-depth profiles on each family - AUM, source of wealth, investment criteria, previous investment history, industries of interest - and other key data points to help elevate your workflow. FINTRX offers an inside look at the alternative investment industry and private capital markets.

With complete coverage of over 3,090+ family offices, 15,800+ family office contacts, and 19,600+ tracked investments, FINTRX ensures direct access to accredited investor intelligence. The FINTRX platform is an essential tool in understanding the family office landscape in the U.S. and abroad, while also empowering users to uncover commonalities with these family offices for effective, personal outreach.

For an in-depth exploration of the FINTRX family office platform, click below:

Written by: Renae Hatcher |

December 06, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)