START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

2022 RIA Data Capital Allocator Report

To shine a light on the Registered Investment Advisor (RIA) landscape, the FINTRX family office and RIA database provider has compiled the 2022 RIA Capital Allocator Report to showcase some of the latest data trends and developments that have taken place in the space. Explore metrics such as total Capital Allocators, total accounts, assets under management (AUM), geographical breakdown, and much more. Download our 22-page report below...

Note from the VP of Research

Hello and welcome to the 2022 RIA Capital Allocator Report. The goal of this report is to provide a high-level synopsis of a specific cross-section of registered investment advisors we refer to as Capital Allocators. Because the registered investment advisor (RIA) arena is so broad, we sub-categorize RIAs as wealth or fund managers (among others) in an effort to provide a consolidated synopsis of the landscape. We do this in the hopes of taking out the leg work for our valued clients.

At its core, our firm’s mission is to accelerate the productivity of investment professionals in their day-to-day research efforts. Since 2014, FINTRX has done so by providing industry-leading private wealth data intelligence and analysis to hundreds of firms throughout the financial industry. The FINTRX platform has been specifically engineered with technology designed to solve the complex issues that industry professionals face on a daily basis. We look forward to engaging with your company and thank you for your interest in our 2022 Capital Allocator Report.

“Navigating the enormous RIA landscape can be incredibly challenging given how broad and fragmented the space is. Our research team has put in thousands of hours, coupled with machine learning and AI to help organize and make sense of this space in an effort to save our clients’ valuable time and resources.” - Dennis Caulfield, VP of Research, FINTRX

What is a Capital Allocator?

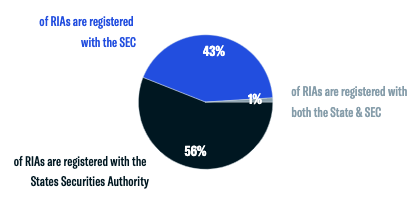

In this instance, we define Capital Allocators as SEC-registered investment advisors that invest capital to external third-party managers as a consistent business practice. This includes Registered Investment Advisors (RIAs), those registered with the State Securities Authority, and those registered with both the SEC and States Securities Authority.

In more depth, an RIA is defined as any individual or firm registered with the Securities and Exchange Commission (SEC) or State Securities Authorities that advises and offers analyses on investments based on a client's individual needs. RIAs act on a fiduciary basis, always acting in the best interest of their clients. Because of their self-governing nature, fiduciary value, and sophisticated financial expertise, the highly fragmented registered investment advisor channel is particularly well-positioned to serve high-net-worth individuals and families seeking an alignment of interests between the firm and client. The sample size used throughout this report does not include Broker-Dealers or Exempt Reporting Advisors.

Registered Investment Advisors provide more than just investment advice. RIAs generally advise on a range of financial subjects, from retirement planning to insurance and estate planning. The total RIA market is diverse and includes any firm registered as a registered investment advisory firm. It comprises banks, broker/dealers, financial planners, hedge funds, family offices, asset managers, wealth managers, and more. If firms want to give advice as fiduciaries for a fee, they must register as an RIA to do so.

All data was derived from the FINTRX Family Office & Registered Investment Advisor Data Platform.

