START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

25 Women Leading the Hedge Fund Industry In the US

We are pleased to present our report on 25 of the most powerful women leading the Hedge Fund industry in the United States. Compiled using FINTRX proprietary data, our report offers a unique window into the industry and showcases some of the highest-performing hedge funds in the US that are founded, managed, and led by women.

Click below to access the full report.

Continue reading to view our list of 25 of the most powerful female leaders in the US hedge fund space.

Overview

According to FINTRX data, approximately only 10% of hedge funds globally are managed under female leadership, and this number drops even further for firms with over $1 billion in assets under management. Despite the male-dominated reputation of the hedge fund industry, these women-led firms have broken through barriers and achieved remarkable success, making them shining examples of female leadership in finance.

Of the 25 women listed in this report, 17 of them either founded or co-founded their respective firms. In addition, 12 of these women are C-suite executives of their firm, nine of which act as Chief Executive Officers, and four of these women are currently serving as Chairmen for their firm. The total assets under management (AUM) of the firms in this report range from roughly $127 million to over $48 billion, with a median AUM of $595 million, highlighting the financial impact that these women-led firms currently have on the investment space.

Women-Led Hedge Funds - Breakdown by State

-Apr-26-2023-02-37-18-8437-PM.png?width=881&height=660&name=Untitled%20design%20(1)-Apr-26-2023-02-37-18-8437-PM.png)

Key Takeaways

+ Most of the featured women-led hedge funds are located in major financial centers such as New York, Boston, and California, but can be found across the United States.

+ The majority of the firms in this report utilize a variety of different strategies, but most specialize in Long-Short Equity strategies.

+ The total assets under management (AUM) of these hedge funds range from roughly $127 million to $48.7 billion with a median AUM of $595 million.

+ Education background from Ivy League universities such as Harvard, Yale, and Princeton is a common theme among the founders of these hedge funds.

+ Many of these women-led hedge funds specialize in ESG/Impact Investing, which highlights a growing trend toward socially responsible investing. Additionally, the majority of these firms have a strong focus on technology, media, and healthcare, indicating a shift toward investing in innovative and disruptive companies.

+ Several of these firms specialize in emerging markets and other strategies that suggest a willingness to embrace higher risk in investing.

+ While most of the firms on this list do not publicly disclose their performance data, the fact that they have attracted significant AUMs indicates that they are successful in attracting investors.

Nancy Zimmerman

Bracebridge Capital

Position: Co-Founder

Location: Boston, MA

Estimated AUM: $48B+

Strategy: Absolute Return, Fixed Income, Long-Short Equity

Nancy Zimmerman is a pioneering hedge fund manager and a co-founder of Bracebridge Capital. As the managing partner of Bracebridge with over 25 years of experience, Nancy oversees the management of private investment funds serving longstanding investors that include endowments, foundations, family offices, and pensions for her Boston-based firm. Prior to founding Bracebridge, Nancy began her career at O’Connor & Associates before managing the interest rate option group for Goldman Sachs on a worldwide basis.

Nancy is a proud alumna of Brown University and currently serves as a Trustee of the Corporation of Brown University. In addition to her work in finance, Nancy is a philanthropist and chairs the Carney Institute for Brain Science Advisory Council at Brown. Through her work at the Carney Institute and the Transformative Scholars Program in Neurology at Mass General, Nancy has funded cutting-edge research into the brain and supported early-career investigators. Nancy has also responded to the COVID-19 pandemic with philanthropic support for coronavirus diagnostic development at The Ragon Institute of MGH, MIT, and Harvard and for expansion of testing in Section 202 housing for the elderly. Nancy continues to act as a trailblazer and a role model for women in finance, and was named to the 2022 Forbes 50 Over 50 & America's Self-Made Women lists for her success.

Marcia Page

Varde Partners

Position: Co-Founder & Co-Executive Chairman

Location: Minneapolis, MN

Estimated AUM: $21.6B+

Strategy: Long-Short Equity, Derivatives

Marcia Page is a co-founder and co-executive chair of Varde Partners, an alternative credit firm headquartered in Minneapolis. With over 30 years of experience in alternative investments, she oversees all aspects of the firm's growth and is a member of the investment committee. In addition to her work at Varde, Marcia is also the founder and CEO of MPowered Capital, an investment firm that invests in best-in-class female and other underrepresented investment talents in alternative markets. She continues to be a strong advocate and role model for women in the financial services and investment industry.

Prior to co-founding Varde in 1993, Marcia managed Merced Partners, an investment partnership at EBF & Associates, another alternative investment firm. Before that, she traded distressed and high-yield bonds and managed fixed-income portfolios at Cargill. Marcia received her MBA from the University of Minnesota and is actively involved in her alma mater, serving on the board of trustees and as chair of the investment committee at Gustavus Adolphus College, and on the board of overseers of the Carlson School of Management at the University of Minnesota. She is also a member of The Committee of 200, a global organization that advances women’s leadership in business.

