START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Q1 2022 Registered Investment Advisor (RIA) Data Report

To shine a light on the Registered Investment Advisor (RIA) landscape, FINTRX - Family Office and RIA Database provider - has compiled the Q1 2022 Registered Investment Advisor (RIA) Data Report to provide a high-level synopsis of the investment advisory landscape for Q1 2022. Explore metrics such as registered firms, alternatives used, assets under management, representative breakdown, services provided, geographic breakdown, and more.

Introduction

Hello and welcome to the Q1 2022 Registered Investment Advisor (RIA) Data Report. This report provides a high-level synopsis of the investment advisor arena with data compiled through the use of the FINTRX Family Office & Registered Investment Advisor Data Platform.

A Registered Investment Advisor (RIA) is defined as any individual or firm registered with the Securities and Exchange Commission (SEC) or State Securities Authorities that advises and offers analyses on investments based on a client's individual needs. RIAs advise on a range of financial subjects, from retirement planning to insurance and estate planning.

The total RIA market is diverse and includes any group registered as an investment advisory firm. It is comprised of banks, financial planners, hedge funds, family offices, asset managers, and wealth managers, among others. The highly fragmented RIA channel is particularly well-positioned to serve high-net-worth individuals and families seeking an alignment of interests between the firm and client. The sample size used throughout this report does not include firms registered solely as broker-dealers.

- - Total Registered Firms: 31,981

- - Total Dually Registered Firms: 235

- - Firms Registered as an RIA: 98%

- - Dually Registered Firms: 2%

Note From our VP of Research

Dear Reader,

Thank you for taking the time to read through our Q1 data report on the Registered Investment Advisor landscape. Nearly a year and a half ago we endeavored on a mission at the behest of our client base.

The goal was to create a research tool, in the likeness of our family office product, that would greatly improve our clients’ efficiency when targeting the RIA industry. After months of dedicated effort across the research and product teams, FINTRX launched the RIA data suite.

The following report is a high-level examination of the RIA landscape throughout Q1 of 2022. The figures provided within have been gathered entirely from the FINTRX RIA platform after having been aggregated from several sources and analyzed using dozens of native algorithms.

We look forward to engaging with your company and appreciate your interest in our report.

Dennis Caulfield, Vice President of Research, FINTRX

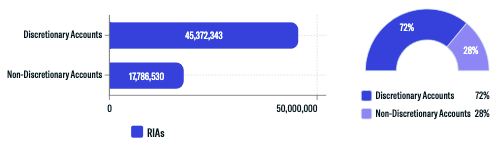

Accounts Breakdown

- - Total Accounts: 63,158,873

- - Total Discretionary Accounts: 45,372,343 (72%)

- - Total Non-Discretionary Accounts: 17,786,530 (28%)

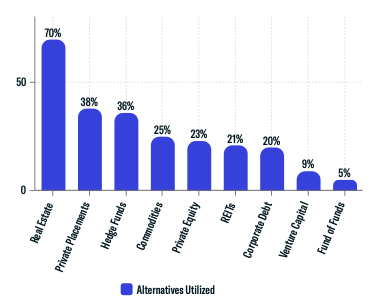

Alternatives Utilized

The most utilized alternatives for the quarter include Real Estate at 70%, Private Placements at 38%, and Hedge Funds at 36%.

- - Total Firms Using Alternatives: 24,751

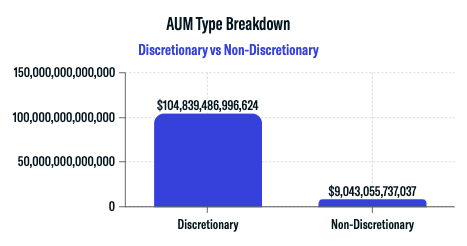

Assets Under Management (AUM) Breakdown

Regarding the Assets Under Management (AUM) for RIAs throughout Q1, 92% of AUM is discretionary, while 8% is non-discretionary.

