START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

2022 FINTRX Family Office & Registered Investment Advisor Annual Roundup

On behalf of FINTRX, the leading Family Office and Registered Investment Advisor (RIA) Database solution, it is our pleasure to share the 2022 Family Office and RIA Yearly Roundup. With an emphasis on family offices, investment advisors and the alternative wealth landscape at large, this unique newsletter edition features news articles and summaries of some of the most notable private wealth narratives that occurred each month throughout 2022.

World's Wealthiest Doubled Their Incomes as 99% of Global Income Fell

January 17, 2022

Warren Buffett, Jeff Bezos, Larry Ellison, Larry Page, Sergey Brin, Mark Zuckerberg, Steve Ballmer and Bernard Arnault Doubled Their Wealth Amid Pandemic as 99% of Incomes Declined

According to an Oxford report, 10 of the world's richest men saw a two-fold increase in their wealth during the COVID-19 pandemic. Between March 2020 and November 2021, their wealth rose from roughly $700 billion to $1.5 trillion. During that same time, 99% of global income fell.

According to Federal Reserve data, the wealthiest 1% of U.S. households own over 50% of all publicly listed stock on the market, while the bottom 50% possess less than 1%. The stock market increased significantly between March 2020 and January 2022 partly because of monetary policies implemented by the Federal Reserve. These policies have resulted in frequently untaxed gains for the wealthy.

According to Oxfam International Executive Director Gabriela Bucher, one strategy for "righting the violent wrongs of this outrageous inequity," is taxation. The research recommending a new tax on the world's wealthiest individuals came after a ProPublica investigation revealed the use of legal loopholes to avoid paying taxes on their wealth gains.

Various tax rates were mentioned in the Oxfam study, which required billionaires to pay taxes annually on any growth in wealth, whether the gains are realized or not. According to Oxfam's methodology, information on the declining earnings of the world's 99% was derived from World Bank data.

Link to the original article written by: Catherine Thorbecke, ABC News

Private Funding Pulse Check: January | ICONIQ Capital Family Office | $620M Series C | 1Password

Ukraine War Poses Global Economic Risks

February 26, 2022

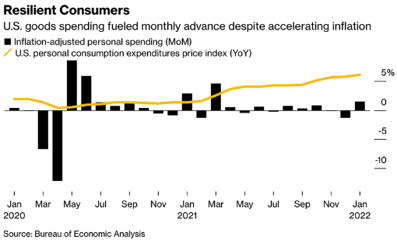

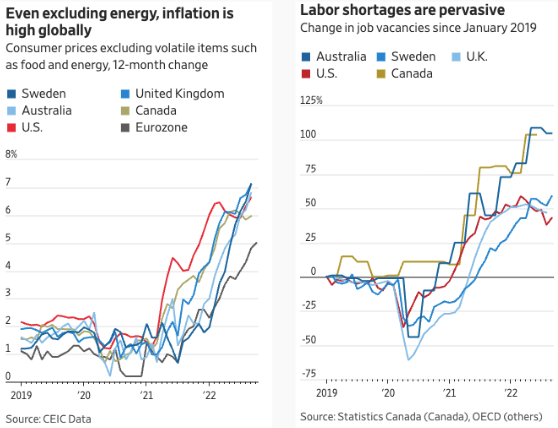

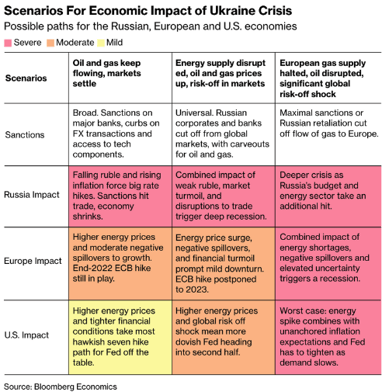

According to Bloomberg, energy inflation in the European Union accelerated to a record high in January and looked likely to worsen as natural gas and oil prices continued to soar. The PCEPI (personal consumption expenditures price index) increased by 6.1% in 2021, causing a significant jump in the prices of goods and services. This was likely due to multiple factors including rising production costs, increased demand for goods and services and other economic conditions.