Tracy Stuart

Corbin Capital

Position: Chief Executive Officer

Location: New York, NY

Estimated AUM: $10.4B+

Strategy: Private Credit, Structured Credit, Opportunistic Credit

Tracy Stuart is an accomplished financial executive with over 30 years of experience in the industry. She is currently the Managing Partner and CEO of Corbin Capital, a leading independent alternative asset management firm based in New York City. Tracy has been recognized for her impact on the financial sector in New York City and was named to Crain's New York Business Notable Women on Wall Street List. She earned her bachelor's degree in economics from UCLA and her M.I.M. from the American Graduate School of International Management (Thunderbird), and she also holds a CFA charter that she received in 1992.

Before joining Corbin in 2004, Tracy was the Managing Director and Head of the Global Multi-Manager Strategies group at Goldman Sachs Asset Management, where she created and managed an $11 billion external manager of managers business. Tracy's expertise and leadership have played a significant role in Corbin's success. Under her guidance, Corbin Capital Partners has experience creating and managing differentiated commingled and bespoke portfolios for investors globally. She is focused on leading a client-centric, results-driven alternative investment firm that specializes in multi-strategy hedge fund and opportunistic credit investing and is committed to diversity, equity, and inclusion throughout the organization.

Sonia Gardner

Avenue Capital Group

Position: President, Managing Partner & Co-Founder

Location: New York, NY

Estimated AUM: $7.2B+

Strategy: Distressed Debt & Equity, Long-Short Equity, Real Estate, Collateralized Debt

Sonia Gardner is an accomplished financial executive, entrepreneur, and advocate for gender equality in the finance industry. She graduated with honors from Clark University with a B.A. in Philosophy and received her J.D. from Cardozo School of Law. Gardner began her career as Senior Attorney in the Bankruptcy and Corporate Reorganization Department at Cowen and Company, where she gained experience in debt brokerage. In 1989, Gardner and her brother Marc founded Amroc Investments, a debt brokerage firm that they later merged with global investment management firm, Avenue Capital Group, in 1995.

Gardner's extensive experience in the hedge fund industry has earned her numerous accolades, including the 100 Women in Hedge Funds’ 2008 Industry Leadership Award, being named as one of The Hedge Fund Journal's Top 50 Women in Hedge Funds in both 2010 and 2011, and being recognized as one of Business Insider's 25 most powerful women on Wall Street. Gardner is currently a member of the board of directors of 100 Women in Hedge Funds and the board of trustees of the Mount Sinai Medical Center. In addition to her impressive business career, Gardner is committed to promoting gender equality in access to finance as the United Nations Capital Development Fund (UNCDF) Goodwill Ambassador for Gender Equality in Access to Finance. Gardner has also served on the board of the non-profit organization "Her Justice," which helps victims of domestic violence, demonstrating her commitment to supporting social causes.

Leslie Lake

Invus Financial Advisors

Position: Co-Founder & Managing Director

Location: New York, NY

Estimated AUM: $4.1B+

Strategy: Long-Short Equity

Leslie Lake is the Co-Founder and Managing Director of Invus Financial Advisors, LLC, a New York City-based investment boutique specializing in long/short equity strategies. With over 25 years of experience in the hedge fund industry, Leslie has particular expertise in emerging and early-stage hedge fund managers. Leslie co-founded Invus Financial Advisors in 2006, following her tenure as Chief Investment Officer of The Invus Group.

In addition to her work at Invus, Leslie is also a Trustee and Vice Chair of the Board of Trustees at Simmons University in Boston, MA. She is also an active equestrian and dog lover, and serves as the president of the National Blood Clot Alliance, where she volunteers her time to raise public awareness of venous thromboembolism (VTE). With her impressive experience in the hedge fund space, Leslie continues to be a trailblazer and role model for women in the financial industry.

Candace Weir

Paradigm Capital

Position: President & Chief Investment Officer

Location: Albany, NY

Estimated AUM: $1.7B+

Strategy: Long-Short Equity

Candace King Weir is a pioneer in small-cap institutional research, having founded her own firm in 1972. Her ability to identify hidden value for investors led her to expand her business, forming an investment advisory practice in 1984 and ultimately incorporating as Paradigm Capital Management, Inc. in 1994. Candace holds a BA from Vassar College and currently serves as Chief Investment Officer and co-manager of the firm's Small-Cap, SMid-Cap, Micro-Cap, and Personal Wealth portfolios.

Paradigm Capital Management, founded in the early 1990s, specializes in small-cap equities and maintains a belief in the outsize return potential of these investments. The firm's investment process includes a focus on constant interaction with and evaluation of a company's management and competitive positioning to drive superior results. As the co-manager of multiple portfolios at Paradigm, Candace has played a critical role in the firm's success and continues to apply her expertise and experience to identify value and generate strong returns for clients. She & her daughter, Amelia Weir, work as a team in the investment space and are advocates for female involvement in the industry.

