ADVISOR M&A AND RECRUITING WITH FINTRX

Pinpoint Top Advisors & Streamline Recruiting and M&A Efforts

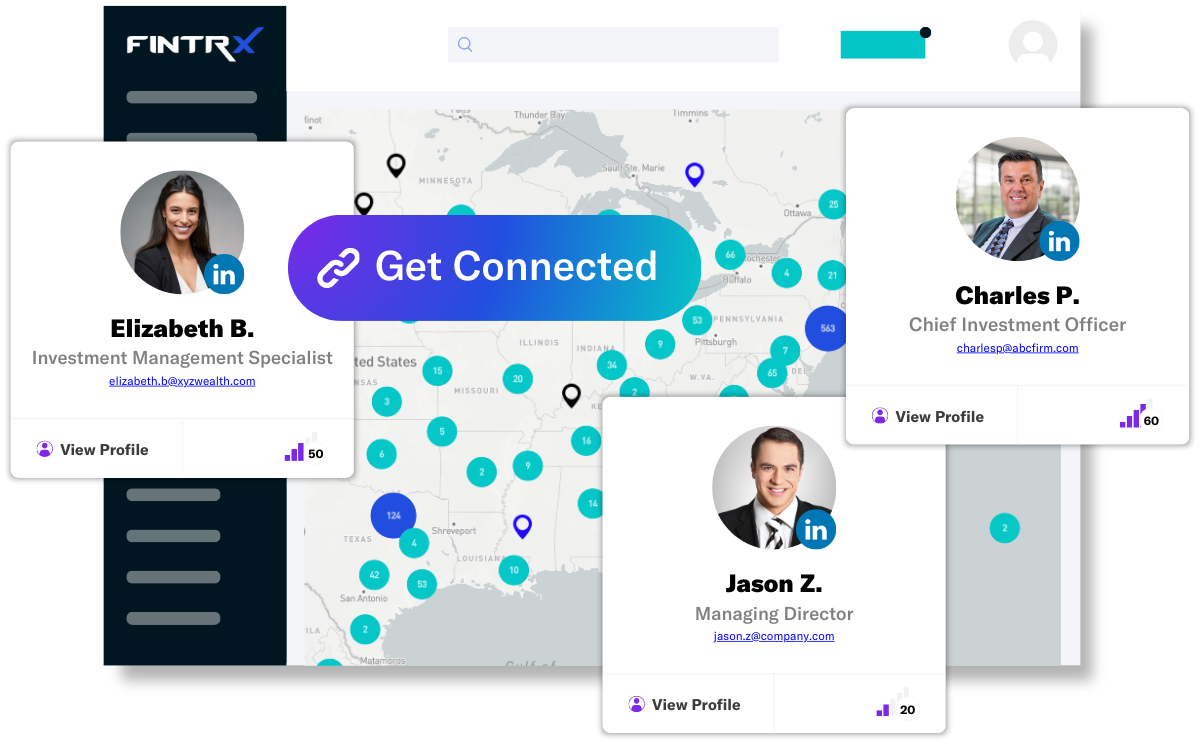

Identify and Engage High-Value Financial Advisors

AI-driven prospecting to identify top talent, engage at the right moment, and personalize outreach for maximum conversion

Identify High-Value Advisor Talent

Access real-time intelligence on 760,000+ RIA and broker-dealer reps, including AUM, investment focus, and custodian relationships to target the right advisors.

Track Advisor Movement

Get real-time alerts on advisor movements, firm mergers, and team breakaways, ensuring proactive outreach at the right moment.

Leverage AI-Driven Relationship Mapping

Uncover network connections and warm introductions to advisors, strengthening engagement and improving recruitment success rates.

Streamline Outreach & Personalization

Automate advisor segmentation and tailored messaging based on career history, investment strategy, and past firm affiliations to enhance recruiting efficiency.

