START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Global Family Office Report Part 5 | Sponsored By Charles Schwab

It is with great enthusiasm that we present Part Five of the Family Office Industry Briefing Series, presented in partnership between FINTRX and Charles Schwab. In this segment, we delve into the intricate world of family office classification, presenting a detailed examination of the diverse archetypes of family offices that play a crucial role in the global financial ecosystem. By uncovering the nuances of these classifications, we aim to provide readers with a deeper understanding of how these entities influence investment trends and financial strategies worldwide.

FINTRX & Charles Schwab Family Office Industry Briefing Series Part Five | Examining Family Offices by Primary Business Activities

Over the last several years, alongside our partners at Charles Schwab, FINTRX released the highly anticipated Industry Briefing Series, which explores a variety of topics relevant to family offices, including their geographic distribution, assets and direct investment behaviors. In our latest, the fifth edition, we explore the complex realm of family office classifications, offering an in-depth analysis of the various types of family offices that play a crucial role in the global financial landscape. By uncovering the nuances of these classifications, we aim to provide readers with a deeper understanding of how these entities influence investment trends and financial strategies worldwide. We encourage you to delve into this report for a comprehensive overview of the global family office arena.

"As a proud sponsor, I would like to congratulate Russ and his FINTRX team on the launch of the Industry Briefing Series, which provides valuable research and insight into the family office community."

- Eddie Brown, National Managing Director & Head of Schwab Advisor Family Office

Download the Report

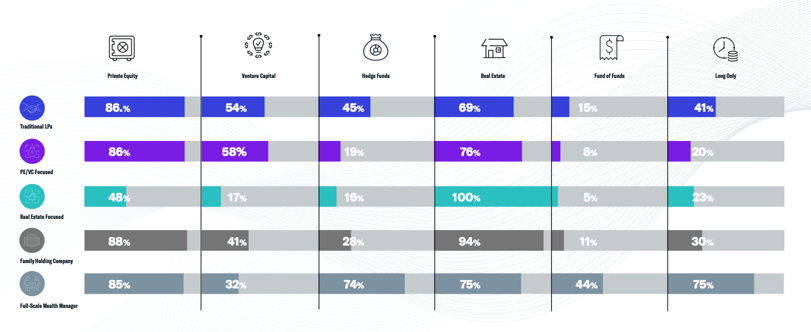

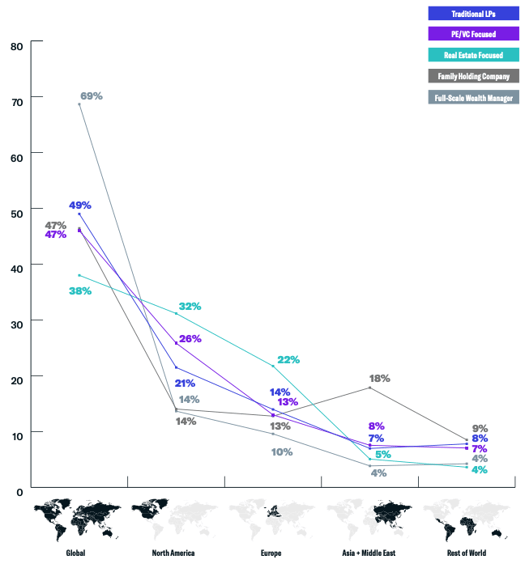

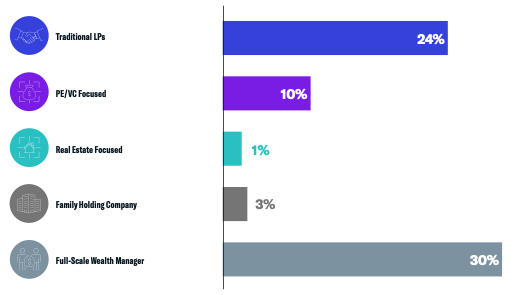

As the family office ecosystem continues to evolve and diversify, understanding the distinct characteristics, structures, and investment strategies of different family office types becomes pivotal for informed decision-making and strategic collaboration. In this installment, we explore the data we’ve meticulously gathered, presenting insights into classifications such as traditional Limited Partners (LPs), Private Equity (PE) and Venture Capital (VC) focused offices, real estate-focused offices, family holding companies, full-scale wealth managers and active trading firms.

By delving into their defining features and analyzing key data points, we aim to illuminate the nuanced distinctions between these categories, ultimately offering a deeper understanding of the family office landscape’s rich diversity and its implications for both investors and industry stakeholders.

