START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

February '24 FINTRX Family Office & RIA Data Report

Every month, the FINTRX Family Office & RIA Database adds and updates thousands of family offices, registered investment advisors (RIAs), decision-makers and an array of investment information to our extensive private wealth dataset. To illustrate this growth, we have compiled the Monthly Family Office & RIA Data Report for February 2024, showcasing key metrics such as assets under management (AUM), alternative investments, fee models, geographic distributions, separately managed accounts, direct transactions by family offices, services offered by RIAs and more.

Download the Report

February '24 Family Office Data

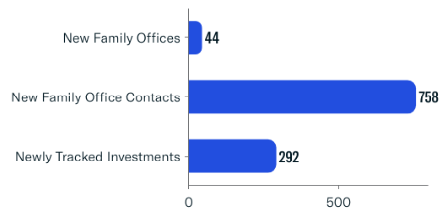

Family Office Platform Additions

The FINTRX Data & Research team added 40+ new family offices, 750+ family office contacts and nearly 300 direct investment transactions to our Family Office Dataset.

- - New Family Offices: 44

- - New Family Office Contacts: 758

- - Newly Tracked Family Office Investments: 292

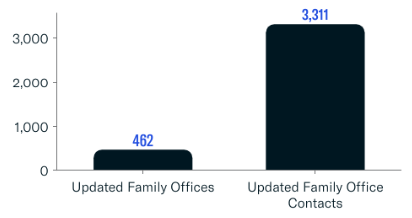

Updated Family Office Entities

In addition to 1,090+ platform additions, FINTRX made over 3,700 family office updates including 460+ firm updates and 3,330+ contact updates.

- - Updated Family Offices: 462

- - Updated Family Office Contacts: 3,311

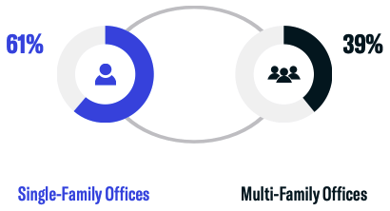

Single Family Offices vs. Multi-Family Offices

61% of newly added firms in February are single family offices (SFOs) while 39% are multi-family offices (MFOs).

- - New Single Family Office Additions: 27

- - New Multi-Family Office Additions: 17

Assets Under Management (AUM) Breakdown

A majority (44%) of family offices added in February manage between $400 million and $1 billion in assets on behalf of their clients. A combined 38% of added firms manage between $50 million - $100 million and $100 million - $400 million.

%20Breakdown%20-%20February%202024.png?width=409&height=203&name=Assets%20Under%20Management%20(AUM)%20Breakdown%20-%20February%202024.png)

- - $50M - $100M: 13%

- - $100M - $400M: 25%

- - $400M - $1B: 44%

- - $1.5B - $2B: 6%

- - $2B - $5B: 6%

- - $5B+: 6%

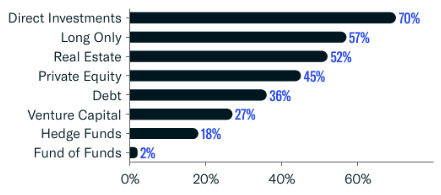

Asset Class Interest Breakdown

FINTRX continued to see a majority of firms (70%) allocating via direct investments into private companies. Other prominent asset classes include long only equities, real estate and private equity.

- - Direct Investments: 70%

- - Long Only: 57%

- - Real Estate: 52%

- - Private Equity: 45%

- - Debt: 36%

- - Venture Capital: 27%

- - Hedge Funds: 18%

- - Fund of Funds: 2%

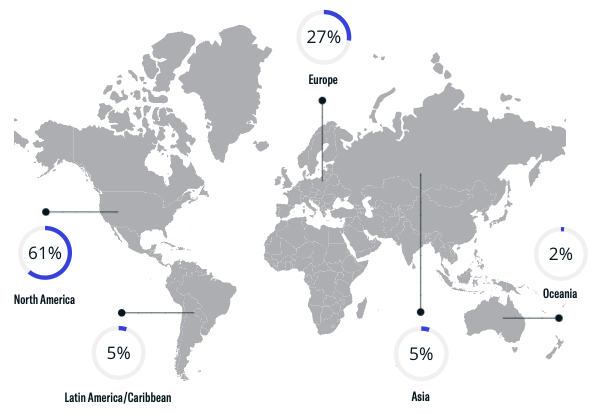

Family Office Geographical Breakdown

The vast majority of family offices added to the FINTRX Family Office Dataset in February are headquartered in North America, accounting for 61% of total firms. European offices accounted for roughly 27%, up 5% from last month. Asia and Latin America/Caribbean made up 5% of new offices, respectively, with Oceania making up the remaining 2%.

