START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Office Wealth Origin Series: Energy, Oil & Gas

Family offices, or private wealth vehicles managing the wealth of high-net-worth families and individuals, often allocate capital with fewer restraints compared to other investment entities. With greater control over their investments and increased transparency into their investment style, background, and structure, we often identify similar patterns and developments taking place within the alternative wealth space. This narrative looks into a specific cross-section of family office entities whose wealth was created in the energy, oil, and gas industries, with high-level insight regarding this specific subset.

Introduction

Family offices represent a highly diversified cross-section of the private wealth landscape. When you consider the structure of family offices and the resources available to them, it's no surprise investors follow their activity so closely. Several variables play a role in the investments these entities make. One of the more prevalent patterns explained by our research is the connection between the industry of wealth origin and the industry of investment interest. As outlined throughout this report, there is a clear tendency for groups to invest in opportunities throughout familiar industries. As stated above, this narrative looks into a specific cross-section of family office entities whose wealth was created in the energy, oil, and gas industries, with high-level insight regarding this specific subset.

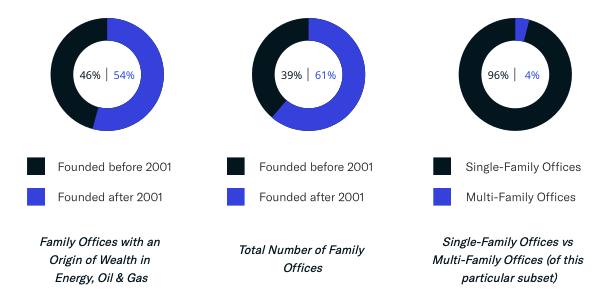

Family Offices with an Origin of Wealth in Energy, Oil & Gas: Year Founded & SFO/MFO Breakdown

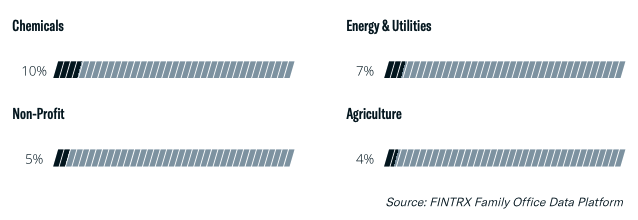

Direct Transactions Based on Origin of Wealth

Here, we provide the top sectors of interest of family offices pertaining to this specific subset when going the direct route. As outlined, there is a clear tendency for family offices to allocate capital to the industries in which they are the most familiar, and the data below corresponds accordingly. As you can see, 10% of all families making direct transactions into the chemicals sector made their wealth in energy, oil, and gas. 7% of all families making direct transactions into the energy & utilities landscape made their wealth in energy, oil, and gas. Sectors that followed include the non-profit sector at 5% and agriculture, at 4%.

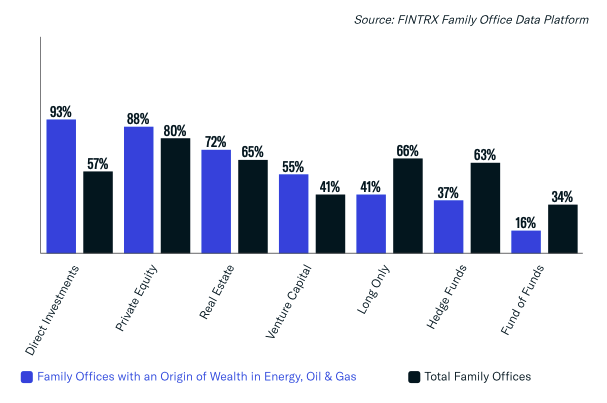

Asset Class Interest Breakdown: Family Offices with an Origin of Wealth in Energy, Oil & Gas: Top Asset Classes

As a leader in family office data and research, we often see family offices focusing on non-traditional asset classes such as private equity, direct investments, venture capital, and real estate - hoping to capitalize on their investments.

As outlined below, 93% of those who made their wealth in energy oil, and gas choose the direct route, compared to the total percentage of family offices that directly invest, at 57%. Asset classes that follow for this subset include private equity at 88%, real estate at 72%, venture capital at 55%, long-only funds at 41%, hedge funds at 37%, and fund of funds, at 16%.

Asset allocation can be a key determinant for total return potential and risk characteristics. Given the unique structure of family offices, direct investments and private equity often provide attractive solutions to these private wealth entities, as they offer long-term time horizons and a high appetite for risk.

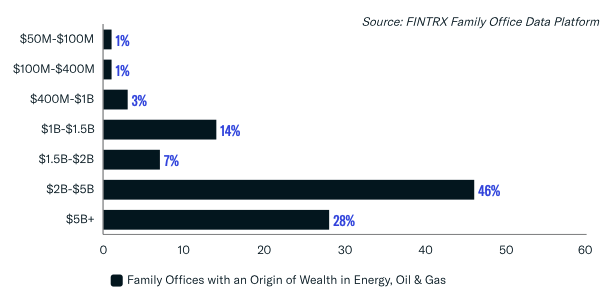

Assets Under Management (AUM) Breakdown: Family Offices with an Origin of Wealth in Energy, Oil & Gas: Top AUM Ranges

Here, we outline the AUM breakdown of family offices that made their wealth in the energy, oil, and gas sectors. The most prevalent among this sample size are family offices with AUM between the $2 billion and $5 billion mark, at 46%.