Commodity price spikes can have significant impacts, as they typically affect the prices of food and energy. Some countries may see benefits, but for many emerging markets, higher prices and capital outflows posed major challenges. Because emerging markets often rely on exports of commodities (i.e. oil and other natural resources) higher prices meant increased inflation and a weaker exchange rate.

Capital outflows would also put further pressure on the exchange rate, making it harder for a country to finance its debt. Commodity price spikes and capital outflows can pose significant risks for many emerging markets, especially those already struggling to recover from the effects of the pandemic or other economic challenges.

Link to the original article written by: Vince Golle and Molly Smith, Bloomberg Economics

Private Funding Pulse Check: February | MSD Partners | $935M Series E | Flexport

The U.S. Prepares for a Post-Pandemic Economy

March 4, 2022

According to forecasts by Bloomberg Economics, energy inflation in the European Union accelerated to a record in January, which looked likely to worsen as natural gas and oil prices continued to increase. In the U.S., higher fuel costs meant delaying the peak of inflation.

Link to the original article written by: Josh Mitchell, WSJ

Private Funding Pulse Check: March | Interplay Family Office | $25M Series D | Black Crow AI

BofA Warns A "Recession Shock" is Imminent

April 8, 2022

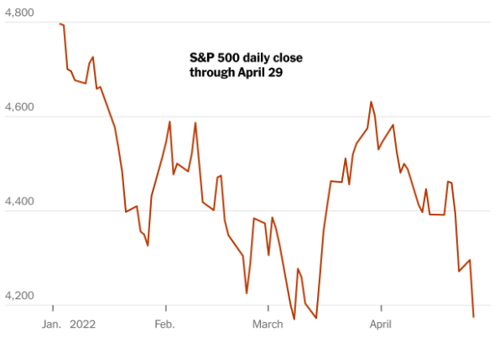

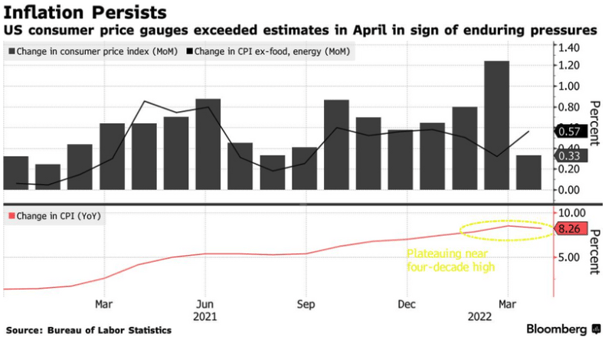

According to BofA strategists, the macroeconomic situation rapidly deteriorated, causing the U.S. economy to enter a recession as the Federal Reserve tightens monetary policy to combat rising inflation. In response to four-year decade-high inflation, the Federal Reserve indicated in April that it would likely begin removing assets from its $9 trillion balance sheet at its meeting in early May. A majority of investors anticipated the central bank to increase its benchmark interest rate by 50 basis points.

April saw emerging market equity funds receive $5.3 billion, the largest weekly inflow it had in 10 weeks while emerging market debt vehicles received $2.2 billion, the highest weekly inflow since September 2021. Additionally, European stocks lost $1.6 billion over the course of eight weeks, while U.S. stocks gained $1.5 billion. The analysis was based on EPFR data.

Link to the original article written by: Julien Ponthus & Karin Strohecker, Yahoo Finance

Private Funding Pulse Check: April | Orchard Ventures| $2.8M | Skill Struck

Fed Chair Jerome Powell Turns Hawkish Amid Inflation

May 17, 2022

Federal Reserve Chair, Jerome Powell gave some hawkish remarks in May, stating that the U.S. central bank would continue to increase rates to counteract historic inflation. In early May, the central bank raised its benchmark rate by 50 basis points in addition to telegraphing that similar hikes would be coming in June and July.

April inflation data did little to subdue any impending recession fears, with the CPI rising 0.33% month-over-month and 0.57% excluding Food and Energy inputs. Ultimately, if the Fed did not see enough convincing evidence of slowing inflation, it would choose to raise rates more aggressively.

