START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Q4 2021 RIA Data Report

To shine a light on the Registered Investment Advisor (RIA) landscape, FINTRX - family office and RIA database provider has compiled the Q4 2021 RIA Data Report to provide a high-level synopsis of registered investment advisors (RIAs) for Q4 of 2021. Explore metrics such as total registered firms, assets under management, contact breakdown, services provided, geographical breakdown, and more. Download the 16-page report below...

Introduction

Hello and welcome to the Q4 2021 RIA Data Report. This report provides a high-level synopsis of registered investment advisors (RIAs) for Q4 of 2021.

An RIA is defined as any individual or firm registered with the Securities and Exchange Commission (SEC) or State Securities Authorities that advises and offers analyses on investments based on a client's individual needs. RIAs act fiduciarily, always acting in the best interest of their clients.

RIAs advise on a range of financial subjects, from retirement planning to insurance and estate planning. The total RIA market is diverse and includes any firm registered as a registered investment advisory firm. It comprises banks, broker/dealers, financial planners, hedge funds, family offices, asset managers, wealth managers, and more. If firms want to give advice as fiduciaries for a fee, they must register as an RIA to do so.

Because the Registered Investment Advisor space is encompassing a wide variety of financial institutions, we have sub-categorized RIAs to provide an organized and consolidated synopsis of the landscape. It comprises banks, financial planners, hedge funds, family offices, asset managers, wealth managers, and several additional firm types.

The highly fragmented registered investment advisor channel is particularly well-positioned to serve high-net-worth individuals and families seeking an alignment of interests between the firm and client. The sample size used throughout this report does not include Broker-Dealers or Exempt Reporting Advisors.

It is important to note, the data throughout this report was compiled by utilizing the FINTRX Family Office & Registered Investment Advisor Data Platform.

Totals

- - Total Registered Firms: 38, 329

- - Total RIAs: 34,795 (91% of total registered firms)

- - Total Broker-Dealers: 3,047 (8% of total registered firms)

- - Total Dual-Registered: 487 (1% of total registered firms)

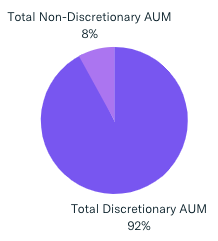

Total AUM

- - Total Firm AUM: $113,042,233,503,578

- - Median AUM (Q4): $70,000

- - Total Discretionary AUM: $104,096,736,392,762

- - Total Non-Discretionary AUM: $8,945,497,110,816

Contact Breakdown

A majority of RIAs either act as broker-dealers (43%) or dually-registered reps (42%).

- - Broker-Dealer Reps: 313,641

- - Investment Advisor (IA) Reps: 74,724

- - Dually Registered Reps: 305,051

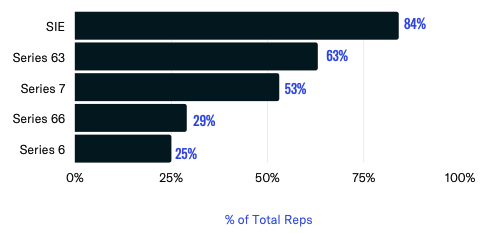

Representative License Breakdown

- - SIE: 84%

- - Series 63: 63%

- - Series 7: 53%

- - Series 66: 29%

- - Series 6: 25%

Contact Breakdown

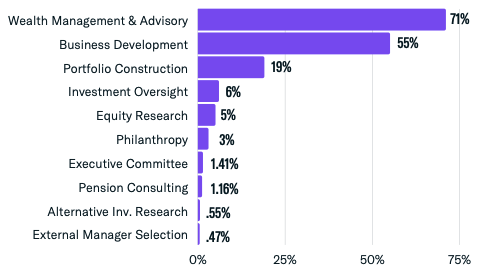

Representative Skills & Experience

- Top 3:

- - Wealth Management & Advisory: 71%

- - Business Development: 55%

- - Portfolio Construction: 19%

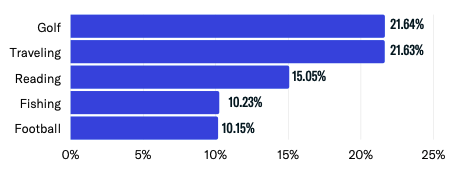

Hobbies & Interests

In addition to the above investment advisory hobbies, registered reps also show an interest in running, volunteering, basketball, hiking, and baseball.

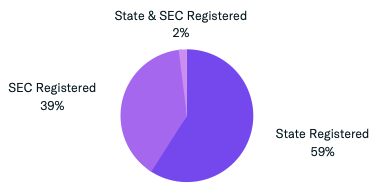

Firm Registration Status

- - State Registered: 59%

- - SEC Registered: 39%

- - State & SEC Registered: 2%

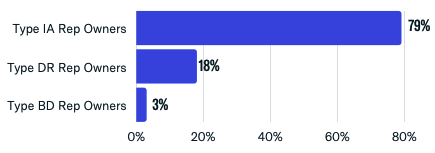

Representative Ownership Breakdown

These are owners that are also representatives. This chart displays the type of registration each rep holds.

- - Total Registered Reps with Ownership: 39,191

ESG Investing

- - Total ESG Investors: 1,331+

This is approximately 4% of total investor entities explicitly implementing ESG practices.

Rep Universities

The top five Universities of Registered Investment Advisors include New York University, the University of Pennsylvania, Harvard University, the University of Wisconsin, and Penn State. Approximately 8% of total registered reps have matriculated from these five Universities.