Total Capital Allocators: 8,013+

- - RIAs registered with the SEC: 43%

- - RIAs registered with the States Securities Authority: 56%

- - RIAs registered with both the State & SEC: 1%

- - Contacts Employed by Capital Allocators: 52,381+

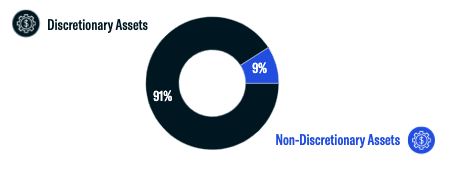

Total Accounts: 9,572,034+

- - Discretionary Assets: 91%

- - Non-Discretionary Assets: 9%

- - Total RIA AUM Attributed to Capital Allocators: 9%

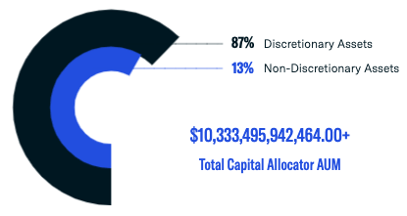

Total AUM

- - Discretionary Assets: 87%

- - Non-Discretionary Assets: 13%

- - Total Capital Allocator AUM: $10,333,495,942,464.00+

- - Total RIA AUM Attributed to Capital Allocators: 9%

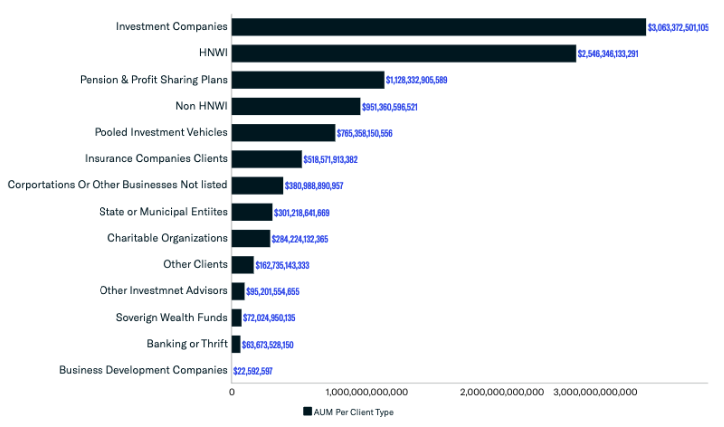

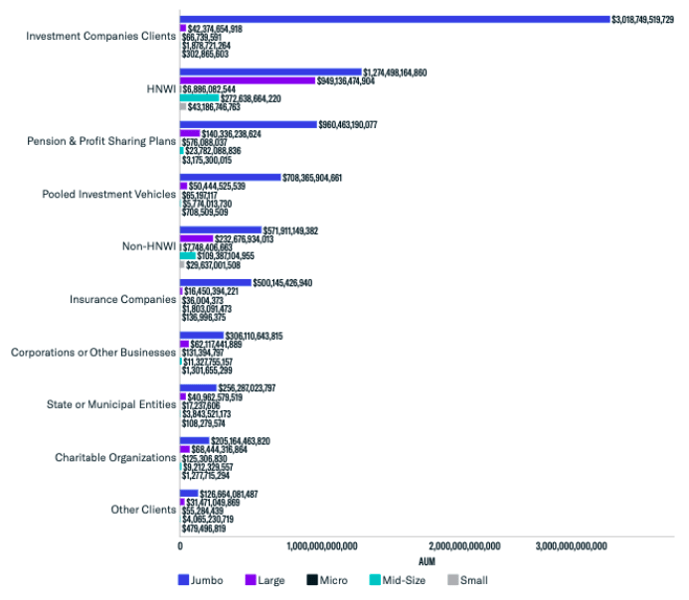

Client Breakdown by AUM

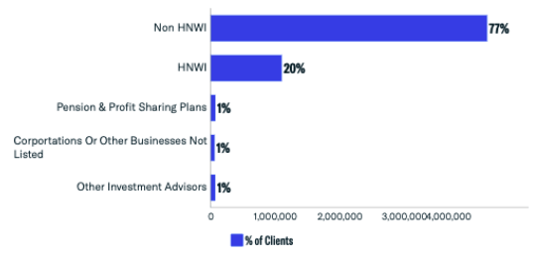

Client Breakdown by Type

Capital Allocators provide financial services to a number of clients. For this subset, 77% of clients are non-high-net-worth individuals, while 20% are high-net-worth families or individuals. All other clients make up 1% or less.

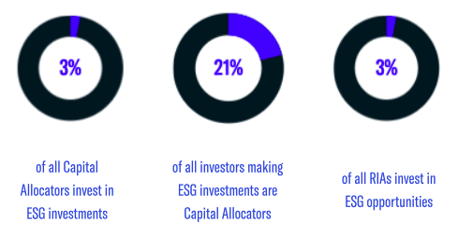

ESG & Progressive Investing

- - 25% of investors experiencing rapid growth are Capital Allocators

- - 7% of Total RIAs are experiencing rapid growth

- - 21% of progressive investors are Capital Allocators

- - 3% of all Capital Allocators invest progressively

- - 4% of all RIAs invest progressively

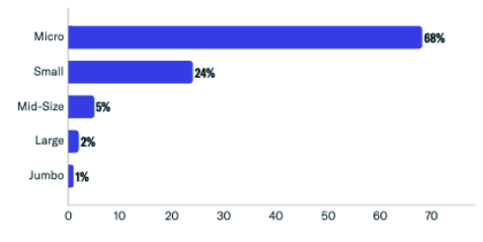

Firm Size Breakdown by Employee Count

A majority of firms are micro-size (68%) or small (24%). Mid-size and large groups followed at 5% and 2%, respectively. 'Jumbo' size firms make up the remaining 1%.

A majority of firms are micro-size (68%) or small (24%). Mid-size and large groups followed at 5% and 2%, respectively. 'Jumbo' size firms make up the remaining 1%.

