START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Global Family Office Report | Sponsored By Charles Schwab

It is with great enthusiasm that we present Part Four of our Family Office Industry Briefing Series. Nearly two years ago, alongside our partners at Charles Schwab, we at FINTRX released the Industry Briefing Series to provide valuable and insightful commentary on the global family office landscape. Part Four examines the family office ecosystem and the investment allocation tendencies of family offices globally.

FINTRX & Charles Schwab Family Office Industry Briefing Series Part Four | Family Office Overview & Allocation Preferences

"As a proud sponsor, I would like to congratulate Russ and his FINTRX team on the launch of the Industry Briefing Series, which provides valuable research and insight into the family office community."

- Eddie Brown, National Managing Director & Head of Schwab Advisor Family Office

Download the Report

Introduction

Following the release of two subsequent chapters, it became evident that the information published in the piece was incredibly well-received and highly sought after by the greater financial services community. Thus, after minimal discussion, we began to plan a second Industry Briefing Series, which has culminated in the following piece.

As with all FINTRX data, the information and analysis contained in the following pages was sourced using a bottom-up methodology. Through public sources, proprietary research, and personal communication the dedicated FINTRX research team has compiled, over many years, an extensive database of family office research. A cross-section of this data was ultimately used to provide the insights contained within this piece. We believe this piece represents the most accurate industry analysis and commentary to date.

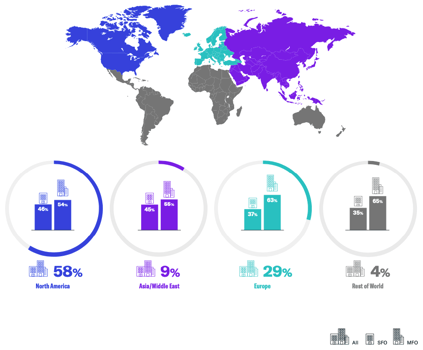

Geographic Location of Single & Multi-Family Offices

Throughout this report, we define family offices as private wealth vehicles established to service the needs of high and ultra-high-net-worth families including investing and managing their financial assets. This report excludes private companies established strictly to operate or serve as a holding company to family businesses, which some may classify as a family office.

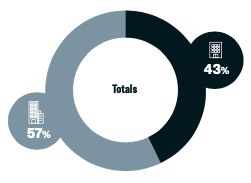

We bifurcate between two firm types. Single family offices, which manage the wealth of and serve a single individual or family and multi family offices, which as the name suggests, serve the needs of multiple high-net-worth families.

Countries With the Most Family Offices

The origin of the “family office” is not entirely clear; however, most agree that what we consider to be the modern family office traces its origins to the 19th century as captains of industry and magnates sought solutions to the complex issues that came with enormous fortunes. These private wealth vehicles originated in the United States and Europe and over the subsequent century grew increasingly popular across the globe. Today, the majority of family offices are headquartered in the United States, followed by Switzerland, the United Kingdom and Germany respectively.

Top 15 Countries with the Most Number of Family Offices

1. United States of America

2. Switzerland

3. United Kingdom

4. Germany

5. Canada

6. China

7. Singapore

8. France

9. Australia

10. India

11. Netherlands

12. UAE

13. Brazil

14. Spain

15. Belgium

Family Offices throughout the United States

Top States

1. New York

2. California

3. Texas

4. Florida

5. Illinois

6. Massachusetts

7. Pennsylvania

8. Connecticut

9. Colorado

10. Georgia

Top Cities

1. New York City

2. Chicago

3. Dallas

4. San Fransisco

5. Boston

6. Los Angeles

7. Miami

8. Houston

9. Atlanta

10. Denver

Asset Class Interest by Family Office Type

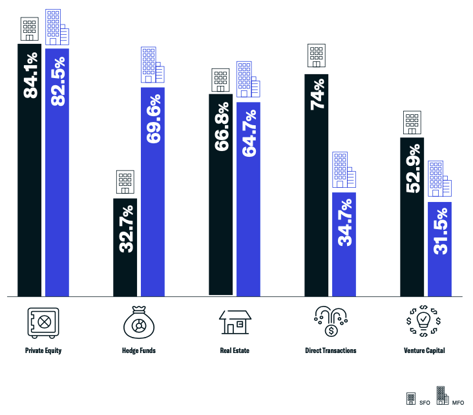

While single and multi family offices frequently offer similar services and ultimately strive to protect and create wealth on behalf of their clients, the difference in their client base leads to diverging asset class interests. For example, while both single and multi family offices typically consider private equity investments, an overwhelming majority of single family offices elect to make direct investments while less than half of all multi family offices consider investing directly into private companies. Conversely, over the past five years, hedge funds have largely fallen out of favor with single family offices while remaining an integral part of multi family office investment strategies.

As information and access to investment opportunities have become increasingly globalized, asset class interest has trended toward a standardized approach across geographic regions for family offices. While there remain minor outliers such as an outsized venture capital interest amongst Asian family offices, market pressures and a decrease in inefficiencies throughout the alternative investment landscapes have led to more consistent allocations with regard to asset class.

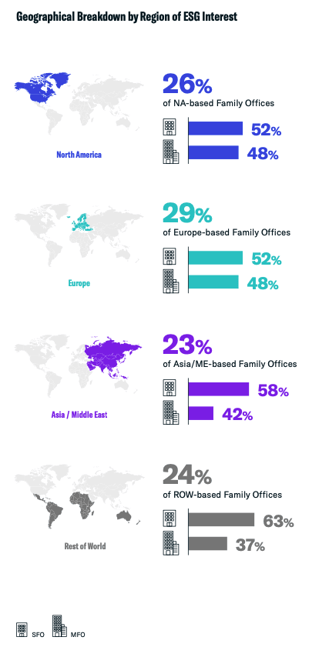

ESG Interest

64% of family offices with an ESG strategy were established later than 2000. Top industries of wealth creation amongst ESG investors include Real Estate, Technology & Financial Services. ESG Investing is most popular among family offices domiciled throughout Norway, Austria, Belgium, France and Germany.

Additional Report Insights

- Regional AUM Breakdown

- Asset Class Interest by AUM Range

- Industry of Wealth Origin by Region

- Asset Class Interest by Industry Origin of Wealth

- Direct Transactions by Stage, Industry & Company Location

A special thanks to Jill Matesic, Paul Ferguson, Eddie Brown and the entire Schwab team for their continued assistance and valuable insight throughout the creation of this report. We hope you enjoy our second Family Office Industry Briefing Series.

About FINTRX

FINTRX is a unified data & research platform providing comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help asset-raising professionals identify, access & map the global private wealth ecosystem. FINTRX data intelligence covers nearly 4,000+ family offices, 21,000+ family office contacts, 40,000+ registered investment advisor entities, and 750,000+ registered reps. Data for every record within FINTRX is pooled from 10+ public & private sources.

Equipped with 375+ search filters and numerous customization options, FINTRX allows you to seamlessly track where family office & investment advisor capital is flowing, uncover allocation trends, break down investments by sector & size, understand future investment plans and much more.

Written by: Renae Hatcher |

February 14, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)