Link to the original article written by: Matthew Boesler and Craig Torres, Bloomberg

Private Funding Pulse Check: May | Kestra Private Wealth | $590M Acquisition | Provista Wealth Advisors

Europe Cuts GDP Outlook, Citing Ukraine and China

June 28, 2022

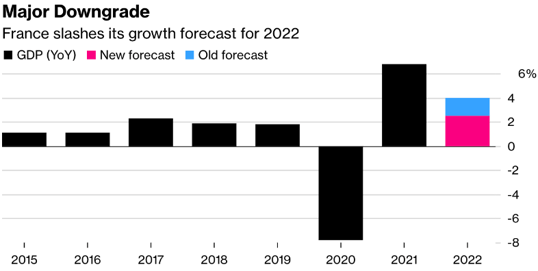

France Cuts GDP Forecast, Citing Ukraine War and China

At the end of June, the French Government lowered its Gross Domestic Product forecasts for the 2022 calendar year, cutting estimates from 4% to 2.5%. The outlook for Europe's second-largest economy was negatively impacted by pricing pressures from the Ukraine War, increased Covid-19 infection rates and supply chain restraints caused by China's 'Covid Zero' policy.

This revision came after a 2022 budget plan that included efforts to prolong energy price caps and increased pensions, among other spending. Shrinking GDP estimates were not the only ongoing issue for the French Government, with average inflation hovering around 5%, the spending deficit passing $52 billion and the debt level sitting at 111.9% of GDP.

Link to the original article written by: Gaspard Sebag & William Horobin, Bloomberg

Link to the Newsletter: Volume 13

Private Funding Pulse Check: June | The Kraft Group | $35M Series A | Jackpot.com

Global Inflation Continues to Scorch

July 13, 2022

The Euro Trades in Parity with the Dollar, Signaling Global Slowdown

For the first time in nearly 20 years, the euro and the dollar traded in parity with one another, meaning the two currencies have the same worth. The euro's sharp decline came as a result of continuous headwinds from the Ukraine War, energy disruptions and an overall slowing of Europe's major economies.

The decline in the currency's value put the European Central Bank (ECB) in a rather difficult position, needing to carefully navigate the end of their bond purchases and begin monetary tightening. However, not all was bad as the majority of Europe's largest companies were expected to beat initial earnings estimates, signaling a potential recovery.

Link to the original article written by: Olivia Rockeman, Bloomberg

Link to the Newsletter: Volume 14

Private Funding Pulse Check: July | Moore Ventures | $63M Series C | Aurora Labs

U.S. Labor Remains Sturdy In Light of Economic Contraction

August 8, 2022

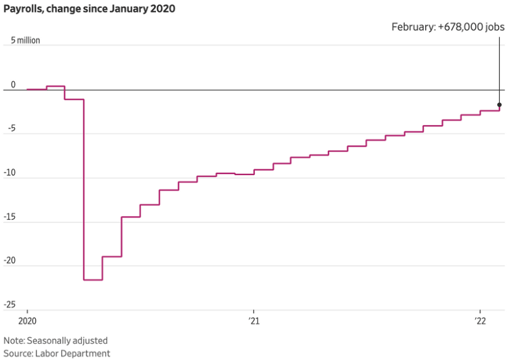

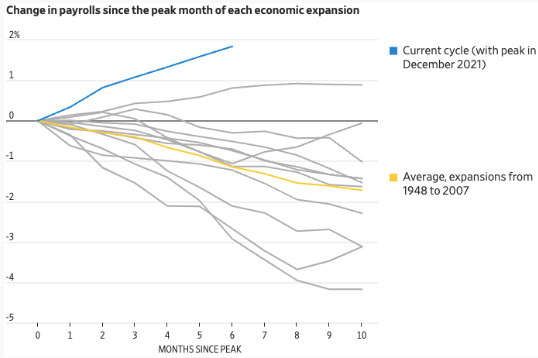

In the wake of rising inflation, geopolitical uncertainty and rising interest rates the labor market remained strong. Despite the growing gap between the labor market and the broader economy, job listings continued to increase while unemployment remained near economic cycle lows.