- 1. New York University: 7,684 or 1.95% of Total Reps

- 2. University of Pennsylvania: 7,529 or 1.91% of Total Reps

- 3. Harvard University: 5,541 or 1.41% of Total Reps

- 4. University of Wisconsin: 5,122 or 1.30% of Total Reps

- 5. Penn State: 4,672 or 1.19% of Total Reps

Gender Breakdown

When it comes to the gender breakdown of reps, 74% of reps are male while 26% of reps are female. Nearly 7,000 new contacts entered the industry throughout Q4 of 2021.

- - Male Reps: 74%

- - Female Reps: 26%

- - New Contacts Entering the Industry (in Q4 2021): 6,802

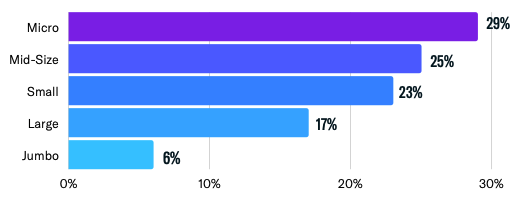

Firm Size Breakdown

by Assets

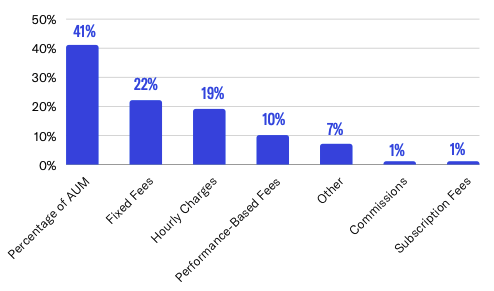

Fee Structure Breakdown

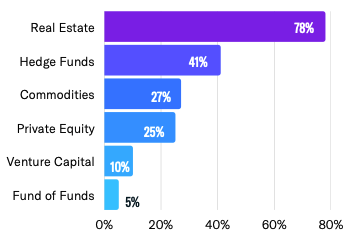

Alternatives Used

Across the entire RIA space, about 64% rely on alternative investments to some degree.

Of this subset of 64% in the space, the most commonly used alternatives include Real Estate (78%), Hedge Funds (41%), Commodities (27%), Private Equity (25%), Venture Capital (10%), and Fund of Funds (5%).

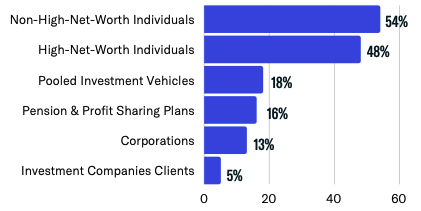

Services Provided at the Firm Level

The data here displays entities providing services at the firm level. For instance, 54% of all RIAs offer services to non-high-net-worth individuals, and 48% offer services to high-net-worth families and individuals.

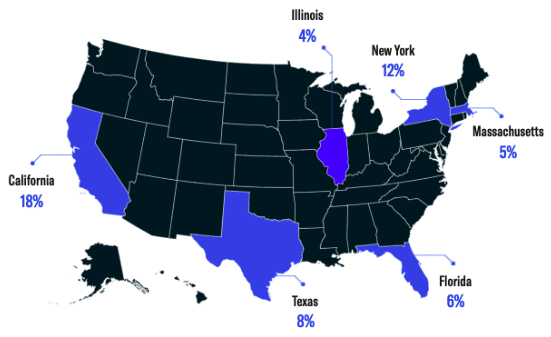

Geographical Breakdown

Top States by Firm Count

The US states with the most RIA firms include California (18%), New York (12%), Texas (8%), Florida (6%), Massachusetts (5%), and Illinois (4%). Of all firms, these six states make up approximately 53% of all US firms.

- 1. California: 18%

- 2. New York: 12%

- 3. Texas: 8%

- 4. Florida: 6%

- 5. Massachusetts: 5%

- 6. Illinois: 4%

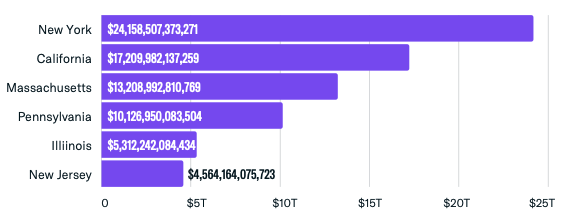

Top States by AUM

- 1. New York: 25%

- 2. California: 17%

- 3. Massachusetts: 13%

- 4. Pennsylvania: 10%

- 5. Illinois: 5%

- 6. New Jersey: 4%

- - Total AUM in the United States: $98,609,412,975,086

- - Total AUM outside the United States: $14,130,801,123,517

- - Total AUM outside the United States & Private Residences: $14,432,820,528,492

- - Total Count of RIA Firms in the United States: 24,723

Separately-Managed Accounts (SMAs) Breakdown

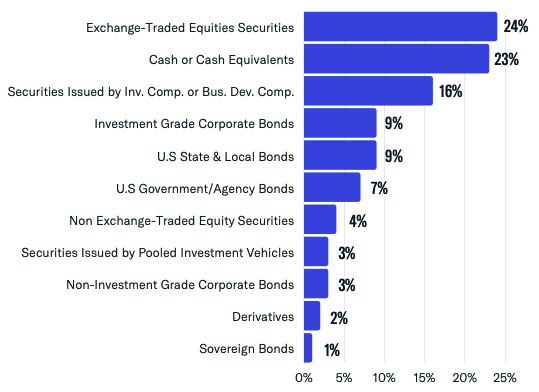

Investment Types Used by Firm Count

As expected, some of the most popular SMA investments include Exchange-Traded Equities Securities (24%), Cash or Cash Equivalents (23%), and Securities Issued by Investment Companies or Business Development Companies (16%).

Download the Report

FINTRX provides comprehensive data intelligence on 750,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, advisor growth signals, amongst other key data points.

Additionally, FINTRX provides insight and expansive contact information on key decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For additional details and a live walkthrough, please request a demo below.

Written by: Renae Hatcher |

February 03, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)