Teresa Barger

Cartica Management

Position: Co-Founder & CEO

Location: Washington D.C.

Estimated AUM: $875M+

Strategy: Long-Short Equity, Long-Only, Private Equity

Teresa C. Barger is a highly respected investment professional with over 20 years of experience investing in emerging market companies. She co-founded Cartica Management LLC, an independent investment boutique that focuses exclusively on emerging markets, where she currently serves as CEO. Cartica is a majority women-owned and women-led firm that manages a concentrated portfolio of high-quality emerging market companies and seeks value-enhancing improvements in ESG and related factors. Prior to founding Cartica, Teresa spent 21 years at the International Finance Corporation (IFC), where she held various positions, co-founded the Emerging Markets Private Equity Association (EMPEA), and created the first index for EM private equity.

Teresa is a member of the Council on Foreign Relations and serves on the boards of several organizations, including the American University in Cairo, the Casey Health Foundation, and ANERA. She also serves on the Advisory Councils for Princeville Global and Lumia Capital. Teresa received her BA from Harvard College, and her MBA from the Yale School of Management, and did post-graduate work at the American University in Cairo. With Teresa's extensive experience and leadership, Cartica continues to provide top-tier investment services to institutional investors seeking exposure to emerging markets.

Debra Fine

Fine Capital Partners

Position: Founder & Chairman

Location: New York, NY

Estimated AUM: $850M+

Strategy: Long-Short Equity

Debra Fine is an accomplished investment professional and founder of Fine Capital Partners, a New York-based investment firm that manages U.S. equity assets for university endowments and foundations. She serves as Chair and brings her extensive experience and expertise to help manage the firm's investments and deliver strong returns for its clients. Debra has also served on various for-profit and non-profit boards in leadership positions with a focus on governance, finance, audit, and investment committees. Her non-profit work focuses on global humanitarian relief and poverty alleviation, and she is also a seed investor in social enterprises that focus on financial inclusion domestically and internationally. Debra received a bachelor's degree from Yale University and an MBA from Harvard University.

Before starting Fine Capital, Debra was the Director of Global Equities at Loews Corporation, where she managed a global equity portfolio. Prior to Loews Corporation, Debra was a Principal and a buy-side equity analyst at Sanford C. Bernstein. She has also worked for the New York City Department of Sanitation as a special assistant to the commissioner. Debra has served in leadership positions on many nonprofit boards and investment committees, including the Jewish Museum, Footsteps, and advisory committees for the Yale School of Engineering and Applied Science and the Yale Women's Faculty Forum.

Nancy Prial

Essex Investment Management

Position: Co-Chief Executive Officer

Location: Boston, MA

Estimated AUM: $845M+

Strategy: Long-Short Equity, Micro/Small-Cap Growth, ESG

Nancy Prial is a Co-Chief Executive Officer and Senior Portfolio Manager at Essex Investment Management, an independent, employee-owned institutional investment firm that focuses on incorporating environmental sustainability and social factors into their portfolio management process. Nancy is the portfolio manager for the micro, small, and SMID growth strategies, and has a demonstrated history of working in the investment management industry. She has extensive experience in equity research, portfolio management, mutual funds, valuation, and department reorganization.

Before joining Essex in 2005, Nancy spent six years at Burridge Growth Partners as the Chief Investment Officer and Senior Vice President responsible for the SMID and Small Cap Growth Strategies. She also spent four years at American Century Investors as a Senior Vice President and Senior Portfolio Manager, leading the team that managed the Heritage Fund. Nancy began her career at Frontier Capital Management in 1984, where she served as both a fundamental analyst and portfolio manager in the small and mid-cap area. Nancy earned a B.S. in Electrical Engineering and a B.A. in Mathematics from Bucknell University and an M.B.A. from Harvard Business School. Nancy serves as a Trustee Emeritus for Bucknell University and is the President of Women Investment Professionals.

Rebecca Pacholder

Snowcat Capital Management

Position: Founder & CEO

Location: New York, NY

Estimated AUM: $740M+

Strategy: High-Yield, Distressed Debt

Rebecca Pacholder is an experienced investor with 20 years of work experience in high-yield and distressed debt investments across various market cycles. She is the founder of Snowcat, an investment firm that specializes in investing in high-yield and distressed debt. Prior to founding Snowcat, Rebecca served as a Portfolio Manager and Partner at Omega Advisors and as a senior analyst at Anchorage Capital Group LLC. From 2004 to 2010, she was a partner at Sandell Asset Management, a multi-strategy fund, where she focused on high-yield and distressed debt investments. Rebecca began her career as a corporate attorney at Baker Botts, LLP in Houston.

