START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Exploring Real Estate Investment Trends Among Family Offices

Family offices, responsible for managing the wealth of high-net-worth individuals and families, have long been recognized for their strategic and customized approach to investment. Join us as we provide valuable insights into the current landscape of real estate activity and analyze recent real estate investments. All powered by FINTRX Family Office data, this white paper will equip you with the knowledge needed to navigate the ever-evolving world of real estate investments within the family office space. Let's dive in and uncover the trends shaping the future of real estate investments among family offices.

Download Your Copy

Introduction

In recent years, there has been a noticeable surge in the allocation of capital towards alternative investments, with real estate emerging as a prominent choice. As markets continue to fluctuate, investors are constantly seeking the most effective routes to mitigate risk and generate stable returns. Continue reading as we delve into the reasons behind the growing popularity of real estate investments among family offices. We will explore the benefits of such investments and delve into current family office investment trends taking place.

Family Office Real Estate Investing: An Overview

Real estate has always held a special place in investment portfolios due to its tangible nature and potential for substantial returns. However, in the context of family offices, several factors have contributed to the steady popularity of real estate investments:

Diversification: Real estate offers an attractive avenue for portfolio diversification, as it exhibits a low correlation with traditional assets like stocks and bonds, which can help mitigate risk and protect wealth during market downturns.

Steady Income Streams: Real estate investments, such as rental properties and commercial real estate, often generate stable and consistent cash flows, which is particularly appealing for family offices looking to maintain and grow their wealth over generations.

Inflation Hedging: Real estate has historically proven to be an effective hedge against inflation. As the cost of living rises, property values and rental income tend to increase, preserving the real value of investments.

Long-Term Appreciation: Real estate typically appreciates significantly in value over time, especially in desirable locations. This long-term outlook aligns well with the generational perspective of family office strategies.

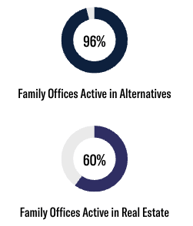

Why Family Offices Invest in Alternatives

The growing interest among family offices in alternative investments, notably real estate, can be attributed to several pivotal factors. Firstly, family offices prioritize effective risk management and the reduction of exposure to market volatility. In this context, alternative assets such as real estate serve as a valuable counterbalance to traditional investments, offering a measure of insulation from economic downturns. Family offices also strive for portfolio diversification through the strategic allocation of capital across various asset classes.

Additionally, the long-term perspective often adopted by family offices, which can extend over multiple generations, aligns well with the characteristics of alternative investments. These assets possess the potential for consistent income generation and capital appreciation, making them well-suited to the wealth preservation objectives of family offices.

The appeal of real estate investing extends well beyond its growing popularity, as family offices are increasingly drawn to this asset class for various reasons. Foremost among these is real estate's unparalleled ability to preserve wealth across generations, underpinned by its tangible nature and potential for seamless inheritance, thus ensuring the enduring financial security of the family. Moreover, real estate investments offer a suite of valuable tax advantages, including depreciation deductions, 1031 exchanges, and the capacity to offset expenses with rental income, all of which work together to optimize the overall return on investment.

Furthermore, real estate investments provide portfolio stability, a critical consideration while mitigating risk in wealth management strategies. Their low correlation with stock markets means that values remain relatively unaffected by the turbulence and volatility that can plague equity markets during challenging economic times. This inherent stability can effectively balance the risk exposure associated with other investment avenues.

This resilience of real estate as an investment becomes particularly evident during periods of economic uncertainty. Its capacity for capital preservation shines through as real estate's income-generating potential remains robust, offering a reliable income stream that acts as a cushion against the turbulence of market downturns. Simultaneously, real estate investments serve as a potent hedge against inflation, a common phenomenon during economic tumult that today’s investors are all too familiar with. The ability of real estate assets to appreciate and generate increasing rental income makes them a natural safeguard against the erosion of purchasing power. These attributes collectively underscore the enduring appeal of real estate investments within the strategies of family offices seeking long-term wealth preservation and growth in an ever-changing financial landscape.

