Tiedemann Advisors, LLC delivers advisory services to high-net-worth individuals, pooled investment vehicles and charitable organizations. With additional offices in Bethesda, Dallas and Seattle, the firm oversees $25.3 billion in assets, with a substantial portion under discretionary management. Tiedemann Advisors provides tailored financial planning and portfolio management, leveraging a blend of traditional and alternative investment strategies including private equity and real estate. The firm’s diverse portfolio demonstrates a strategic focus on international equities, highlighted by investments such as the iShares MSCI EAFE ETF.

START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

5 Leading Independent RIAs in New York

In the heart of the world's financial capital, New York's independent Registered Investment Advisors (RIAs) stand as titans of wealth management, shepherding billions in assets and shaping investment strategies for some of the world's most discerning clients. Whether you're an asset manager looking to forge new partnerships, a fintech company seeking to understand the needs of top-tier wealth management firms, or simply a curious observer of the financial world, this blog will offer valuable insights into the leading independent RIAs in New York, backed by FINTRX wealth management data.

FINTRX Data Reveals New York's Wealth Management Giants

Leveraging our powerful data intelligence platform, FINTRX highlights New York's most prominent independent RIAs, with rankings driven by the latest FINTRX data on Assets Under Management (AUM). These insights provide a comprehensive view of the leading firms, offering a detailed snapshot of their financial standing in the market. It's important to note that AUM can fluctuate due to market conditions, client inflows or outflows, and other financial factors, while additional qualitative metrics such as client retention, service offerings and growth potential also play a critical role in evaluating these firms.

1. Cerity Partners LLC

Cerity Partners LLC serves high-net-worth individuals and institutions with financial advisory services including financial planning, portfolio management and pension consulting. With additional offices in Wyoming and California, the firm has experienced significant growth, managing $80.57 billion in assets across 16,424 clients. Their investment strategy blends traditional and alternative assets, including private equity, hedge funds and real estate. With a team of over 900 employees, Cerity Partners has seen a 51% increase in AUM over the past year.

- Estimated AUM: $80 billion

- Founded: 2009

- Total Clients: 16,424

- Total Accounts: 16,424

2. Silvercrest Asset Management Group LLC

Silvercrest Asset Management Group LLC provides financial advisory services to high-net-worth individuals, banking institutions and investment companies. With $33.28 billion in assets, the firm serves ~1,289 clients, averaging $25.8 million per client. Silvercrest has experienced 15% growth in AUM over the last year and is recognized for its commitment to ESG investing. The firm employs 150+ professionals and manages a portfolio including significant investments in Microsoft and a range of traditional and alternative asset classes. Silvercrest operates from 17 offices, including locations in Boston, Charlottesville and Richmond.

- Estimated AUM: $33.3 billion

- Founded: 2001

- Total Clients: 1,289

- Total Accounts: 1,289

3. Tiedemann Advisors

- Estimated AUM: $25.3 billion

- Founded: 1999

- Total Clients: 467

- Total Accounts: 669

4. BBR Partners, LLC

BBR Partners, LLC provides tailored advisory services to high-net-worth individuals, families and investment companies. With additional offices in Chicago, San Francisco and Austin, the firm manages approximately $28.08 billion in assets, including $25.78 billion on a discretionary basis. BBR Partners has achieved a 17% increase in assets under management over the past year. Known for its commitment to active ESG investing, the firm engages in alternative investments such as real estate and commodities.

- Estimated AUM: $28.1 billion

- Founded: 1999

- Total Clients: 1,831

- Total Accounts: 4,600

5. Summit Rock Advisors, LP

Summit Rock Advisors, LP offers advisory services to high-net-worth individuals, pooled investment vehicles and charitable organizations. With $21.48 billion in AUM, including $2.87 billion in foreign assets, the firm provides a range of services including financial planning, portfolio management, and advisor selection, tailored to meet the unique needs of its clientele. Summit Rock Advisors has seen an 8% growth in assets over the last year, with an average client size of about $311.3 million. The group primarily focuses on alternative assets such as private equity and hedge funds, managing $7.41 billion in hedge funds and $4.62 billion in private equity funds.

- Estimated AUM: $21.5 billion

- Founded: 2007

- Total Clients: 69

- Total Accounts: 204

FINTRX data offers further insights on these firms, including:

- Detailed investment strategies and preferences

- Key decision-makers and their contact information (updated emails, mobile phone numbers, hometowns & more)

- Recent growth trends and AUM changes

- Rep movements

- Advisor wealth teams data

- Custodian relationships

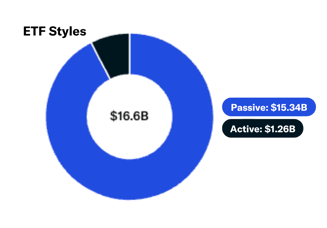

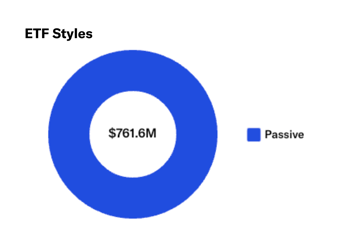

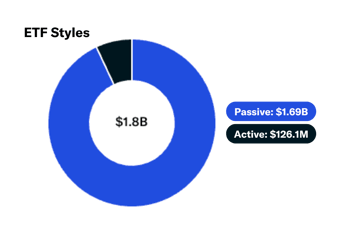

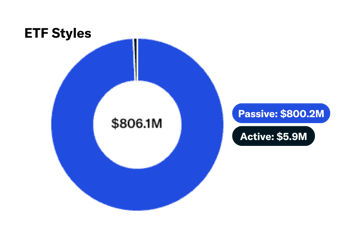

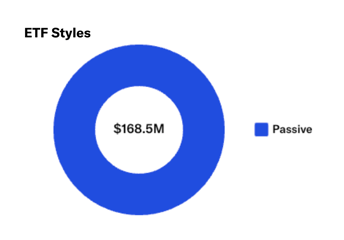

- ETF Allocation ($ ETFs, ETF % of AUM, $ Active ETFs & more)

- SMA Asset Breakdown

- Technology stack and adoption

- ESG and impact investing focus & so much more

This level of information is crucial for anyone looking to engage with these independent RIAs, whether for business development, partnerships or competitive analysis. Our dedicated research team regularly updates this information to ensure you always have access to the most current and precise data in the dynamic RIA and broker dealer landscape.

About FINTRX

FINTRX is a unified data and research platform that provides unparalleled data intelligence on 850,000+ wealth management firm and contact records. Our platform is designed to empower industry professionals to seamlessly access, map and engage with the global wealth management landscape. With AI-powered utility, 375+ advanced search filters and customizable workflow tools, FINTRX enables seamless tracking of allocation trends, in-depth analysis of investment data, relationship mapping and much more.

Written by: Renae Hatcher |

September 09, 2024

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)