Rebecca received her BA in Politics from Princeton University and her JD from the University of Texas, where she graduated with honors. She is also a CFA charter holder and has participated as a speaker at Invest for Kids, an annual investment conference where top investment managers share their market views and best investable ideas and all proceeds from the conference go to nonprofit organizations serving Chicago area youth from disadvantaged communities. Rebecca's expertise and experience in the investment space make her a respected figure in the industry.

Nehal Chopra

Ratan Capital Management

Position: Founder & Chief Investment Officer

Location: Miami Beach, FL

Estimated AUM: $690M+

Strategy: Long-Only Equity, Technology/Consumer Goods

Nehal Chopra is the Founder and Chief Investment Officer of Ratan Capital Management, a Florida-based hedge fund management firm. The firm aims to identify mispricings in securities resulting from corporate and structural change, including spin-offs, transformational mergers, management change, and bankruptcies. Nehal's investment approach is rooted in researching and investing in fundamental value with catalyst opportunities across sectors and geographies. Prior to founding Ratan, Nehal managed a portfolio at Balyasny Asset Management, where she focused on fundamental value with catalyst opportunities. Before that, Nehal was part of a three-person research team at Ramius, focusing on event-driven investing.

Nehal's finance career started at Lehman Brothers and UBS AG as an investment banking analyst. Nehal grew up in Mumbai, India, where she attended Fort Convent and Sydenham College before coming to the United States to attend the University of Pennsylvania. At UPenn, Nehal received an MBA from the Wharton School in 2002, as part of an elite sub-matriculation program, and a BS in Economics from the Wharton School in 2001. Nehal is a 2013 recipient of Institutional Investor's Rising Stars of Hedge Funds award and has been recognized as a thought leader in the industry. Nehal also participated as a speaker at Invest for Kids, a conference where top investment managers share their market views and best investable ideas.

Angela Aldrich

Bayberry Capital

Position: Founder & Managing Partner

Location: New York, NY

Estimated AUM: $820M+

Strategy: Long-Short Equity

Angela Aldrich is a trailblazer in the hedge fund industry, where women-led firms manage only 3 percent of the assets in American funds that launched between 2013 and 2017. At just 33 years old, Angela founded Bayberry Capital, a long-short equities fund based in New York, where she serves as both managing partner and portfolio manager. The firm, which employs a fundamental primary-research-driven process, invests globally and has a focus on the short side of the portfolio, which is a critical component of its strategy.

Prior to founding Bayberry, Angela spent almost six years at Blue Ridge Capital, where she earned the nickname “Tiger grandcub” while working under Julian Robertson protégé John Griffin. She also worked at Goldman Sachs in their investment banking division and was a pre-launch member of the investment team at BDT Capital. Angela holds a BS in Economics from Duke University and an MBA from the Stanford Graduate School of Business. Angela's leadership and success in founding Bayberry Capital is a step forward for diversity in an industry that remains one of the most male-dominated in the country.

Fariba Ronnasi

Lattice Capital Management

Position: Chief Executive Officer

Location: Kirkland, WA

Estimated AUM: $590M+

Strategy: Long-Short Credit

Fariba Ronnasi is a financial industry veteran and the CEO of Lattice Capital Management, an alternative investment firm that manages two hedge funds serving accredited investors. Fariba has extensive experience in the investment sector, having previously held positions at KeyCorp and Citicorp, where she established and managed private banking divisions. In 2006, she founded Lattice Capital Management, where she serves as the driving force behind the firm's mission to deliver value to clients through innovative investment solutions.

Fariba is also the founder of Elite Wealth Management, which serves high net worth and institutional investors. She received her Bachelor’s and Master's degrees from Seattle University, where she concentrated in finance. Her deep knowledge and understanding of the investment industry have made her a respected figure in the field, and she has been recognized for her contributions by industry publications such as Barron’s and Worth magazine.

Kate Nevin

TSWII Capital Advisors

Position: President & Portfolio Manager

Location: Chattanooga, TN

Estimated AUM: $550M+

Strategy: Long-Short Equity

Kate Nevin is an experienced portfolio manager and advocate for diversity and inclusion. For over 20 years, she has served as the President and Portfolio Manager at TSWII Capital Advisors, an investment firm with a focus on hedge fund, private equity, venture capital, and co-investment strategies. At TSWII, Kate believes that diversity is key to long-term success and is committed to building diverse, innovative teams to provide attractive returns for clients. With a 30+ year track record of successful investments, TSWII is well-positioned for future growth and remains dedicated to investing in opportunities that align with their client's objectives.

In addition to her work at TSWII, Kate is actively involved with industry groups such as The Academy of Institutional Investors and Nexus, as well as community organizations focused on conservation and gender equality. As a Riley Diversity Fellow, Kate has championed the advancement of female founders by ensuring they have access to mentorship, networks, and coaching to thrive. She is a passionate advocate for diversity and inclusion, and her efforts have helped bridge the gender pay gap and increase opportunities for underrepresented groups in finance. Kate also serves as the chair of the Ackland National Advisory Board and has made generous contributions to the University of North Carolina at Chapel Hill, her alma mater, to support the Caldwell Family Artist-in-Residence Fund and the Caldwell Family Fund for the Ackland Art Museum.