Family Office Primary Structures Defined

Traditional LPs

A traditional limited partner (LP) follows the standard approach of investing capital through external alternative investment managers. Traditional LPs are both single family offices and multi-family offices that have allocated capital to various investment funds run by professional firms or individuals. They take a conventional passive role as LPs, entrusting investment professionals to manage their capital across funds.

PE/VC Focused

Family offices with dedicated teams or employees focused on making direct private equity and venture capital investments are considered PE/VC-focused. These FOs take an active role in acquiring equity stakes in privately held companies or providing startup funding to new ventures in exchange for ownership interests. They are directly involved in deal sourcing, evaluation, and execution. Unlike the traditional LP investor, they handle PE & VC direct investments in-house.

Real Estate Focused

Family offices with internal teams or employees focused exclusively on making and managing direct real estate transactions fall into this category. Their real estate teams specialize in property acquisition, development, and management. They are directly involved in the sourcing, evaluation and execution of real estate transactions. These investments are handled in-house.

Family Holding Company

A family holding company is a family office actively tied to large, often publicly traded companies. These FOs have substantial wealth concentrated in a single company or group of companies. They utilize the FO to preserve and oversee this wealth, governing various financial, investment, and strategic aspects related to the company. The FO serves as a central oversight entity for the family’s ownership stake.

Full-Scale Wealth Manager

A full-scale Wealth Manager is a comprehensive, full-service investment advisory firm. Operating independently, these groups are typically registered investment advisors and offer a wide array of financial services beyond investment management, such as financial planning, retirement planning, estate planning, and other customized wealth management solutions. With extensive capabilities, full-scale wealth managers provide holistic, tailored financial advice based on the individual needs of clients. Furthermore, they are typically actively recruiting new business to the firm.

Primary Structure Totals

- Traditional LPs: 31%

- PE/VC Focused: 13%

- Real Estate Focused: 7%

- Family Holding Company: 4%

- Full-Scale Wealth Manager: 46%

Primary Structure by Asset Class Interest

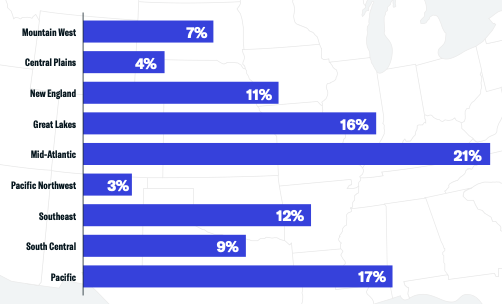

Primary Structure by Geographic Focus

Emerging Manager Interest by Primary Structure

Philanthropic Data

Family offices and philanthropy have long gone hand in hand, given the focus on long-term, strategic 3% investment and legacy building. The establishment of 4% formal philanthropic arms and initiatives within the family office allows for a more targeted and impactful approach to philanthropy. Thus, it is not surprising that an increasing number of larger, institutional family offices have established formal philanthropic arms, a prerequisite for many high-net-worth families looking to take advantage of a single bespoke solution.

Family Offices with Philanthropic Agenda by U.S. Region

Additional Takeaways

- Primary Structure by:

- Family Office Type

- Geographic Region

- Assets Under Management (AUM)

- Family Office Established Date

- Firm Contact Count

- Co-Investment Activity

- Progressive Investor

- ESG & Emerging Market Interest by Primary Structure

- Employee Gender & C-Suite Executives by Primary Structure

- Primary Structure by Top Direct Investment Sector

- Family Offices with Philanthropic Arm/Agenda

- Interview with Eddie Brown and Fred Kaynor

A special thanks to Jill Matesic, Paul Ferguson, Fred Kaynor, Eddie Brown and the entire Schwab team for their continued assistance and valuable insights throughout the creation of this series.

About FINTRX

FINTRX is a unified data & research platform providing comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help asset-raising professionals identify, access & map the global private wealth ecosystem. FINTRX data intelligence covers nearly 4,000+ family offices, 21,000+ family office contacts, 40,000+ registered investment advisor entities, and 750,000+ registered reps. Data for every record within FINTRX is pooled from 10+ public & private sources.

Equipped with 375+ search filters and numerous customization options, FINTRX allows you to seamlessly track where family office & investment advisor capital is flowing, uncover allocation trends, break down investments by sector & size, understand future investment plans and much more.

Written by: Renae Hatcher |

February 13, 2024

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)