START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Enhance Your Investment Approach with the FINTRX RIA Database Solution

In today's rapidly evolving financial landscape, data has become an invaluable asset for individuals seeking to enhance their investment approaches. As the demand for transparent, data-driven investment strategies continues to grow, the role of comprehensive and reliable information has become paramount. That's where the FINTRX RIA Database solution comes in. With extensive coverage of registered investment advisors (RIAs) and their detailed profiles, FINTRX empowers asset-raising professionals to make informed decisions, streamline due diligence processes, uncover new investment opportunities and strengthen relationships with trusted advisors. In this blog, we will explore how FINTRX can elevate your investment approach and help you navigate the wealth management landscape with confidence and precision.

Harnessing FINTRX Data to Fuel Your RIA Search

With the exponential growth of available data and technological advancements, relying on empirical evidence and insights has become imperative to navigate complex markets, identify trends and assess risk. By leveraging data-driven investment strategies, asset-raising professionals can gain a competitive edge, enhance portfolio performance and adapt to changing market conditions.

Comprehensive & Accurate RIA Data at Your Fingertips

The FINTRX RIA Database Solution offers investors unparalleled access to a vast network of registered investment advisors and broker dealer information, ensuring investors have access to a wide range of investment advisor intel across various geographies and asset classes. This expansive data coverage includes 40,000 RIAs of all sizes and nearly 750,000 registered reps, which allows industry professionals to navigate a diverse pool of advisors to find the right fit for their needs.-1.png?width=324&height=299&name=RIA%20layered%20screens%204%20(1)-1.png)

FINTRX provides in-depth profiles that include essential information such as regulatory history, investment strategies, client types, assets under management (AUM) and much more. This information enables individuals to evaluate the track record and expertise of RIAs, ensuring alignment with their investment goals and risk tolerance.

With a thorough understanding of an RIA's investment approach, specialization and client base, individuals can select advisors who possess the necessary expertise and experience to navigate specific asset classes or sectors. Ultimately, this data equips you with the knowledge you need to make well-informed decisions, fostering confidence in your choice of RIAs and increasing the likelihood of successful investment outcomes.

Streamlining Due Diligence Processes

FINTRX streamlines the due diligence process by providing in-depth insights into various aspects of registered investment advisors. By accessing information on RIAs' regulatory history, investors can ensure compliance and mitigate potential risks. The solution also offers a comprehensive view of investment strategies, allowing you to assess alignment with your own investment goals. For example, investors seeking a conservative approach may look for RIAs with a track record of stable and low-risk strategies. On the other hand, those seeking higher growth potential may seek RIAs with a history of strong performance in more aggressive investment strategies. Performance data provides transparency and helps investors evaluate the track record of RIAs, while additional details such as client types and AUM offer insights into their specialization and scalability. By consolidating this information into one platform, FINTRX simplifies due diligence and saves investors valuable time and effort in their search for suitable RIAs.

Uncovering New Investment Opportunities

By utilizing FINTRX's robust search functionality and 375+ filtering options, asset-raising professionals can narrow down their search criteria to target RIAs who specialize in their desired investment areas. Whether it's a focus on alternative investments, real estate, technology or any other sector, the database allows you to identify RIAs who have a demonstrated track record in those areas. This enables you to expand your investment horizons and explore new opportunities that align with your investment preferences and risk appetite. By uncovering these previously unknown RIAs with specific expertise, the FINTRX RIA Database broadens the investment landscape and opens doors to unique investment opportunities.

Diversification is a fundamental principle of investing that helps mitigate risk and maximize returns. FINTRX is instrumental in enriching investment portfolios by fostering this diversification. By providing access to a wide range of RIAs with expertise in various asset classes, sectors and strategies, FINTRX enables individuals to diversify their portfolios effectively. Users can identify firms specializing in different industries, regions, or investment styles, allowing them to allocate their capital across multiple areas of the market. This diversification helps reduce the concentration risk associated with investing in a single asset class or sector, ensuring that potential losses in one area can be offset by gains in others. FINTRX ultimately empowers wealth professionals to build well-rounded portfolios that are resilient in the face of market fluctuations and can capture opportunities from different market segments.

Strengthening Investor-Advisor Relationships

Establishing long-term partnerships with RIAs holds significant value for investors. These partnerships provide a foundation of trust, expertise and continuity in managing investment portfolios. FINTRX seamlessly nurtures these lasting collaborations through its array of sophisticated features and functionalities. For instance, FINTRX empowers you to cultivate connections with RIAs via tailored interactions and communication histories. With features that capture everything from conversation notes to meeting records and follow-up reminders, users gain an all-encompassing view of their engagements, ensuring that no pivotal detail or dialogue goes unnoticed. Access to a detailed communication history empowers individuals to recall prior discussions, showcasing their diligence and deepening the bond as time progresses.

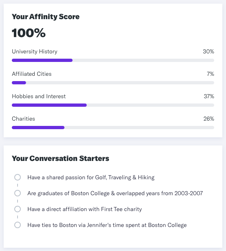

FINTRX offers personalized contact relatability scores specific to you, an innovative tool used to identify commonalities and shared interests with decision-makers. These relatability scores enable asset-raising professionals to initiate conversations on a more personal level, fostering stronger connections and ultimately booking more meetings. This personalized approach helps build trust and credibility with advisors, enhancing the overall partnership experience. By building rapport, wealth professionals can work closely with RIAs to align investment strategies and adapt to changing market conditions.

FINTRX also offers features such as data enrichment technology which ensures teams across your organization are utilizing the most accurate and complete information on your target market, as well as list automation, which saves time, ensures data accuracy, enhances organization and allows for efficient analysis and reporting. Leverage these tools to access relevant private wealth data, enabling informed decisions and valuable contributions.

Boasting exhaustive data, state-of-the-art search functionality and bespoke engagement tools, FINTRX seamlessly aligns you with registered investment advisors tailored to your unique goals. Whether it's prospect targeting, streamlining investment research efforts or conducting competitor analysis, FINTRX equips you with the tools needed to identify promising investment opportunities in the ever-evolving RIA landscape.

About FINTRX

FINTRX is a unified family office and RIA database that provides comprehensive data intelligence on 850,000+ family office and investment advisor records, ultimately designed to help asset-raising professionals identify, access and map the global private wealth ecosystem. Find relevant decision-makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it and filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and much more. FINTRX sources data from both public and private sources and has a team of 75+ researchers who map, validate and compile data daily to ensure its accuracy.

Written by: Renae Hatcher |

August 23, 2023

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)