START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

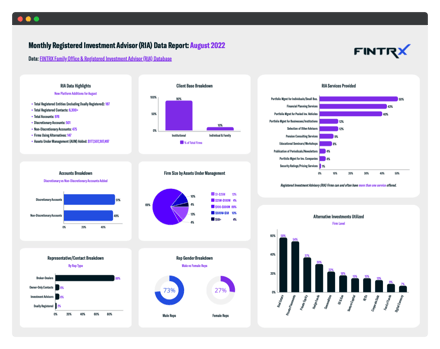

Monthly Registered Investment Advisor (RIA) Data Report: August 2022

FINTRX - Family Office & RIA Database provider - has compiled the Monthly Registered Investment Advisor (RIA) Data Report to provide a high-level synopsis of the investment advisory landscape for August 2022. Explore newly added registered entities and contacts, alternatives used, assets under management, services provided and more...

RIA Data Highlights: New Platform Additions for August

- - Total Registered Entities (including Dually Registered): 187

- - Total Registered Contacts: 6,300

- - Total Accounts: 976

- - Total Discretionary Accounts: 501

- - Total Non-Discretionary Accounts: 475

- - Total Firms Using Alternatives: 147

- - Assets Under Management: $177,507,307,497

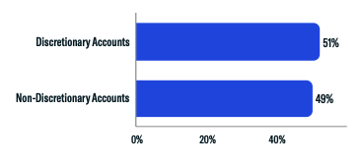

Accounts Breakdown

- - Total Accounts: 976

- - Discretionary Accounts: 501 (51%)

- - Non-Discretionary Accounts: 475 (49%)

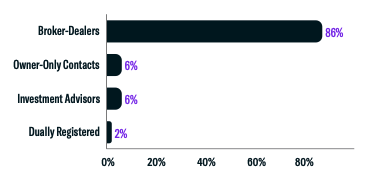

Representative/Contact Breakdown by Type

- - Total Reps/Contacts Added: 6,300

- - Broker-Dealers: 86%

- - Owner-Only Contacts: 6%

- - Investment Advisors: 6%

- - Dually Registered: 2%

Of the 6,300 representatives added to our dataset in August, 86% are registered as Broker-Dealers, 6% as Owner-Only Contacts, 6% as Investment Advisors and 2% as Dually Registered.

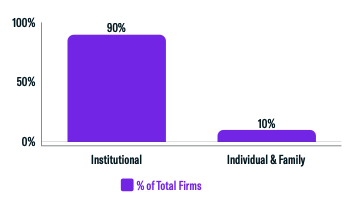

Client Base Breakdown

- - Institutional: 90%

- - Individual & Family: 10%

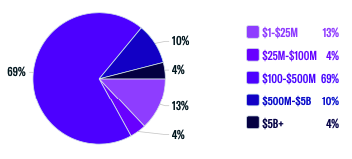

Firm Size Breakdown by Assets Under Management

- - $1-$25M: 13%

- - $25M-$100M: 4%

- - $100-$500M: 69%

- - $500M-$5B: 10%

- - $5B+: 4%

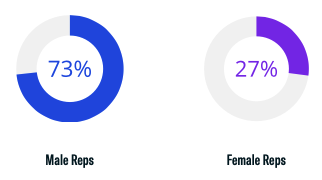

Rep Gender Breakdown

- - Male Reps: 73%

- - Female Reps: 27%

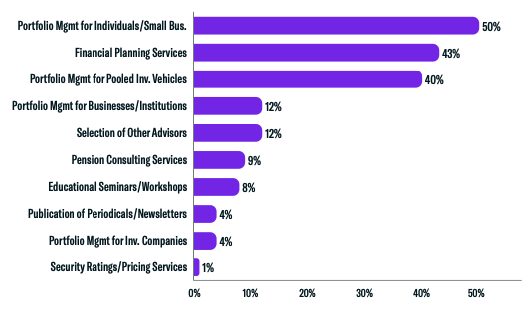

RIA Services Provided

Registered investment advisors often provide an array of financial and investment services to their clients. As you can see, 50% of RIAs offer portfolio management for individuals and small businesses. Financial planning services followed at 43%. Additional services include the selection of other advisors, portfolio management for businesses and institutions, pension consulting services, educational seminars, and several others.

Registered investment advisor firms can and often have more than one service offered.

- 1. Portfolio Management for Individuals/Small Businesses: 50%

- 2. Financial Planning Services: 43%

- 3. Portfolio Management for Pooled Investment Vehicles: 40%

- 4. Portfolio Management for Businesses/Institutions: 12%

- 5. Selection of other Advisors: 12%

- 7. Pension Consulting Services: 9%

- 8. Educational Seminars/Workshops: 8%

- 9. Publication of Periodicals/Newsletters: 4%

- 9. Portfolio Management for Investment Companies: 4%

- 10. Security Ratings/Pricing Services: 1%

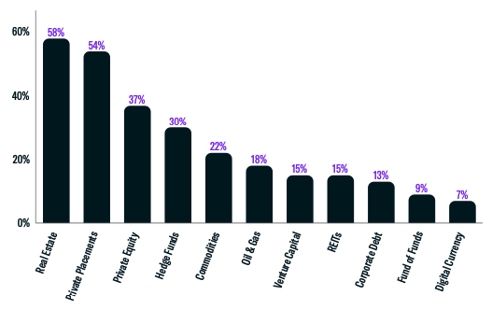

Alternative Investments Utilized

Firm Level

It's important to note that each registered firm can and often utilize more than one alternative investment.

- - Real Estate: 58%

- - Private Placements: 54%

- - Private Equity: 37%

- - Hedge Funds: 30%

- - Commodities: 22%

- - Oil & Gas: 18%

- - Venture Capital: 15%

- - REITs: 15%

- - Corporate Debt: 13%

- - Fund of Funds: 9%

- - Digital Currency: 7%

Download the Report

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest and advisor growth signals, among other key data points.

Additionally, FINTRX provides insight and expansive contact information on key decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For additional details and a live walkthrough, request a demo below.

Written by: Renae Hatcher |

September 09, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)