PERSONALIZED ADVISOR M&A INTEL

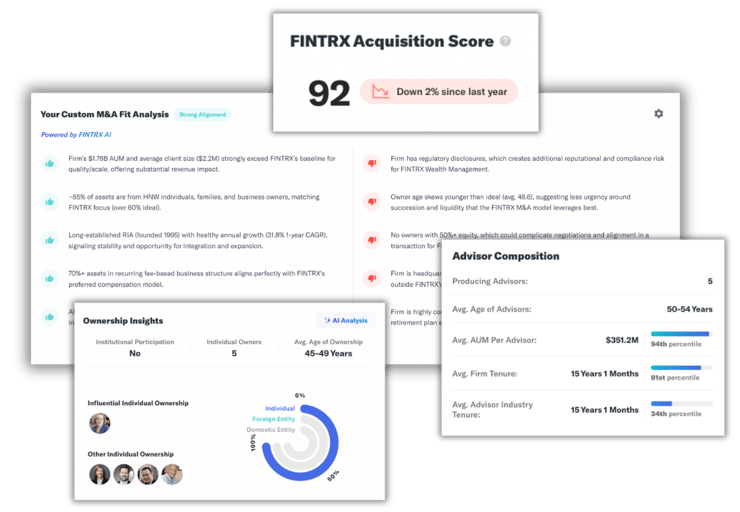

Advisor M&A SmartView

Advisor M&A SmartView is an AI-powered solution that helps acquisition-focused teams identify, prioritize, and engage advisor firms most likely to transact. By combining predictive scoring, firm-fit analysis, and warm introduction mapping, SmartView delivers personalized, high-probability M&A targets tailored to your growth strategy.

INDUSTRY-LEADING DATA

Unparalleled Data Accuracy & Coverage

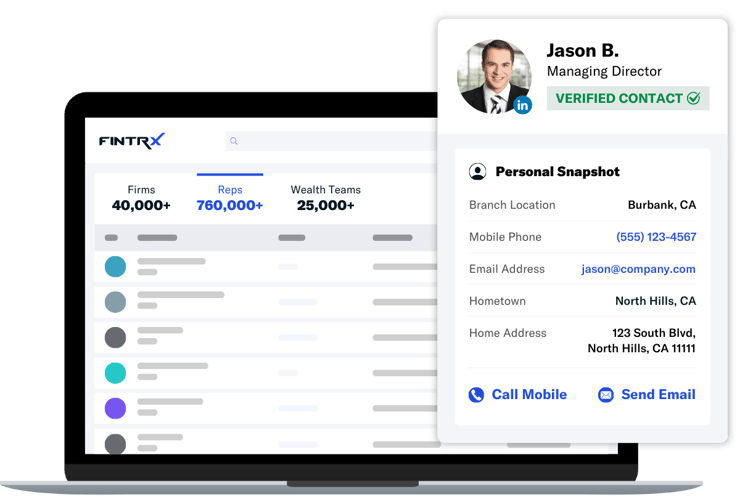

Real-time intelligence on 40,000+ RIA and broker-dealer firms and 760,000+ advisor contacts, including AUM, investment preferences, custodian relationships, regulatory data, and personnel movements.

CUTTING-EDGE ARTIFICIAL INTELLIGENCE

AI-Driven Alerts, Trends, and Advisor Movement

Automate advisor segmentation, personalized messaging, and data-driven prospecting to streamline the recruiting process and increase conversion rates.

CONNECT WITH CONFIDENCE

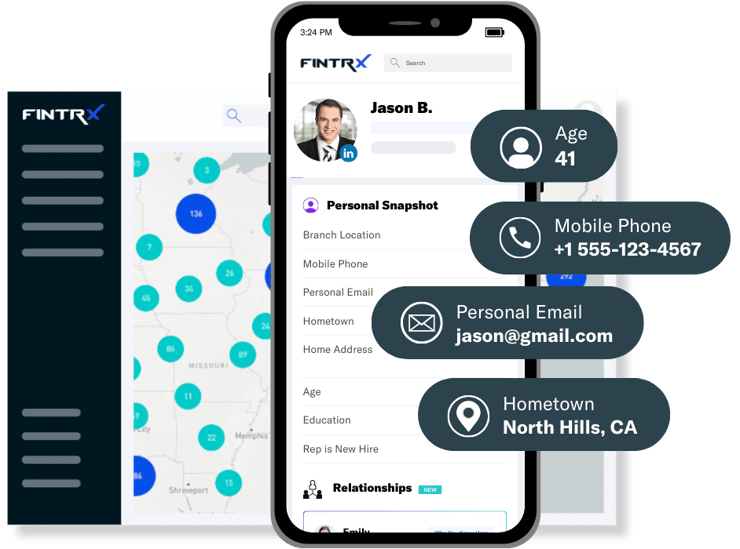

Detailed Contact Information

Target advisors with detailed employment history, job titles, LinkedIn profiles, firm affiliations, offices, email addresses and phone numbers.