- Total Assets Under Management: $113,882,542,733,661.00- - RIA Assets Under Management: $106,674,927,225,372

- - Dually Registered Assets Under Management: $7,207,615,508,289

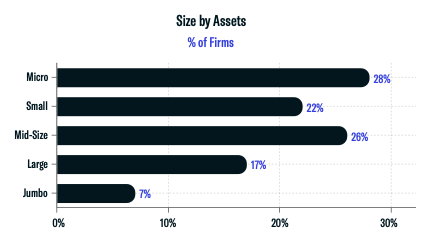

The chart below depicts a breakdown of Assets Under Management based on the size of firms. As you can see, a majority of AUM comes from micro-sized groups, at 28%. Mid-size firms followed closely behind at 26%.

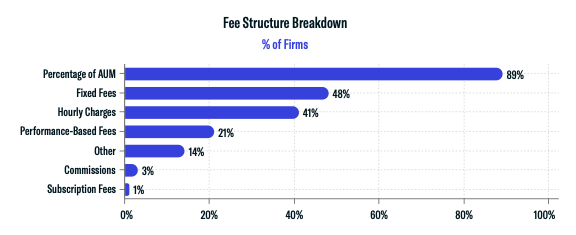

Fee Structure Breakdown

89% of RIAs compensate through a percentage of Assets Under Management (AUM). Others use fixed fees, hourly charges, and performance-based fees as a means to charge clients.

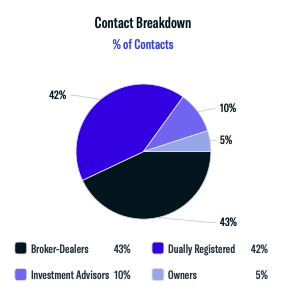

Contact Breakdown

- - Total Contacts: 727,387

- - Total Female Reps: 26%

- - Total Male Reps: 74%

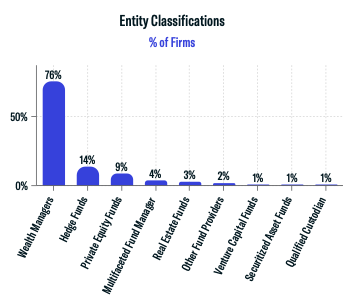

Entity Classification Breakdown

Here, we demonstrate the entity classifications of Registered Investment Advisor firms throughout Q1. Most firms classify themselves as Wealth Managers, at 76%. Other classifications include Hedge Funds at 14%, Private Equity Funds, at 9%, and Multifaceted Fund Managers at 4%.

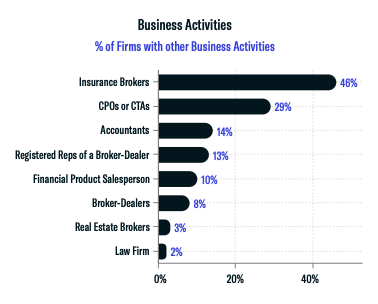

Business Activities Breakdown

This graph highlights the percentage of RIA firms offering additional business activities throughout Q1. Of those firms with additional business activities, 46% also act as Insurance Brokers, 29% as CPOs or CTAs, and 14% as Accountants.

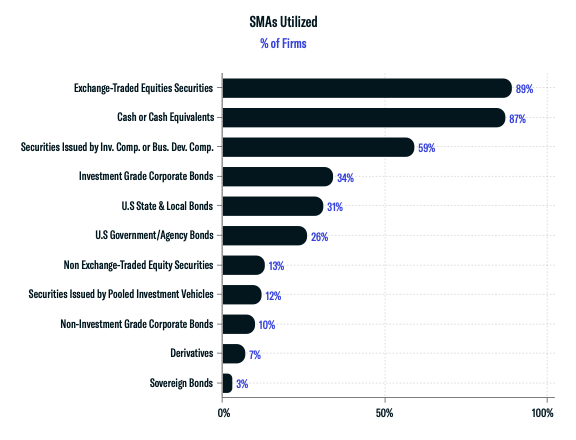

Separately Managed Accounts (SMAs) Utilized (by Firm)

The chart below demonstrates the types of investments utilized throughout Separately Managed Accounts (SMAs) across the RIA landscape. For instance, 89% of groups hold Exchange-Traded Equities within their separately managed accounts. Cash or cash equivalents followed, at 87%.