Firm Size Breakdown by AUM

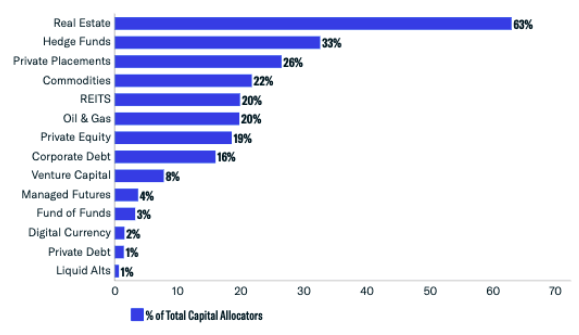

Alternatives Used

When it comes to alternative investments, Capital Allocators are most interested in Real Estate (63%), Hedge Funds (33%), and Private Placements (26%).

Alternatives Used by Firm Size (Employee Count)

.png?width=529&name=alternatives%20used%20by%20firm%20size%20(employee%20count).png)

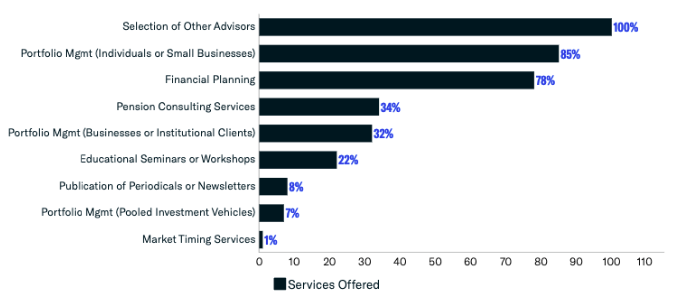

Services Offered

Breadth of service is a key theme among RIAs this year, with many advisors providing financial planning (78%), portfolio management for individual or small businesses (85%), and selection of other advisors (100%), and other aspects of clients’ financial lives beyond just investments.

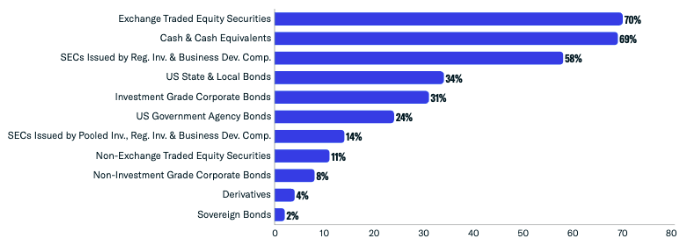

Separately-Managed Accounts (SMAs) Utilized

70% of Capital Allocators utilize exchange-traded equity securities in their SMAs and 69% use cash or cash equivalents. The least used is sovereign bonds at just 2%.

70% of Capital Allocators utilize exchange-traded equity securities in their SMAs and 69% use cash or cash equivalents. The least used is sovereign bonds at just 2%.

Rep Universities: Top 6

Rep Hobbies: Top 5

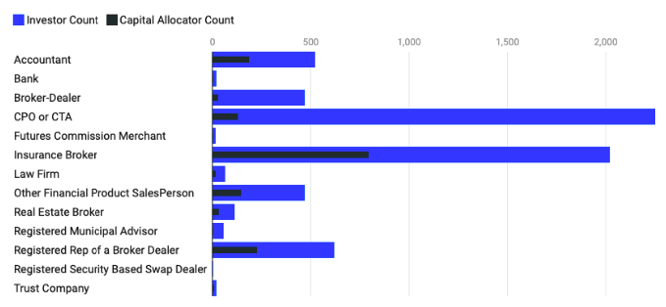

Business Activities

A majority of Capital Allocators are also accountants, CPOs, CTAs, insurance brokers, real estate brokers, registered reps of broker-dealers, part of a trust company, or other financial product associates.