On average, following economic peaks, payrolls decreased by more than 1.5%. After the peak in December 2021, payrolls increased nearly 2%, the most since World War II. Also worth noting, companies operating in the business service, retail and manufacturing spaces have surpassed their pre-pandemic levels, however, demand for work far exceeded their ability to hire. According to the WSJ, "Job openings in transportation, warehousing and utilities have surged nearly 78% since February 2020 as Americans binged on goods. Companies in the sector have hired just 14% more workers in the same period."

Link to the original article written by: Sarah Chaney Cambon and Gwynn Guilford, WSJ

Link to the Newsletter: Volume 17

Private Funding Pulse Check: August | Kerecis | $100M Series D | KIRKBI

Fund Managers Buy the Dip Following Market Selloff

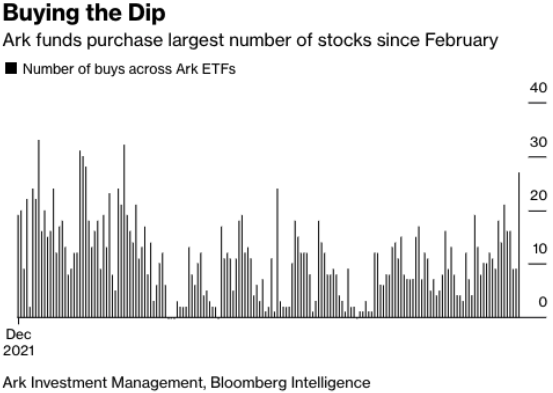

September 14, 2022

During the pandemonium of the market selloff, caused by a higher-than-expected inflation report, Ark Invest CEO Cathie Wood was busy adding to her ARK ETFs. Wood and her team made a total of 27 purchases across eight ETFs, including Roku Inc. its largest buy, dropping 70% since January.

The street criticized the firm's largely underperforming funds including $ARKK which is down more than 55% this year. In a tweet from Woods, she stated "deflation is in the pipeline" and declining inflation pressures would provide a more optimal environment for equities.

Link to the original article written by: Katherine Greifeld, Bloomberg

Link to the Newsletter: Volume 23

Private Funding Pulse Check: September | Greenoaks Capital | $300M Series B | Mysten Labs

Elon Musk Finalizes Twitter Deal

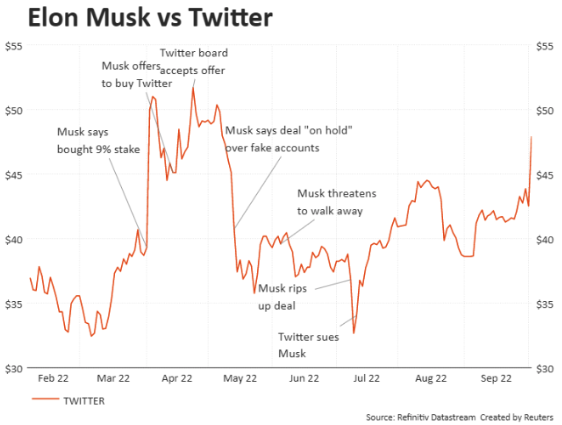

October 4, 2022

In a move that shocked many, Elon Musk made a proposal in a letter to Twitter offering the initial deal established between the two sides back in April. The Musk v. Twitter trial was set to begin proceedings on October 17th in Delaware, however, signs pointed to the two parties coming to an agreement while avoiding litigation that would seemingly cost extraordinary amounts of legal fees.

According to insider reports, Musk's legal team began to recognize that the case was not going well for their side, citing many instances where the judge sided with Twitter during pretrial rulings. In a tweet from Musk, he mentioned the Twitter deal would "accelerate" his plans for X Corporation, a business idea he explains as "the everything app".

Link to the original article written by: Jef Feeley, Ed Hammond and Kurt Wagner, Bloomberg

Link to the Newsletter: Volume 26

Private Funding Pulse Check: October | Thiel Capital | $42M Series D | Alloy Therapeutics, Inc.

Midterm Elections Reveal Economy & Inflation as Key Factors

November 9, 2022

In the polls leading up to midterm elections, would-be voters routinely cited inflation as one of their top concerns. Many Americans looked to blame either Democrats or Republicans for rising prices, however, data pointed to inflation being a bi-partisan issue that has been "socially corrosive and politically destabilizing". Inflation remains a global issue that has been exacerbated by a lack of investment in the energy industry.