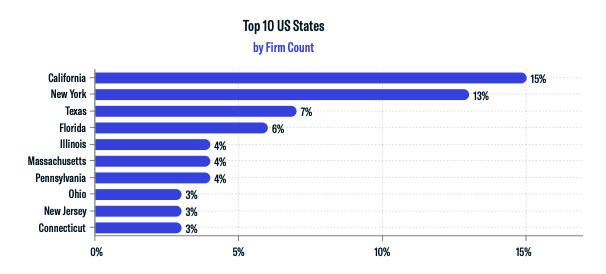

Geographic Breakdown

87% of all RIAs are headquartered in offices throughout the United States.

The chart above depicts the top ten states with the most RIA firms throughout Q1. 15% of RIAs are domiciled in California, while 13% are based in New York, 7% in Texas, and 6% in Florida. North-Eastern states (New York, Maine, Vermont, New Hampshire, Massachusetts, Connecticut, Rhode Island, and Pennsylvania) account for 51% of RIAs, while states in the Pacific region (California, Oregon, Washington, Alaska, and Hawaii) make up 18%.

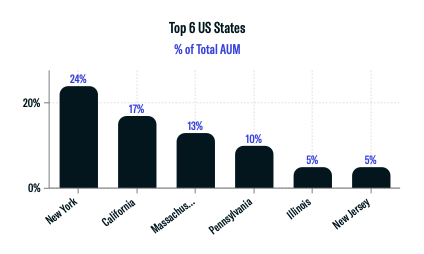

New York accounts for 24% of investment advisory Assets Under Management (AUM) throughout Q1. California and Massachusetts followed at 17% and 13%, respectively.

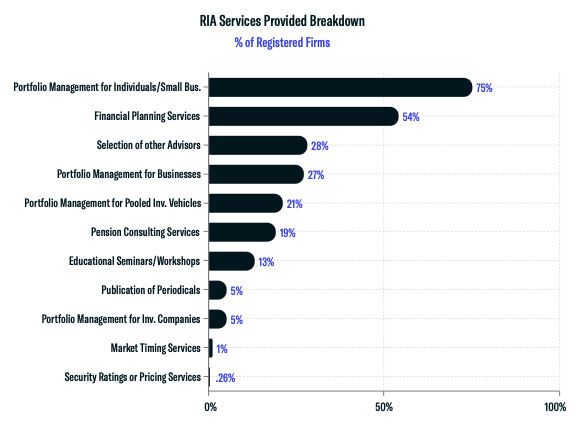

RIA Services Provided

Of all the services provided by Registered Investment Advisors, Portfolio Management for Individuals and Small Businesses is the most frequently offered at 75%. Other common services provided include Financial Planning at 54%, Selection of other Advisors at 28%, and Portfolio Management for Businesses at 27%.

- Count of Firms (Top 3)

- - Portfolio Management for Ind./Small Business: 23,901

- - Financial Planning Services: 17,377

- - Selection of other Advisors: 8,815

Download the Report

FINTRX is the leading family office and registered investment advisor data, research, and intelligence platform to the alternative and private capital markets community. FINTRX provides comprehensive data intelligence on 750,000+ family office and investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office and investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors and industries of interest, advisor growth signals, among other key data points.

Additionally, FINTRX provides insight and expansive contact information on key decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For additional details and a live walkthrough, request a demo below.

Written by: Renae Hatcher |

April 22, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)