- - Europe: 27%

- - Latin America/Caribbean: 5%

- - Asia: 5%

- - Oceania: 2%

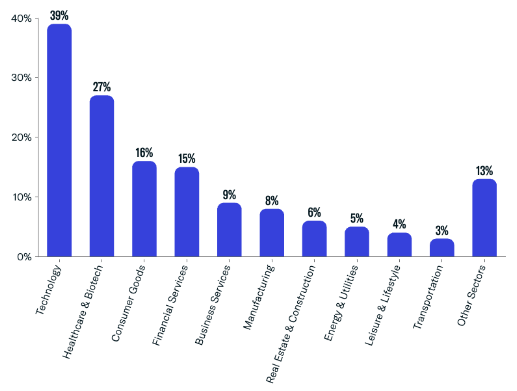

Newly Tracked Family Office Investments

Top 10 Sectors of Interest

Throughout February, FINTRX continued to see a majority of newly tracked family office investments made into private technology companies, which accounted for 114 direct transactions of the nearly 300 tracked investments. Other top sectors of interest included healthcare & biotechnology, consumer goods and financial services.

- - Technology: 39%

- - Healthcare & Biotech: 27%

- - Consumer Goods: 16%

- - Financial Services: 15%

- - Business Services: 9%

- - Manufacturing: 8%

- - Real Estate & Construction: 6%

- - Energy & Utilities: 5%

- - Leisure & Lifestyle: 4%

- - Transportation: 3%

- - Other Sectors: 13%

February '24 Registered Investment Advisor (RIA) Data

RIA Data Highlights: February Platform Additions

- - Total Registered Entities (including Dually Registered): 185

- - Total Registered Contacts: 3,459

- - Total Accounts: 273

- - Firms Using Alternatives: 128 or 69%

- - Total AUM Added by New Firms: $10.9 Billion+

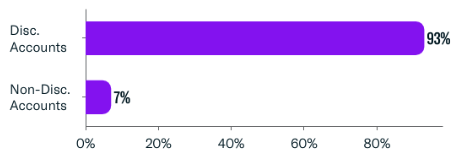

Accounts Breakdown

The FINTRX RIA dataset saw a significant addition of discretionary accounts to our dataset in February, making up 93% of new accounts added.

- - Total Accounts Added: 273

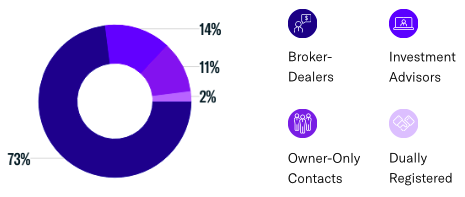

Contact Breakdown by Rep Type

A majority (73%) of the newly added RIA representatives have registered as broker-dealers. Additionally, 14% of the additions are registered as investment advisors, while 11% are classified as owner-only representatives. A smaller segment, comprising just 2%, consists of dually registered contacts.

- - Broker-Dealers: 2,518

- - Investment Advisors: 497

- - Owners: 379

- - Dually Registered: 65

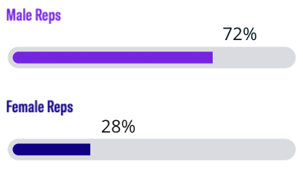

Rep Gender Breakdown

The distribution of genders among RIA representatives indicates the ratio of male to female registered advisors. As depicted below, in February, 72% of the newly added representatives are male, and 28% are female, maintaining the same ratio as last month.

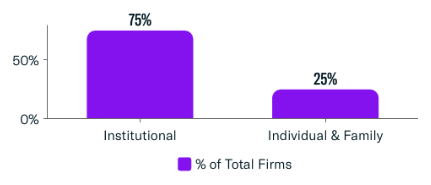

RIA Client Base Breakdown

The February additions to the FINTRX RIA dataset revealed a significant 75% of their client base consists of institutional clients, while individual and family clients make up just 25%. This highlights the strong institutional focus of these RIA firms, showcasing their expertise and dedication in serving this segment of the market.

Firm Size by Assets Under Management (AUM)

Nearly half (47%) of newly added RIA firms fall under the 'micro' category, managing assets between $1 and $25 million.

