START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Office Wealth Origin Series: Sports & Media

The family office vertical represents a highly diversified section of the private wealth landscape. Given the private nature of these groups, they often allocate capital with fewer restraints compared to their institutional counterparts. A prevalent pattern drawn from our research is the connection between the industry origin of wealth and the industries of investment interest. Throughout this narrative, we explore a specific cross-section of family office entities whose wealth was created in the sports and media sectors, offering high-level data and insight into this particular group.

Family Wealth Origin: Sports & Media

Asset Class Interest Breakdown

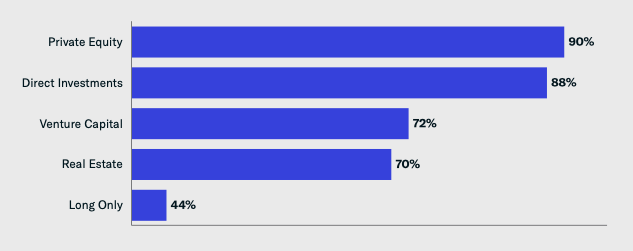

As the search for predictable rates of return intensifies amid volatile market conditions, family offices continue to focus on non-traditional asset classes such as private equity, direct investments, venture capital, and real estate - hoping to capitalize on their investments.

Percentage of Total Sports & Media Family Offices: Top 5 Asset Classes

As outlined above, the most popular asset class of this sample size family offices is private equity at 90%. Next are direct investments at 88%, venture capital at 72%, real estate at 70%, and long-only at 44%. Overall, asset allocation can be a key determinant for total return potential and risk characteristics. Given the structure of family offices, the private equity asset class provides attractive solutions to family offices with long-term time horizons and a high appetite for risk.

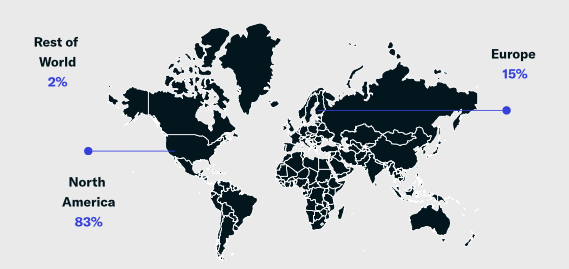

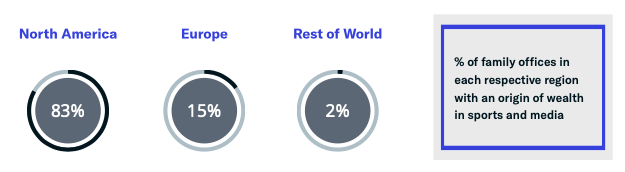

Regional Breakdown

As with the industry origin of wealth, geographic location often plays a significant role in the investment preferences of family offices. Research highlights correlations among the percentages of family offices allocating to certain sectors based on where they are domiciled. Here, you can see 83% of family offices with an origin of wealth in sports and media are based in North America, followed by Europe at 15%. The rest of the world makes up the remaining 2%.

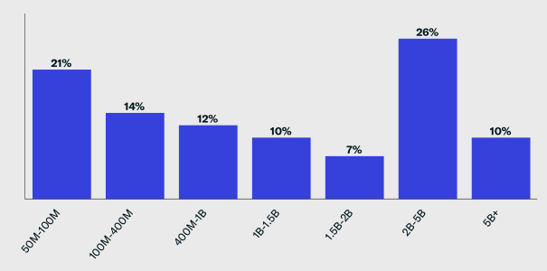

Assets Under Management Breakdown

Family offices allocate significant capital in meaningful ways when a suitable opportunity presents itself. Below, we outline the assets under management (AUM) breakdown of family offices that have created their wealth in sports and media. The most prevalent are family offices with AUM between two billion and five billion, at 26%, followed by those with AUM between 50 and 100 million, at 21%.

Past Transactions

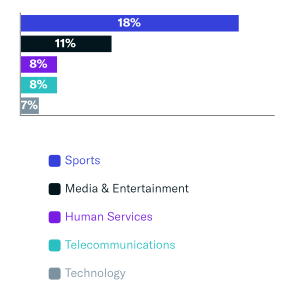

Over the past decade, we've seen family offices accumulate the assets and necessary skills to allocate capital directly into the private landscape. Currently, more than half of all family offices elect to invest directly to some degree. Here, we provide a direct investment breakdown of family offices that have an industry origin of wealth in sports and media compared to the total number of family offices allocating to that sector.

into the private landscape. Currently, more than half of all family offices elect to invest directly to some degree. Here, we provide a direct investment breakdown of family offices that have an industry origin of wealth in sports and media compared to the total number of family offices allocating to that sector.

As you can see, there is a clear tendency for family offices to invest capital in the industries in which they made their wealth, as 18% of all family offices investing in sports made their wealth in sports and media. Sectors that follow include media and entertainment at 11%, human services, at 8%, telecommunications at 8%, and technology at 7%.

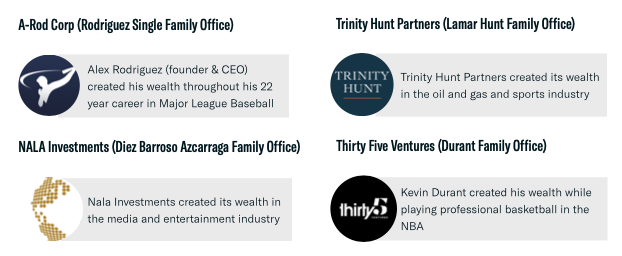

Family Offices with an Origin of Wealth in Sports & Media

Conclusion

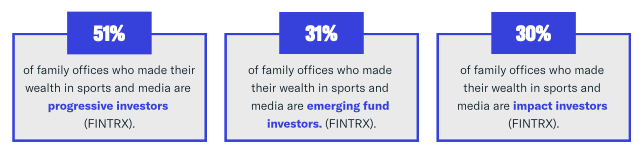

Family offices often prefer investing capital in verticals they understand - often in the industries in which they created their personal wealth. This stems from a pure understanding of the space, as well as the industry connections they possess, which ultimately adds value to the allocation.

Roughly 3% of the family office market comprises family offices that created their wealth in the sports and media spaces. This subset of family offices represents more than $75 billion AUM across the globe, with the majority being domiciled in North America. Family offices that made their wealth in the sports and media industry invest progressively and directly, with over half reallocating towards the sports and media sector. Navigating the complex nuances of this highly capitalized pool of capital takes time and patience, but the more you understand, the more likely you are to peel off capital.

Download the 9-Page PDF

With complete coverage of over 3,090+ family offices, 15,800+ family office contacts, and 19,600+ tracked investments, FINTRX ensures direct access to accredited investor intelligence. The FINTRX platform is an essential tool in understanding the family office landscape in the U.S. and abroad, while also empowering users to uncover commonalities with these family offices for effective, personal outreach.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

June 08, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)