Current Trends in Real Estate Investing: Insights into FINTRX Data

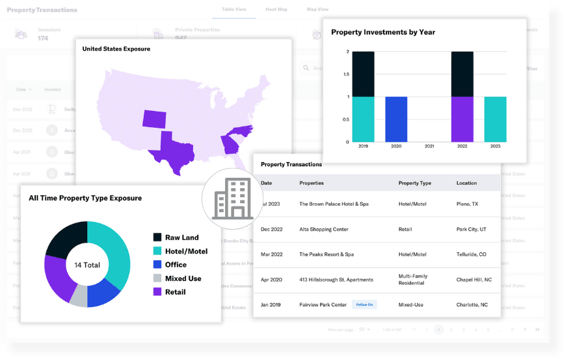

By leveraging FINTRX’s new property transactions feature, which tracks family office investments in real estate, we gain valuable insights into the latest real estate investment trends among family offices in recent years.

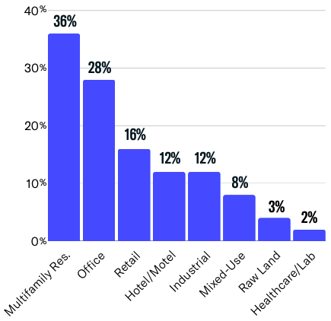

Real Estate Investments by Property Type

The chart below provides a visual representation of the dominant property types favored by family offices. Multifamily residential stands out as the most prominent, comprising about 36% of all real estate investments. Office and Retail spaces are also of great interest, accounting for 42%.

Hotels/Motels, Industrial and Mixed-Use spaces follow closely, making up 32% of family office investments. Conversely, Raw Land and Healthcare/Lab spaces garner the least interest, constituting less than 5%. This breakdown offers valuable insights into the property types that family offices find most appealing and those that are less favored.

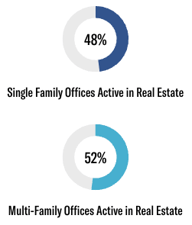

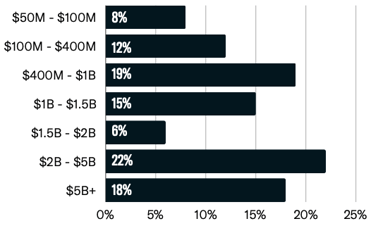

Family Offices Active in Real Estate by AUM

The graph below shows a breakdown of family offices active in real estate investments by the total value of managed assets (AUM).

FINTRX data reveals that real estate investment patterns remain largely consistent across various ranges of AUM and appear to be independent of the size or wealth of the group. This highlights the enduring appeal of real estate as an investment avenue for family offices of all scales.

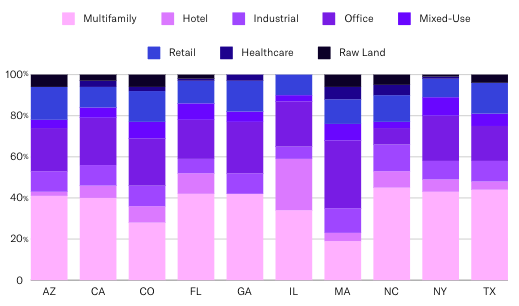

Distribution of Property Types by State

Here we offer an analysis of real estate investment distributions across various states, with a focus on the property types within the top ten U.S. states attracting family office real estate investments. Florida emerges as the premier destination for these investments, capturing more than half of the real estate transactions at 52%. Texas and California follow suit, securing 38% and 35% of investments, respectively. Florida distinguishes itself with the largest share of multifamily residential properties, which make up 42% of its investments, while investments in office spaces follow at 19%. This breakdown not only underscores the dominant role of Florida in the real estate investment landscape but also sheds light on the preferred property types within these leading states.