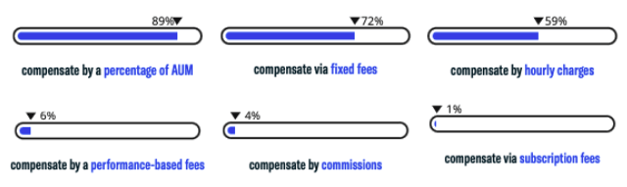

Fee Structure Breakdown

- - Percentage of AUM: 89%

- - Fixed Fees: 72%

- - Hourly Charges: 59%

- - Performance-Based Fees: 6%

- - Commissions: 4%

- - Subscription Fees: 1%

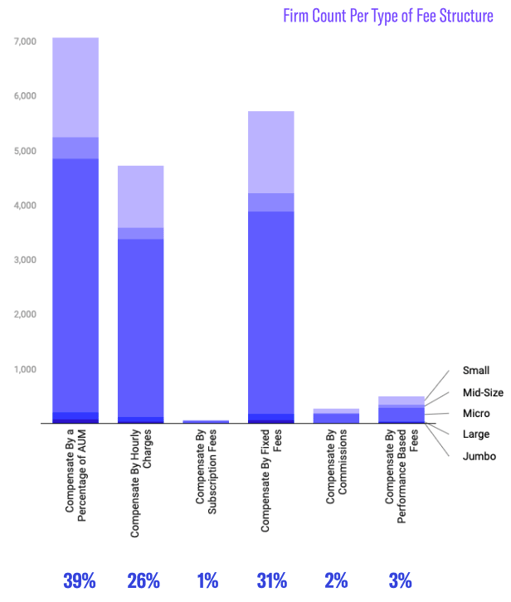

Fee Structure by AUM Size

Fee Structure by Employee Size

For this particular subset, a majority of Capital Allocators compensate by a percentage of its AUM (39%), fixed fees (31%), or hourly charge (26%).

For this particular subset, a majority of Capital Allocators compensate by a percentage of its AUM (39%), fixed fees (31%), or hourly charge (26%).

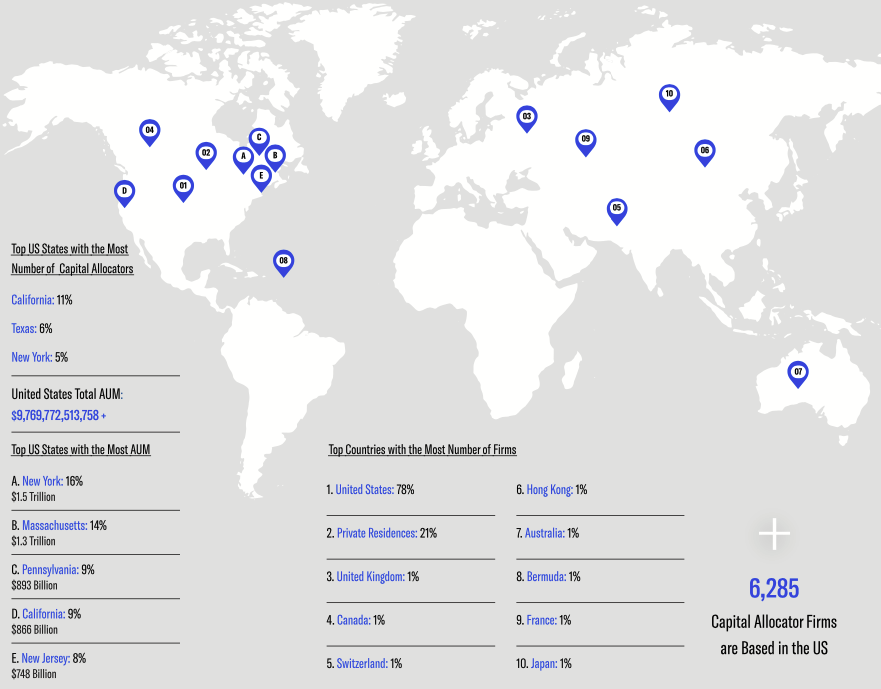

Geographical Breakdown

Recent advances in technology have made fast and sustainable growth a more manageable possibility for registered investment advisors (RIAs) both in the United States and worldwide. This pattern of expansion and consolidation among RIAs has led to growth in assets under management, the number of firms, and the number of individual reps both in the United States and worldwide. It is important to note, 95% of Capital Allocator AUM is in the US. Although most Capital Allocators are in California (11%), the majority of AUM is in New York (16%).

RIA market growth has been notable, to say the least, with an estimated 35,000+ entities and 734,725+ contacts in operation today, with assets increasing to $113 trillion.

- - 78% of all Capital Allocators are based in the United States

- - 21% of all Capital Allocators conduct business out of private residences

- - Top 3 US States with the Most Capital Allocators: California (11%), Texas (6%), and New York (5%)

- - Top 3 US States with the Most AUM: New York, Massachusetts, and Pennsylvania

- - Total Number of Capital Allocators in the United States: 6,285+

Download the Full Report

FINTRX provides comprehensive data intelligence on 750,000+ family office & investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, advisor growth signals amongst other key data points.

Additionally, FINTRX provides insight and expansive contact information on key decision makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For additional details and a live walkthrough, please request a demo below.

Written by: Renae Hatcher |

January 24, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)