Both fossil fuel and renewable energy supply chains remained crippled, leading to higher prices across the board. As a result, many politicians reaped the congressional rewards of higher inflation but may have had just as much difficulty in finding a solution as their predecessors.

Link to the original article written by: Greg Ip, WSJ

Link to the Newsletter: Volume 31

Private Funding Pulse Check: November | Horizons Ventures | $41M Series A | Juvena Therapeutics

Retail Traders Wave the White Flag

December 7, 2022

According to an Oxford report, 10 of the world's richest men saw a two-fold increase in their wealth during the COVID-19 pandemic. Between March 2020 and November 2021, their wealth rose from roughly $700 billion to $1.5 trillion. During that same time, 99% of global income fell.

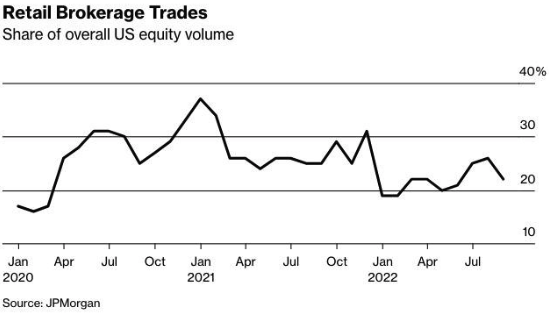

As abruptly as the meme stock retail trade movement burst onto the scene during the height of the Covid-19 pandemic, it seemed to have disappeared just as quickly. The so-called 'dumb-money crowd' of traders flocked to trading highly volatile equities and derivatives in search of exponential and life-changing returns.

However, for every success story, there were many more cases of people losing either a large portion or all of their entire savings. Many of the same investors fell victim to the collapse of FTX where millions of accounts remain locked and perhaps now worthless.

A recent JPMorgan Chase report highlighted the dismal returns posted by retail traders this calendar year, down 40% on average. High-growth technology stocks have had a particularly rough year, declining more than 30%. Overall retail trade across U.S. equities made up nearly 20% of the total volume, this figure was down from 37% during the height of the craze.

Link to the original article written by: Denitsa Tsekova, Bloomberg

Link to the Newsletter: Volume 34

Private Funding Pulse Check: December | Premji Invest | $80M Series D | KreditBee

Subscribe to the Weekly Private Wealth Newsletter

Top Product Enhancements in 2022

Registered Investment Advisor & Broker Dealer Data Set

Access stock and ETF portfolios, account, client & private fund data, and investment preferences for 39,000+ RIAs and 850,000+ registered reps. Connect to the 6.3M+ investment advisor data points and $115T+ in tracked assets. Utilize 200+ data filters to segment RIA entities and contacts.

iOS iPhone & iPad Mobile Apps

Access the full functionality of FINTRX from any iOS mobile device to unlock global private wealth and investment data on the go. Seamlessly search and manage all Family Office and RIA records, contacts, lists, actionable news mentions and more.

CRM Data Integrations (Salesforce, HubSpot & Navatar)

Seamlessly sync all FINTRX data to your respective CRM for more efficient prospecting and client management. Sync RIA, Family Office, and contact data directly into your CRM and migrate your lists to maximize your pipeline capabilities.

Data Enrichment Technology

Our data enrichment solutions ensure you are utilizing the most accurate and complete information on your target market. Uncover hidden networking opportunities within your data to drive better prospecting. Import up to 50,000 CRD numbers or contact emails to upgrade with current contact info and FINTRX native filters.

Download the Newsletter

FINTRX provides comprehensive data intelligence on 850,000+ family office & investment advisor records, each designed to help you identify, access, and map the private wealth ecosystem. Explore in-depth dossiers on each family office & investment advisor. Access AUM, source of wealth, investment criteria, previous investment history, sectors & industries of interest and advisor growth signals, among other key data points.

Additionally, FINTRX provides insight and expansive contact information on 850,000+ decision-makers, featuring job titles, direct email addresses, phone numbers, common connections, alma maters, past employment history, brief bios & much more.

For an in-depth exploration of the FINTRX family office platform, request a demo below.

Written by: Renae Hatcher |

December 30, 2022

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

COMPANY

COMPARE US

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)