The AUM ranges that follow include family offices with AUM above $5 billion, at 28%; those with AUM between $1 billion and $1.5 billion, at 14%; and family offices with AUM between $1.5 billion and $2 billion, at 7%. The following two ranges - AUM between $50 million - $100 million and AUM between $100 million - $400 million - each made up 1% for this group.

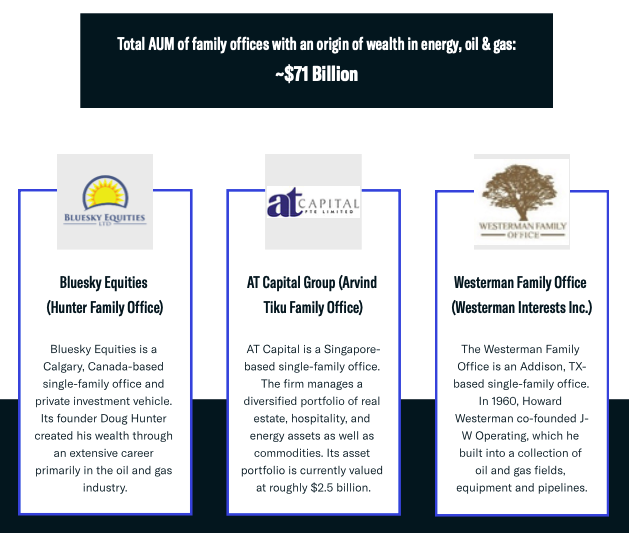

The total number of assets for family offices with an origin of wealth in energy, oil, and gas is approximately $71 billion. This compares to the total AUM of all family offices at roughly $3.2 trillion.

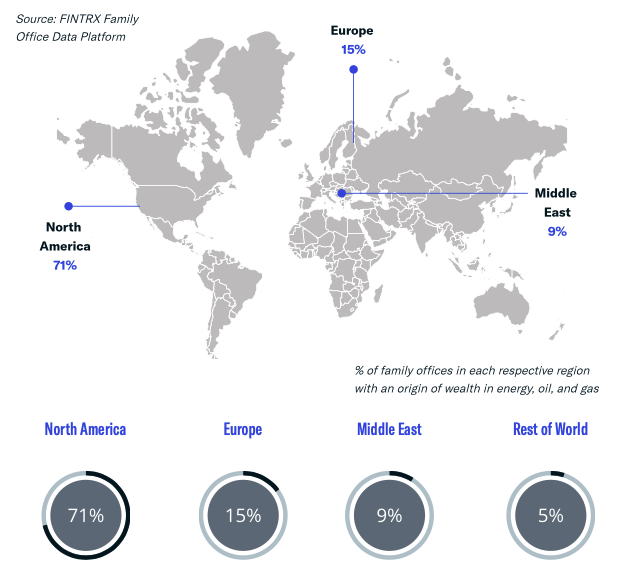

Regional Family Office Breakdown: Family Offices with an Origin of Wealth in Energy, Oil & Gas: Top Regions

As with the industry origin of wealth, geographic location often plays a significant role in the investment preferences of family offices. The research below highlights a regional breakdown of family offices with an origin of wealth in the energy, oil, and gas sectors.

Here, you can see 71% of this specific subset of family office entities are domiciled in North America. Europe and the Middle East follow at 15% and 9%, respectively. The rest of the world makes up the remaining 5%.

Family Offices with an Origin of Wealth in Energy, Oil & Gas

With an enormous amount of pooled capital, family offices now rank with pension funds and institutional investors because they have the funds, flexibility, and sophistication to make savvy investment decisions despite the irregularity in the markets.

As a leading family office data provider, FINTRX continues to see these private wealth vehicles allocating significant capital when suitable opportunities appear. With that said, understanding the industry in which their wealth originated can offer critical insight into how the family office might operate and deploy future capital.

Conclusion

With an enormous amount of pooled capital, family offices now rank with pension funds and institutional investors because they have the funds, flexibility, and sophistication to make savvy investment decisions despite the irregularity in the markets.

As a leading family office data provider, FINTRX continues to see these private wealth vehicles allocating significant capital when suitable opportunities appear. With that said, understanding the industry in which their wealth originated can offer critical insight into how the family office might operate and deploy future capital.

We derived all data from the FINTRX family office data and research platform.

Download the 9-Page PDF

FINTRX provides comprehensive intelligence on thousands of private family offices, each designed to facilitate your prospecting and capital-raising efforts. Explore in-depth profiles on each family - AUM, source of wealth, investment criteria, previous investment history, industries of interest - and other key data points to help elevate your workflow. FINTRX offers an inside look at the alternative investment industry and private capital markets.

With complete coverage of over 3,090+ family offices, 15,800+ family office contacts, and 19,600+ tracked investments, FINTRX ensures direct access to accredited investor intelligence. The FINTRX platform is an essential tool in understanding the family office landscape in the U.S. and abroad, while also empowering users to uncover commonalities with these family offices for effective, personal outreach.

For an in-depth exploration of the FINTRX family office platform, click below:

For more practical family office insights and best practices, visit the FINTRX 'Resource Library' below.

Written by: Renae Hatcher |

November 11, 2021

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)