START YOUR FREE TRIAL

GET STARTED

The Industry’s Most Trusted Private Wealth Data—Comprehensive, Accurate, and Current

Explore the leading platform used by asset managers to find and engage with RIAs, Broker-Dealers, Family Offices, Foundations & Endowments. Request your free trial of FINTRX now and see for yourself.

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

FINTRX Family Office Data Report Q3 2019

With Q3 of 2019 already in the books, we have provided further analysis into the family office data trends and changes our research team has compiled from the quarter. Continue reading for an in-depth breakdown on how the Q3 unfolded within our ecosystem of 2,573+ family offices, 10,452+ contacts, and 3,000+ tracked investments...

As an emerging industry, family offices are increasingly being recognized as full-fledged investment vehicles with the potential to write larger checks and truly move the needle in the investment landscape. This upward shift in size, awareness, and expertise of family offices has been monumental. That said, let's dive right in...

"In July, August, and September of 2019, our team made a total of 1,165 updates to our data set, including the addition of 212 new family offices, 898 new family office contacts, and 725 tracked investments." - Dennis Caulfield, Vice President of Research

Key Highlights

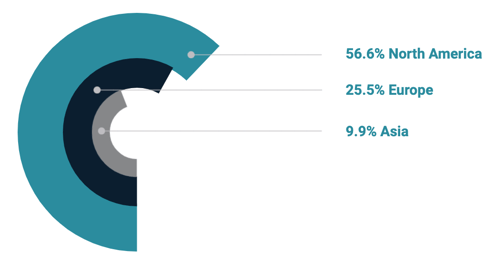

Top regions with the most family office additions:

- North America: 120

- Europe: 54

- Asia: 21

⇒ Latin America, Caribbean, Oceania, and Middle East regions added a combined total of 17 new family offices.

Family office additions by country:

- United States: 116

- Switzerland: 16

- Germany: 6

- Hong Kong: 6

- Australia: 5

- India: 5

Additional countries that added family offices include, but are not limited to:

Canada- Brazil

- France

- England

- Denmark

- Chile

- Israel

- Ireland

- Finland

- Hungary

⇒The countries listed above added a total of 20 family offices added in Q3

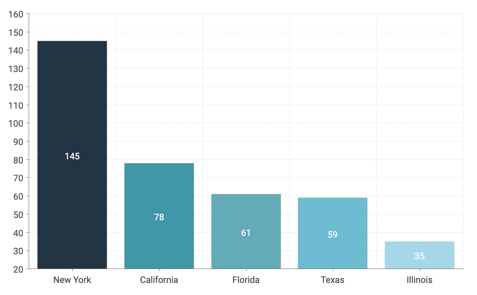

Domestic states with the greatest number of family office additions:

- New York: 145

- California: 78

- Florida: 61

- Texas: 59

- Illinois: 35

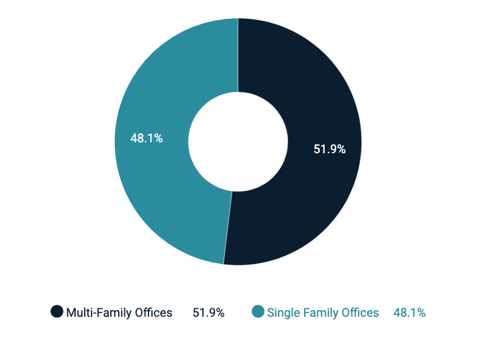

New single family office vs multi family office breakdown:

- 102 single-family offices added

- 110 multi-family offices added

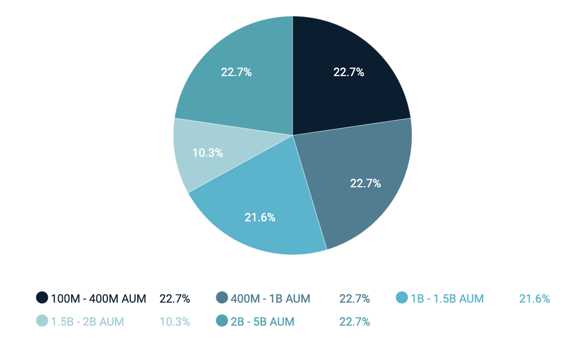

New family office AUM breakdown:

- 100M - 400M AUM: 22%

- 400M - 1B AUM: 22%

- 1B - 1.5B AUM: 21%

- 1.5B - 2B AUM: 10%

- 2B - 5B AUM: 22%

Further findings:

- New family offices active in Impact Investments: 36

- New family offices with a Venture exposure: 213

- New family office contacts responsible for investment oversight, research, and due diligence: 404

Monthly Breakdown

→ July

In July our research team added the following:

- 72 new family offices

- 290 new family office contacts

- 344 new tracked investments

→ August

In August our research team added the following:

- 69 family offices

- 333 family office contacts

- 206 tracked investments

→ September

In September our research team added the following:

- 71 family offices

- 275 family office contacts

- 168 tracked investments

What's to Come...

It is set to be another exciting quarter for us as we close out 2019 - not only for global family office activity, but for our continuously evolving platform and team here at FINTRX. As the market continues to mature, our team expects to see strong growth of global family office activities, a number of new launches, and increased direct investment activity.

By providing continuously updated family office data, capital raising tools, and solutions, FINTRX continues to bring transparency to the family office ecosystem. If you are interested in learning additional information on our proprietary research, please click here.

For an in-depth exploration of FINTRX, request your free trial here:

Written by: Renae Hatcher |

October 08, 2019

Renae Hatcher is a member of the marketing team at FINTRX - focused on delivering targeted & relevant family office and registered investment advisor content to our subscribers.

Similar Content

FROM THE BLOG

Copyright © 2025 FINTRX, Inc. All Rights Reserved. 18 Shipyard Drive Suite 2C Hingham, MA 02043 Data Privacy Policy

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)