START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

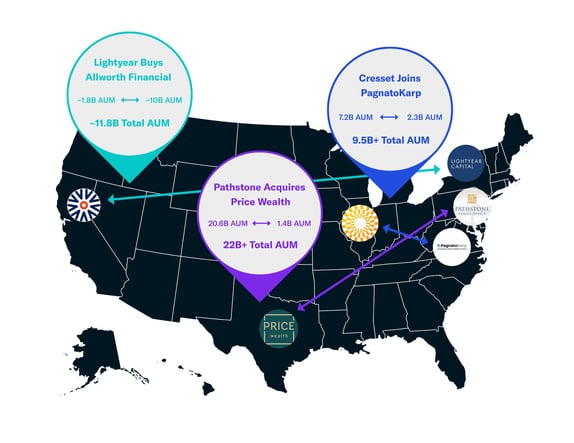

3 Notable RIA Mergers

The speed of consolidations in the Registered Investment Advisor (RIA) space continues to hit record-highs, putting the industry on track for its seventh-straight record-setting year, according to consulting firm Echelon Partners. A growing list of quality buyers (firms with specific teams dedicated to making deals) is a main driver in the progressive M&A trend. To highlight the progressive M&A trend, the FINTRX family office & RIA database provider outlines three recent RIA mergers with insight into each transaction and group.

A registered investment advisor (RIA) is any firm advising or managing the wealth of high-net-worth individuals or institutions. Directly regulated by the Securities Exchange Commission (SEC), RIAs offer a wide range of wealth management services to their clients. RIAs must fully understand the client's definition of financial success to best fulfill their fiduciary duties.

The number of RIA transactions has more than doubled in the past five years, with 97 deals recorded last year compared with 41 such deals in 2014, according to DeVoe & Co.

“Growth on your own is hard... So that has left many firms to explore M&A and acquisitions.” - David DeVoe, Managing Director of DeVoe & Co.

1. Cresset and PagnatoKarp Join Forces

In June 2020, Cresset Asset Management announced the acquisition of PagnatoKarp, a Reston, VA-based RIA managing ~$2.3B in AUM. Together with PagnatoKarp, Cresset now manages ~$9.5B in AUM and has eight offices operating worldwide. This strategic merger places the firm among the 25 largest RIAs in the United States.

The multi-family office, PagnatoKarp, prides itself on maintaining a culture of innovation and true fiduciary standards. After joining forces with Cresset, the team continues to provide customized private wealth management services clients expect.

Founded in 2017, Cresset Asset Management is a Chicago, IL-based family office and private wealth management firm. As wealth management clients themselves, Co-Founders Eric Becker and Avy Stein aimed at creating a firm that delivers comprehensive, personalized financial services. Today, Cresset offers high-net-worth individuals access to an array of family office services, private investment opportunities and wealth advisory services.

"We continue to explore aligning with firms like PagnatoKarp that share our unique vision, culture, and commitment to long-term growth"- Chris Boehm, Managing Partner of Cresset Partners

2. Pathstone Acquisition of Price Wealth

In September 2020, Pathstone, The Modern Family Office announced the acquisition of Price Wealth, LLC, an Austin, TX-based independent wealth advisor managing ~$1.4B in client assets. With the addition of Price Wealth, Pathstone now has 10 offices and a collective $22B in total advisory assets. Matt Fleissig, President of Pathstone, welcomed the employees, partners and clients of Price Wealth to his firm, later explaining their suitability in a press release:

"My partner, Susan Wittliff, and I believe this [transaction] will help us honor our pledge to oversee our clients' financial affairs for many generations to come. For our employees, Pathstone provides additional opportunities for growth and greatly enhances our ability to attract and retain talent." - Matt Fleissig, President of Pathstone

Eric Price, Founder & CIO of Price Wealth replied in a similar fashion, saying this deal is "key to fulfilling the firm’s succession plans." The banking team of Colchester Partners advised Price Wealth in its transaction with Pathstone, and Queen Saenz + Schutz served as legal counsel. Alston & Bird LLP served as legal counsel for the acquisition of Pathstone. Specific financial details of the transaction were not disclosed.

Pathstone, an independently operated and partner-owned advisory firm in Englewood, N.J., provides customized financial advice to high-net-worth families, individuals, family offices and select nonprofit institutions. The firm has created a distinct culture of innovation built on the foundation of trust and service traditionally delivered by family offices.

3. Lightyear Buys Allworth Financial

Lightyear Capital bought Allworth Financial - a small, young RIA - at a reported tremendous valuation. The price could be as high as $800M, an unnamed source told Barron's. The company declined to disclose terms but said senior management will remain significant shareholders. The transaction is estimated to close by the end of 2020.

"This investment is consistent not only with our long-term thesis around the growing need for financial advice, particularly in times of uncertainty, but also with our multiple prior successful investments in the space." - Mark F. Vassallo, Managing Partner of Lightyear

Founded in 1993, Allworth is a Sacramento, CA-based independent investment & financial advisory firm specializing in retirement planning, investment advising, tax & estate planning for the mass affluent. Allworth has grown client AUM from $2.4B to an estimated $10B since 2017.

Lightyear, a New York, NY-based private equity firm with ~1.8B+ in AUM, partnered with the Ontario Teachers’ Pension Plan Board to outbid two private equity firms. Parthenon Capital, which purchased the RIA in 2017, drove the deal.

"We believe the company is an attractive investment given its differentiated and retirement-centric business model as well as industry tailwinds including an aging population and increased demand for professional and holistic wealth planning services. We look forward to supporting management’s long-term value creation and growth aspirations for Allworth."- Karen Frank, Senior Managing Director, Equities at Ontario Teachers

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest, advisor growth signals amongst other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, click below:

For more practical family office insights and best practices, visit our 'Resource Library' below.

Written by: Renae Hatcher |

November 18, 2020

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)