START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Monthly Family Office Data Report April 2020

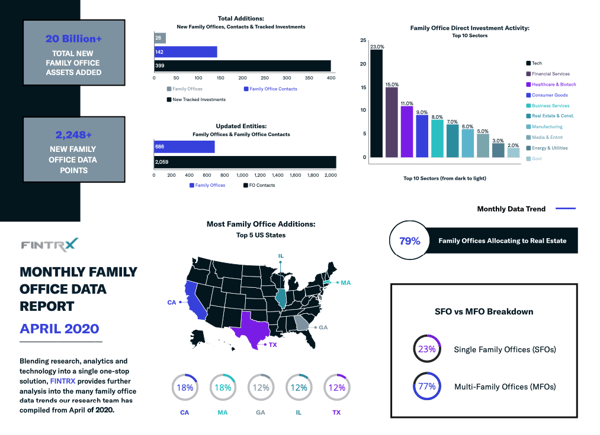

Designed to greatly enhance your capital raising efforts, the FINTRX family office data and research platform offers an inside look at the alternative investment industry and private capital markets. With complete coverage on 2,833+ family offices, 11,063+ family office contacts, and 11,386+ tracked investments, FINTRX strives to ensure direct access to unabridged investor intelligence. In an effort to cast light on the family office space, we have provided further analysis into notable family office data trends compiled from April of 2020. Continue reading for a full breakdown on how last month unfolded within our rapidly evolving database.

FINTRX Data Reports are produced exclusively utilizing our expansive family office data and research platform. Thanks to our dedicated research team - who continuously works to update and expand our vast data set - we are able to share helpful and credible information regarding the private capital markets.

April Findings

→ New Family Office Data Points = 2,248+

→ Total New Family Office Assets Added = $20 Billion+

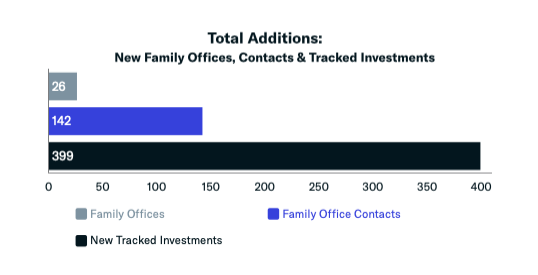

→ Total Additions = 567

- ⇒ 26 family offices added

- ⇒ 142 family office contacts added

- ⇒ 399 new tracked investments

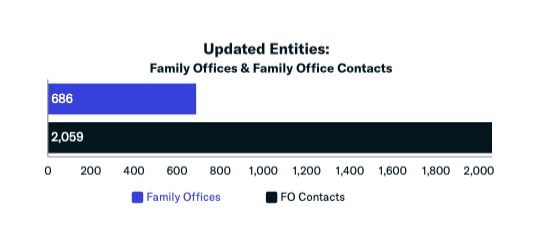

→ Updated Entities = 2,745+

- ⇒ 686 updated family offices

- ⇒ 2,059 updated family office contacts

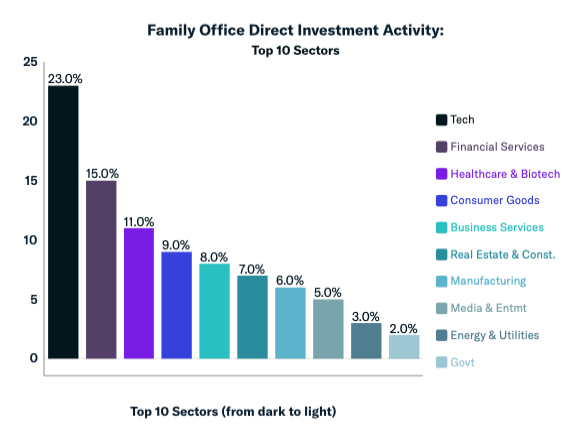

→ Family Office Direct Investment Activity by Sector

- 1. Technology = 23%

- 2. Financial Services = 15%

- 3. Healthcare & Biotechnology = 11%

- 4. Consumer Goods = 9%

- 5. Business Services = 8%

- 6. Real Estate & Construction = 7%

- 7. Manufacturing = 6%

- 8. Media & Entertainment = 5%

- 9. Energy & Utilities = 3%

- 10. Government = 2%

- ⇒ Other sectors make up the remaining 11%

→ Family Office Trend of the Month: Real Estate Allocations

Family offices consistently recognize the importance of a real estate allocation strategy for a number of reasons - favorable, steady returns and tax benefits - to name a few. Leveraging the power of the FINTRX platform, we continue to analyze this growing trend among the private sector.

To discover the six key elements that make real estate investments so appealing to family offices, access your free copy of our 3-page analysis, download it here.

Interested to know more about single and multi-family offices?

To help clarify any underlying assumptions relating to the family office landscape - specifically single family offices and multi-family offices - we have summarized a number of common questions relating to the two private entities.

To access your free copy of our 13-page white paper, download it here.

Used by hundreds of asset raising professionals around the world, the FINTRX family office data and research platform features comprehensive and accurate investor intelligence relating to the alternative investment industry. Updated daily, our cutting-edge solution offers capital raising tools, intelligent data, and savvy search capabilities to best facilitate your outreach efforts. To explore further, read more about our data and research here.

For an in-depth exploration of the FINTRX family office platform, request a demo:

Written by: Renae Hatcher |

May 14, 2020

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)