Ingrid Yin

MayTech Global Investments

Position: Co-Founder, Managing Partner & Portfolio Manager

Location: New York, NY

Estimated AUM: $520M+

Strategy: Global Macro, Long-Short, Liquid Futures/Options

Ingrid Yin, Ph.D., is a Co-Founder, Managing Partner, and Portfolio Manager at MayTech Global Investments. With over 15 years of experience in global equity investing, Ingrid specializes in identifying investment opportunities in Asia and healthcare. Prior to co-founding MayTech, Ingrid worked as a Managing Director at Oppenheimer & Co., a Senior Research Analyst at Brean Capital, and an Asian Equity Analyst at Wellington Management. In addition to her work in finance, Ingrid serves as an External Board Advisor for the Chemistry Department at Stony Brook University. She holds a Ph.D. in Biochemistry from SUNY-Stony Brook University, an MBA from MIT Sloan, and a B.S. from Beijing University.

In April 2019, Ingrid Yin was invited to speak as a guest panelist at Mulan Club Speaker Series on "Women In Investments: Redefining the Paradigm". The discussion centered around how investors can choose the right investment manager and product, particularly alternative investment vehicles, to meet their unique needs. MayTech Global Investments, LLC, is an independent and employee-owned investment management firm that specializes in managing global growth portfolios. With a strong research culture, MayTech's portfolio managers have over 20 years of experience investing globally. The firm manages global equities portfolios for public and private pension funds, corporations, foundations, private banks, wealth managers, registered investment advisors, and high net worth individuals.

Leah Zell

Lizard Investors

Position: Founder & Portfolio Manager

Location: Chicago, IL

Estimated AUM: $475M+

Strategy: Long-Short Equity, Healthcare

Leah Zell, Ph.D., CFA, is a pioneer in the international small-cap category and the Founder and Lead Portfolio Manager of Lizard Investors LLC. She previously co-founded Wanger Asset Management, now Columbia Wanger Asset Management, where she was Head of the International Equities Team, Lead Portfolio Manager of the Acorn International Fund, and Portfolio Manager of the Wanger European Smaller Companies Fund. She has also worked as a global equity analyst for Harris Associates and in investment banking at Lehman Brothers.

Ms. Zell earned her Bachelor of Arts degree from Harvard College, a Ph.D. in Modern Social and Economic History from Harvard, and a CFA designation. She is currently on the Executive Committee of the Chicago Council on Global Affairs, where she has served as Treasurer since 2004. Zell is a member of the New York Council on Foreign Relations, the Global Advisory Council of Harvard University, and the Harris Council of the University of Chicago’s Harris School of Public Policy. She also serves as a Director of the Horton Trust Company LLC and a member of the Investment Committee of the Museum of Contemporary Art in Chicago. Ms. Zell has appeared in various media outlets to share her expertise, including CNBC's "Squawk Box" and "What's Working," as well as multiple newspapers and magazines.

Jolanta Wysocka

Mountain Pacific Group

Position: Co-Founder & CEO

Location: Bellevue, WA

Estimated AUM: $455M+

Strategy: Emerging Markets, Equity Beta Hedging, Currency Overlay, Global Ex-US Equity

Jolanta Wysocka is a seasoned investment professional with over 30 years of experience in portfolio management and research. She is the CEO and Co-founder of Mountain Pacific Group (MPG), an independent and employee-owned investment firm specializing in next-generation quantitative solutions. Prior to founding MPG, Jolanta served as a portfolio strategist at Russell Investments, where she focused on product structuring and risk management.

MPG's investment process is built on a risk-based philosophy that focuses on forecasting risk rather than return. This approach allows the firm to exploit the mispricing of risk and add value to their investment strategies. Jolanta and her team have managed currency and equities for some of the largest pension funds, foundations, and endowments worldwide. By identifying situations with heightened downside risk and reducing exposure when risk is excessive, MPG's approach is highly complementary to conventional return forecasting styles.

Annette Welton

Welton Investment Advisors

Position: Co-Founder & Board Chair

Location: Carmel, CA

Estimated AUM: $450M+

Strategy: Long-Short Equity, Stop-Loss Orders

Annette Welton is the co-founder and Chair of the Board of Managers at Welton Investment Corporation. With over 30 years of experience as an entrepreneur and a female pioneer in alternative investments, Annette provides governance, executive oversight, and industry relations expertise to the company. She takes a particular interest in reputational risk, diversity, and sustainability/ESG matters, utilizing her understanding of markets and business risk. During her 22-year tenure as Welton's Chief Operating Officer, she served on the Managed Funds Association’s Industry Public Relations Committee as well as the National Futures Association (NFA) Nominating Committee.