CLIENT CASE STUDY

How Pure Financial Enhances Advisor M&A and Recruiting with FINTRX

"Almost every meeting I go into, I'm on FINTRX - looking up the firm, learning everything I can. It's become part of my process. It's like a cheat code. If you're not using it, you're behind."

Ben Littman - Pure Financial

>> Read Case Study

Frequently Asked Questions

How does FINTRX ensure data accuracy compared to competitors?

Data accuracy is the foundation of everything we do. Unlike competitors who rely solely on web scraping or manual updates, we take a dual-layered approach:

- AI-powered automation continuously collects, cleans, and structures data from thousands of sources.

- A 70+ person research team meticulously verifies and enhances every record for depth and accuracy. This means daily updates and real-time insights—ensuring you never waste time on stale or incomplete information.

What makes FINTRX different from other private wealth data provides?

FINTRX is an AI-driven private wealth intelligence platform, meaning we don’t just provide data—we provide actionable intelligence. Our platform continuously updates in real-time, leveraging AI-powered insights, relationship mapping, and predictive analytics to ensure you're always acting on the most accurate and relevant information. We don’t just aggregate data; we transform it into intelligence that drives results.

How do you ensure the data is accurate?

Data accuracy is the foundation of everything we do. Unlike competitors who rely solely on web scraping or manual updates, we take a dual-layered approach:

- AI-powered automation continuously collects, cleans, and structures data from thousands of sources.

- A 70+ person research team meticulously verifies and enhances every record for depth and accuracy. This means daily updates and real-time insights—ensuring you never waste time on stale or incomplete information.

Will FINTRX conduct outreach to prospects on my behalf?

No, FINTRX does not conduct outreach on behalf of users. However, the platform equips users with the intelligence and tools needed to optimize their own outreach efforts. While FINTRX doesn’t engage in direct outreach, it empowers users with the best data, AI-driven insights, and workflow tools to drive effective engagement.

What platforms does FINTRX integrate with?

FINTRX integrates seamlessly with leading CRM platforms, including:

- Salesforce

- HubSpot

- Microsoft Dynamics

- DealCloud

Additionally, FINTRX integrates with Snowflake, and custom data feeds and APIs are available to sync data with other internal platforms.

What type of firms use FINTRX to distribute their funds?

Firms that use FINTRX to distribute their funds typically include:

- Asset Managers – ETF issuers, mutual fund companies, SMA providers, hedge funds, and private equity firms targeting RIAs and broker-dealers.

- ETF & Mutual Fund Providers – Firms distributing passive and active ETFs, mutual funds, and alternative investment vehicles to wealth managers.

- Alternative Investment Managers – Private equity, venture capital, real estate, and hedge funds looking to raise capital from RIAs and family offices.

- Insurance & Annuity Providers – Companies offering variable annuities, structured products, and fixed income solutions to financial advisors.

- WealthTech & TAMPs – Technology platforms and turnkey asset management programs seeking to partner with RIAs and broker-dealers for fund distribution.

total assets tracked

total data points covered

FUNDRAISING

Family Office & Investment Advisor Data Optimized For Fundraising

Access to family office and investment advisor data for fundraising purposes has never been easier. Our intelligent registered investment advisor data is engineered to efficiently deliver comprehensive and accurate data. Using automation, artificial intelligence and our expansive research team, we put real time data in your hands to ensure successful outcomes.

ANALYSIS

Growth metric - Assets managed by registered investment advisors has grown to $16.5 trillion in the last year.

Supercharge Your Advisor Recruiting Strategy with AI-Driven Intelligence

Request a Trial to See How FINTRX Can Help You Identify & Engage Top Advisor Talent

RESILIENCY

Since preparation is a key ingredient to success, our team focuses on resiliency and planning when it comes to customer data.

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)