%20-%20Feb%202024.png?width=465&height=185&name=Firm%20Size%20by%20Assets%20Under%20Management%20(AUM)%20-%20Feb%202024.png)

- - Micro ($1-$25M): 47%

- - Small ($25M-$100M): 27%

- - Mid-Size ($100M-$500M): 20%

- - Jumbo ($5B+): 6%

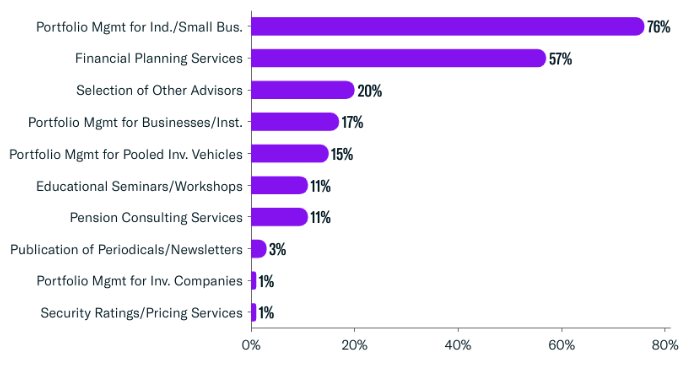

RIA Services Provided

Portfolio management for individuals and small businesses remains the leading RIA service, at nearly 80%. Financial planning services followed at 57%. Other popular RIA service options include selection of other advisors, portfolio management for businesses and institutions and portfolio management for pooled investment vehicles, all making up 20% or less, respectively. It is important to note that RIA firms typically offer more than one service.

Top 10 RIA Services Provided:

- 1. Portfolio Management for Individuals/Small Businesses: 76%

- 2. Financial Planning Services: 57%

- 3. Selection of other Advisors: 20%

- 3. Portfolio Management for Businesses/Institutions: 17%

- 5. Portfolio Management for Pooled Investment Vehicles: 15%

- 7. Educational Seminars/Workshops: 11%

- 6. Pension Consulting Services: 11%

- 8. Publication of Periodicals/Newsletters: 3%

- 10. Portfolio Management for Investment Companies: 1%

- 10. Security Ratings/Pricing Services: 1%

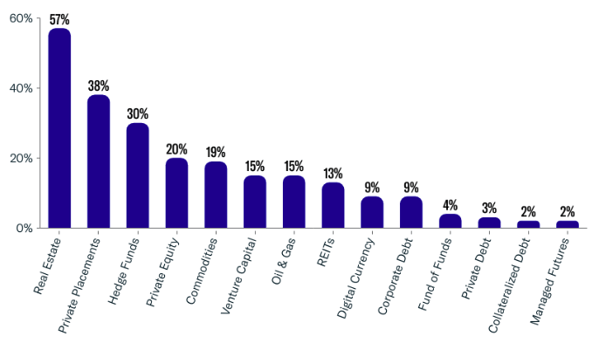

Alternative Investments Utilized

Nearly 60% of newly-added RIA firms displayed some allocation to real estate within their investment portfolios. Smaller fractions displayed interest in private placements, hedge funds, private equity and commodities, among various other alternative investments.

- - Real Estate: 57%

- - Private Placements: 38%

- - Hedge Funds: 30%

- - Private Equity: 20%

- - Commodities: 19%

- - Venture Capital: 15%

- - Oil & Gas: 15%

- - REITs: 13%

- - Digital Currency: 9%

- - Corporate Debt: 9%

- - Fund of Funds: 4%

- - Private Debt: 3%

- - Collateralized Debt: 2%

- - Managed Futures: 2%

FINTRX Overview

FINTRX - the leading family office and registered investment advisor (RIA) data intelligence platform - covers 4,000 family offices, 21,000+ family office contacts, 40,000+ RIA entities, 750,000+ registered reps, as well as 16,000+ private wealth groups. Equipped with 375+ advanced search filters and numerous customization features, FINTRX allows you to seamlessly track where family office & investment advisor capital is flowing, uncover allocation trends, break down investments by sector & size, understand future investment plans and much more.

FINTRX offers comprehensive profiles on each family office and investment advisor, enabling financial professionals to gain insights into assets under management, wealth origins, investment preferences, historical investments, favored sectors and industries, among other valuable information. Data for each record is sourced from 10+ public & private sources.

Written by: Renae Hatcher |

March 07, 2024

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)