Based on the latest insights from FINTRX data, family office direct investments in real estate have shown a degree of volatility throughout 2024. We observed a small decline from 12% in Q4 of 2023 to 10% in Q1 2024. This shift in investment preferences is not entirely unexpected, as investors strive to navigate an unpredictable economy, hedge against inflation and ultimately seek the highest possible returns. Given the current landscape of heightened global political tensions and efforts to stabilize interest rates and equity markets in the United States, it is likely that these fluctuations in real estate investments among family offices will persist.

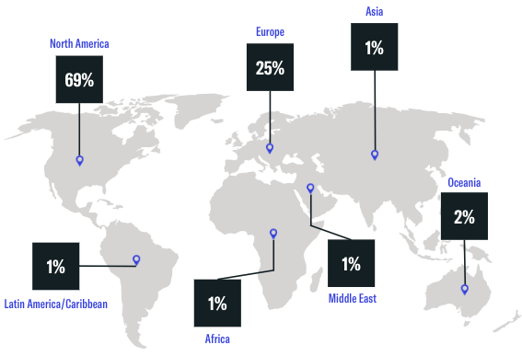

A Global Review

FINTRX's new direct property transactions feature offers a comprehensive view of real estate investment activity across global regions. With the data at hand, it is evident that North America remains the dominant region for direct real estate transactions, accounting for an impressive 69% of all investments.

Europe follows closely behind with 25% of transactions, showcasing the region's enduring appeal. The remaining regions make up only 6% combined, emphasizing the domestic focus of a family office landscape that resides predominately in North America.

Conclusion

As we have explored in this white paper, real estate has long been a cornerstone of family office investment portfolios. However, allocation approaches and priorities have shifted in recent years. While still an attractive asset class for tangible value, inflation hedging, and wealth preservation, real estate no longer commands the auto-include status it once did. Our analysis highlights a pronounced shift towards markets offering both stability and growth potential, with a notable preference for multifamily residential, commercial, and emerging niche sectors.

The growing emphasis on sustainability and technology integration points towards a future where investment decisions are as much about contributing to societal progress as they are about financial gain. As we look ahead, it is clear that family offices will continue to play a pivotal role in shaping the real estate investment landscape. Their ability to deploy capital towards innovative and impactful investments could not only redefine the parameters of success in real estate but also contribute to a more resilient and inclusive market.

FINTRX Property Transactions Overview

FINTRX leads the way in delivering valuable family office investment insights. With our new Property Transactions feature, we take family office data and analysis to the next level. This revolutionary dataset details direct real estate deals by family offices, arming real estate firms, fund managers and professionals with actionable intelligence to enhance investment research and prospecting. The feature allows users to easily track and analyze family offices' global real estate investments. Filter transactions by location, asset class, timeline and other variables to reveal deal-specific and market trends. By simplifying a complex landscape into an intuitive database, FINTRX Property Transactions transforms how you approach real estate investment decisions.

Property Transactions Data Allows You To:

- Identify family offices highly active in real estate investing, ensuring you are in the know about key market players.

- Drill into past transactions by property type, class, location, and more, allowing you to uncover valuable trends and potential business opportunities.

- Access detailed insights on the current family office real estate investment landscape, giving you a competitive edge.

- Stay ahead of the curve with fully customizable, real-time alerts on new transactions and acquisitions, ensuring you never miss important updates in the real estate space.

About FINTRX

FINTRX is a unified data & research platform providing extensive data coverage on both family offices and registered investment advisors, designed to help asset-raising professionals identify, access & map the global private wealth ecosystem. FINTRX data is sourced from public and private sources by a dedicated team of 75+ researchers who map, validate and compile data daily to ensure its accuracy.

The FINTRX platform offers an intuitive interface and numerous analysis tools, charts and graphs to ensure users have access to the most current and accurate private wealth data available in the market. Find relevant decision-makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it and filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and much more.

Written by: Renae Hatcher |

February 29, 2024

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)