Annette has also contributed to various charitable, civic, and nonprofit organizations. She served as a Director on the UCLA Foundation Board from 2012-2022 and as Treasurer of the Monterey, California Chapter of the National Charity League. She previously served as a Founder Director on the Board of Freedom Fields USA, an organization devoted to demining international areas of war-torn conflict in partnership with the US Department of State and the Halo Trust. Annette holds a BS degree from the University of California, Los Angeles (UCLA).

Kathy MacAskie

Zarvona Energy

Position: President & CEO

Location: Houston, TX

Estimated AUM: $310M+

Strategy: Long-Short Equity, Energy

Kathryn MacAskie is an accomplished energy industry executive with over 35 years of experience in the evaluation, acquisition, management, development, and divestiture of oil and gas assets. She is the President & CEO of Zarvona Energy LLC, which she founded in 2010. As President of the General Partner and a Member of the Investment Committee, Kathy manages The Salient Zarvona Energy Fund GP, an investment entity utilizing long-short equity strategies for their pooled investment vehicles in the energy sector with a focus on oil & gas. Kathy holds a BS in Civil Engineering from Rice University and is a registered Professional Engineer in the State of Texas.

Kathy has held leadership positions at several well-respected energy companies. She served as Senior Vice-President of EnerVest Management Company from 1995 to 1999, then as Vice-President for Cawley, Gillespie & Associates until 2001. She was a founding member of FlairTex Resources LLC from 2001 to 2006 and served as Senior Vice-President of Acquisitions of EV Energy Partners, L.P. from 2006 to May 2010. During her tenure at EV Energy Partners, the company acquired over $900 million of oil and gas assets. Kathy's extensive experience makes her a valuable asset to the energy industry.

Nadine Terman

Solstein Capital

Position: CEO & Chief Investment Officer

Location: Menlo Park, CA

Estimated AUM: $275M+

Strategy: Global Macro, Long-Short Equity, Long-Only, ESG

Nadine Terman is the Founder, CEO, and CIO of Solstein Capital, a San Francisco-based investment firm that partners with institutional, family office and high net worth clients to construct tactical, global portfolios across asset classes. With over 25 years of investment experience spanning public markets and private equity, she oversees both investments and operations at Solstein, which manages both hedged and unhedged portfolios for its clients.

Before founding Solstein, Nadine was a Partner at Blum Capital and served on its investment committee. Her career also spans investment positions with Behrman Capital, Merrill Lynch, and Goldman Sachs. She is a longstanding advocate for the advancement of diversity in the financial industry and has spearheaded key industry diversity events, co-founding what is now known as 100WF's FundWomen conference. Nadine holds a B.A. in quantitative economics with Honors and Distinction from Stanford University and an M.B.A from the Stanford Graduate School of Business, where she was an Arjay Miller Scholar, and now serves as a guest speaker. In addition to her professional achievements, Nadine enjoys adventure travel and cycling and is also a Business Challenge Coach for the Stanford-Endeavor Innovation & Growth Program.

Gloria Nelund

TriLinc Global

Position: Founder & CEO

Location: Manhattan Beach, CA

Estimated AUM: $240M+

Strategy: Private Debt, Private Equity, Emerging Markets, ESG/Impact Investing

Gloria Nelund, CEO and Founder of TriLinc Global, is a trailblazer in the international asset management industry, having led multi-billion-dollar financial institutions such as Deutsche Bank Private Wealth Management North America ($50 billion) and Bank of America’s Capital Management ($35 billion). Gloria founded TriLinc in 2008 with a mission to bring globally diversified investment opportunities to investors that offer attractive returns while making positive measurable social impacts in communities around the world. She believes that the capital markets may be the best chance to solve some of the biggest social and environmental issues we face today.

Gloria has been a pioneer in the development of social impact products and was instrumental in making Deutsche Bank a leading institutional supporter of microcredit, creating multiple programs to help Private Wealth Management clients learn about and invest in the sector. She also served on the Board of the Deutsche Bank Americas Community Development Group. In addition to her activities with TriLinc, Gloria is an Independent Trustee of the Victory Funds, a mutual fund complex with more than $43 billion in assets under management. Gloria is involved with not-for-profit organizations and actively supports entrepreneurship, research, and education. She is an active speaker and guest lecturer on Impact Investing at conferences and several top business schools, including Columbia, Georgetown, Wheaton, Kellogg, Stanford, and MIT.

Kelly Chesney

Pluscios Management

Position: Co-Founder & COO

Location: Evanston, IL

Estimated AUM: $225M+

Strategy: Long-Short Equity, Technology, Media

Kelly Chesney is a highly accomplished co-founder of Pluscios Management, with over 25 years of experience in capital markets and alternative asset investing. With a focus on diversity-led and emerging managers, the firm provides hands-on product development support and custom solutions, in addition to broadly diversified core and catalyst solutions. With over 60 years of combined investment management experience, the Pluscios team uses institutional processes to target long-term growth and capital preservation across a variety of market cycles, and excels in manager selection, due diligence, and portfolio construction.

Kelly began her career in law before transitioning to the finance industry and spent several years as a lawyer for the Corporate Investments and Capital Markets Groups at JPMorgan, where she structured and negotiated complex commercial finance transactions & investments. Prior to co-founding Pluscios, Kelly was a Managing Director at JPMorgan Capital Management, where she was responsible for all aspects of portfolio management, including portfolio construction, manager selection, and ongoing monitoring. She was also a key member of the Investment Committee and the Management Committee. Kelly's extensive experience and expertise have made her a respected leader in the investment management industry.

Connie Teska

Pluscios Management

Position: Co-Founder & CIO

Location: Evanston, IL

Estimated AUM: $225M+

Strategy: Long-Short Equity, Technology, Media

Constance Teska is an accomplished principal co-founder with over 30 years of experience in capital markets and alternative asset investing. As the CIO of Pluscios Management, Connie brings a wealth of experience and knowledge to the firm. Prior to co-founding Pluscios, Connie served as the President of JPMorgan Capital Management, where she set the strategic direction of the hedge fund investment group and oversaw all aspects of due diligence, manager selection, portfolio construction, and risk management. She was also instrumental in the formation of a Corporate Investments Group at the bank that managed over $8 billion in assets across a variety of alternative asset classes. Connie's extensive expertise and track record of success have made her a respected leader in the investment management industry.

Today, as a co-founder of Pluscios Management, Connie continues to demonstrate her commitment to developing bespoke investment solutions on behalf of institutions and intermediaries. Along with co-founder Kelly Chesney, she provides hands-on product development support and custom solutions with a focus on diversity-led and emerging managers. As a WBENC-certified investment management firm, Pluscios is well-positioned to provide its clients with access to a wide range of investment opportunities across various asset classes.

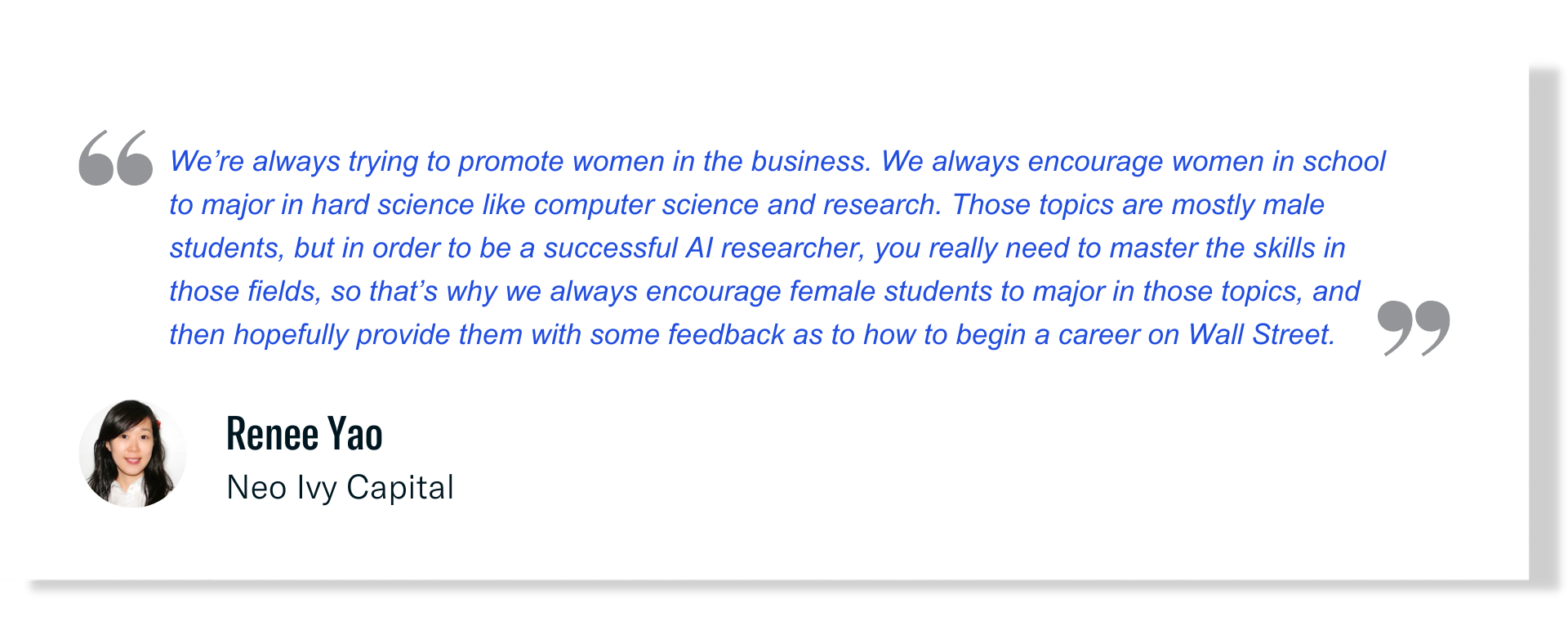

Renee Yao

Neo Ivy Capital

Position: Founder & Portfolio Manager

Location: New York, NY

Estimated AUM: $180M+

Strategy: Long-Short Equity, Global Macro, Fixed Income

Renee Yao is a quantitative hedge fund manager and artificial intelligence expert who has made a name for herself in the industry with her innovative approach to trading. After starting her career at Citadel LLC as a quant researcher, she later worked as a trader at WorldQuant, where she was given discretionary trading authority for her own designated account. Yao then went on to manage multiple statistical arbitrage portfolios at a prop trading firm, totaling several hundred million USD in gross positions. In 2015, Yao founded Neo Ivy Capital Management, her own quantitative hedge fund manager that focuses on trading liquid, publicly traded equity securities via statistical arbitrage strategies. The fund uses an artificial intelligence-driven model that generates trading ideas 24/7. It collects, cleans, and processes relevant data to generate forecasts, which are then translated into tradable targets.

As an artificial intelligence and quant hedge fund expert, Yao represents a new generation of hedge fund managers who embrace cutting-edge technology to gain an edge in financial markets. Despite her focus on AI, she also has a strong background in traditional quantitative investing, having earned a master's degree in statistics from Columbia University and worked at top-tier hedge funds such as Citadel and Millennium Partners. With her expertise in both traditional quantitative analysis and artificial intelligence-driven trading, Yao has established herself as a leading figure in the hedge fund industry.

Parisa Golestaneh

VesperMare Capital

Position: Founder & CIO

Location: New York, NY

Estimated AUM: $125M+

Strategy: Emerging Markets, Global Macro, Fixed Income

Parisa Golestaneh is an accomplished emerging markets investor and the Chief Investment Officer and founding partner of VesperMare Capital, a majority-owned Minority and Women Business Enterprise (MWBE) focused on emerging market macro strategies. Golestaneh has over 20 years of experience in emerging markets investing and is the founder and sole portfolio manager of VesperMare's flagship strategy, the VesperMare EM Tactical Opportunities Strategy (EMTAC). Under Golestaneh's leadership, VesperMare has established itself as a leading MWBE investment manager, focused on emerging markets macro strategies.

Prior to founding VesperMare in 2021, Golestaneh worked as a portfolio manager at NWI Management, where she collaborated with VesperMare's Head of Research, Adam Weiner. Golestaneh previously served as Head of Emerging Markets at Blackstone Alternative Asset Management and worked as a global macro emerging markets portfolio manager at both FrontPoint Partners and BTG Pactual. She began her finance career at JP Morgan, where she worked in emerging markets structuring, hybrids, and investment.

Conclusion

We are honored to be able to provide the data used to feature these women and their extraordinary accomplishments in the financial industry. Each of these women have achieved enormous success and continue to serve as trailblazers and role models for female inclusion in investing.

Disclaimer: This report and accompanying information have been derived using FINTRX-proprietary data. All information contained within is accurate to the best of our knowledge, including--but not limited to--estimated reported AUM (as of Q1 2023), job titles, investment strategies, etc. This report and its data are not intended for reproduction and should not be used as official investment advice. FINTRX does not have any affiliation with any persons or entities included in this report. Any use of this report or its contents is at the sole discretion and responsibility of the user. FINTRX shall not be held liable for any errors or omissions in the information provided herein.

About FINTRX

FINTRX is a leading family office & registered investment advisor (RIA) data intelligence solution that provides comprehensive and reliable data on 3,700+ family offices, 20,000 family office contacts, 40,000 RIAs and 850,000 registered reps. Our platform combines data, analytics and intuitive software to help clients identify potential investment opportunities, connect with investors and clients and stay informed on industry trends and developments.

At FINTRX, we leverage advanced AI technology to provide accurate and updated information on family offices and RIAs worldwide. FINTRX data is powered by millions of sources, both public and private, which are constantly updated and verified by our 70+ person research team as well as a team of experienced data scientists. This ensures you have access to the most relevant and timely information available.

Written by: Emery Blackwelder |

May 03, 2023

Emery Blackwelder is a member of the product marketing team at FINTRX--the preeminent resource for family office & registered investment advisor (RIA) data intelligence.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(1).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(2).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(3).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(4).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(5).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(6).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(7).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(8).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(10).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(11).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(9).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(12).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(13).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(14).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(15).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(16).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(17).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(18).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(19).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(20).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(21).png)

.png?width=150&height=150&name=Hedge%20Fund%20Headshots%20(22).png)